IBM 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

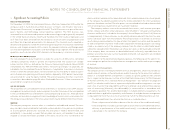

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

55

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

estimated residual values of lease assets

The recorded residual values of the company’s lease assets are estimated at the inception

of the lease to be the expected fair value of the assets at the end of the lease term. The

company periodically reassesses the realizable value of its lease residual values. Any

anticipated increases in specific future residual values are not recognized before realiza-

tion through remarketing efforts. Anticipated decreases in specific future residual values

that are considered to be other than temporary are recognized immediately upon iden-

tification and are recorded as an adjustment to the residual value estimate. For sales-type

and direct financing leases, this reduction lowers the recorded net investment and is rec-

ognized as a loss charged to finance income in the period in which the estimate is changed,

as well as an adjustment to unearned income to reduce future period finance income.

software costs

Costs that are related to the conceptual formulation and design of licensed programs are

expensed as incurred to R&D expense. Also for licensed programs, the company capital-

izes costs that are incurred to produce the finished product after technological feasibility

has been established. Capitalized amounts are amortized using the straight-line method,

which is applied over periods ranging up to three years. The company performs periodic

reviews to ensure that unamortized program costs remain recoverable from future revenue.

Costs to support or service licensed programs are charged to software cost as incurred.

The company capitalizes certain costs that are incurred to purchase or to create and

implement internal-use computer software, which includes software coding, installation,

testing and certain data conversion. Capitalized costs are amortized on a straight-line

basis over two years and are recorded in SG&A expense. See note i, “Intangible Assets

including Goodwill” on page 63.

product warranties

The company offers warranties for its hardware products that range up to four years, with

the majority being either one or three years. The company estimates its warranty costs

based on historical warranty claim experience and applies this estimate to the revenue

stream for products under warranty. Future costs for warranties applicable to revenue

recognized in the current period are charged to cost of revenue. The warranty accrual is

reviewed quarterly to verify that it properly reflects the remaining obligation based on

the anticipated expenditures over the balance of the obligation period. Adjustments

are made when actual warranty claim experience differs from estimates. See note o,

“Contingencies and Commitments” on page 71.

common stock

Common stock refers to the $.20 par value capital stock as designated in the company’s

Certificate of Incorporation. Treasury stock is accounted for using the cost method.

When treasury stock is reissued, the value is computed and recorded using a weighted-

average basis.

earnings per share of common stock

Earnings per share of common stock— basic is computed by dividing Net income by the

weighted-average number of common shares outstanding for the period. Earnings per

share of common stock— assuming dilution reflects the maximum potential dilution that

could occur if securities or other contracts to issue common stock were exercised or

converted into common stock and would then share in the net income of the company.

See note t, “Earnings Per Share of Common Stock,” on page 77 for additional information.

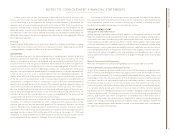

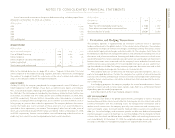

b. Accounting Changes

new standards to be implemented

In December 2004, the FASB issued SFAS No. 123 (Revised 2004), “Share-based Payment”

that will require the company to expense costs related to share-based payment trans-

actions with employees. With limited exceptions, SFAS No. 123(R) requires that the fair

value of share-based payments to employees be expensed over the period service is

received. SFAS No. 123(R) becomes mandatorily effective for the company on July 1, 2005.

The company intends to adopt this standard using the modified retrospective method of

transition. This method requires that issued financial statements be restated based on the

amounts previously calculated and reported in the pro forma footnote disclosures

required by SFAS No. 123.

SFAS No. 123(R) allows the use of both closed form models (e.g., Black-Scholes Model)

and open form models (e.g., lattice models) to measure the fair value of the share-based

payment as long as that model is capable of incorporating all of the substantive charac-

teristics unique to share-based awards. In accordance with the transition provisions of

SFAS No. 123(R), the expense attributable to an award will be measured in accordance with

the company’s measurement model at that award’s date of grant.

The company believes the pro forma disclosures in note a, “Significant Accounting

Policies,” on page 52 under “Stock-Based Compensation” provide an appropriate short-

term indicator of the level of expense that will be recognized in accordance with SFAS No.

123(R). However, the total expense recorded in future periods will depend on several vari-

ables, including the number of shared-based awards that vest and the fair value of those

vested awards.