IBM 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

65

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

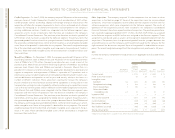

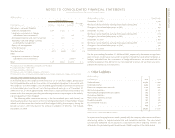

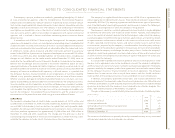

Annual contractual maturities on long-term debt outstanding, including capital lease

obligations, at December 31, 2004, are as follows:

(Dollars in millions)

2005 $«3,221

2006 3,104

2007 1,300

2008 499

2009 2,116

2010 and beyond 7,480

interest on debt

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

Cost of Global Financing $«428 $«503 $«633

Interest expense 139 145 145

Interest expense— discontinued operations ——2

Interest capitalized 415 35

Total interest paid and accrued $«571 $«663 $«815

Refer to the related discussion on page 89 in note x, “Segment Information,” for total

interest expense of the Global Financing segment. See note l, “Derivatives and Hedging

Transactions,” on pages 65 to 67 for a discussion of the use of currency and interest rate

swaps in the company’s debt risk management program.

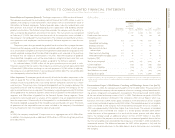

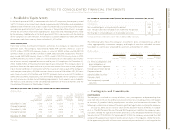

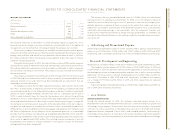

lines of credit

On May 27, 2004, the company completed the renegotiation of a new $10 billion 5-year

Credit Agreement with JP Morgan Chase Bank, as Administrative Agent, and Citibank,

N.A., as Syndication Agent, replacing credit agreements of $8 billion (5-year) and $2 bil-

lion (364 day). The total expense recorded by the company related to these facilities was

$8.9 million, $7.8 million and $9.1 million for the years ended December 31, 2004, 2003,

and 2002, respectively. The new facility is irrevocable unless the company is in breach of

covenants, including interest coverage ratios, or if it commits an event of default, such as

failing to pay any amount due under this agreement. The company believes that circum-

stances that might give rise to a breach of these covenants or an event of default, as

specified in these agreements, are remote. The company’s other lines of credit, most of

which are uncommitted, totaled $9,041 million and $8,202 million at December 31, 2004

and 2003, respectively. Interest rates and other terms of borrowing under these lines of

credit vary from country to country, depending on local market conditions.

(Dollars in millions)

AT DECEMBER 31: 2004 2003

Unused lines:

From the committed global credit facility $«««9,804 $«««9,907

From other committed and uncommitted lines 6,477 5,976

Total unused lines of credit $«16,281 $«15,883

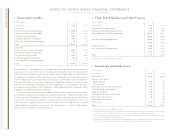

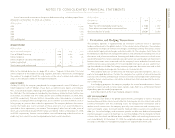

l. Derivatives and Hedging Transactions

The company operates in approximately 35 functional currencies and is a significant

lender and borrower in the global markets. In the normal course of business, the company

is exposed to the impact of interest rate changes and foreign currency fluctuations, and to

a lesser extent equity price changes and client credit risk. The company limits these risks

by following established risk management policies and procedures including the use of

derivatives and, where cost-effective, financing with debt in the currencies in which assets

are denominated. For interest rate exposures, derivatives are used to align rate movements

between the interest rates associated with the company’s lease and other financial assets

and the interest rates associated with its financing debt. Derivatives are also used to man-

age the related cost of debt. For foreign currency exposures, derivatives are used to limit

the effects of foreign exchange rate fluctuations on financial results.

The company does not use derivatives for trading or speculative purposes, nor is it a

party to leveraged derivatives. Further, the company has a policy of only entering into

contracts with carefully selected major financial institutions based upon their credit ratings

and other factors, and maintains strict dollar and term limits that correspond to the institu-

tion’s credit rating.

In its hedging programs, the company employs the use of forward contracts, futures

contracts, interest rate and currency swaps, options, caps, floors or a combination thereof

depending upon the underlying exposure.

A brief description of the major hedging programs follows.

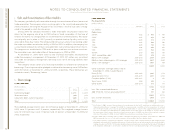

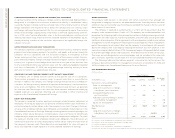

debt risk management

The company issues debt in the global capital markets, principally to fund its financing

lease and loan portfolio. Access to cost-effective financing can result in interest rate and/or

currency mismatches with the underlying assets. To manage these mismatches and to

reduce overall interest cost, the company primarily uses interest-rate and currency instru-

ments, principally swaps, to convert specific fixed-rate debt issuances into variable-rate

debt (i.e., fair value hedges) and to convert specific variable-rate debt and anticipated

commercial paper issuances to fixed rate (i.e., cash flow hedges). The resulting cost of funds

is lower than that which would have been available if debt with matching characteristics

was issued directly. At December 31, 2004, the weighted-average remaining maturity of

all swaps in the debt risk management program was approximately three years.