IBM 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

83

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

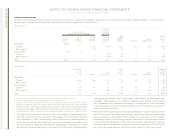

Differences between the aggregate balance sheet amounts listed on page 82

(material pension plans) and on page 85 (material nonpension postretirement plan) and

the totals listed in the Consolidated Statement of Financial Position and Consolidated

Statement of Stockholders’ Equity, relate to the non-material plans. The increase in the

company’s Prepaid pension asset balance from 2003 to 2004 was primarily due to the

$700 million contribution made by the company to the PPP during 2004. The increase in

the company’s pension plan benefit obligation was primarily attributable to the required

accounting for the unfunded status of the non-U.S. pension plans as discussed below, as

well as accrued pension costs and foreign exchange impacts.

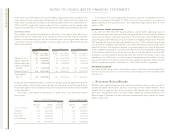

Assumptions used to determine the year-end benefit obligations for principal pension

plans follow:

U.S. Plans Non-U.S. Plans

WEIGHTED-AVERAGE ASSUMPTIONS

AT DECEMBER 31: 2004 2003 2002 2004 2003 2002

Discount rate 5.75% 6.0% 6.75% 3.0–6.0% 3.0–6.0% 4.25–6.5%

Rate of compensation increase 4.0% 4.0% 4.0% 1.9–4.6% 1.5–5.0% 2.2–5.0%

Assumptions used to determine the net periodic pension cost/(income) for principal

pension plans during the year follow:

U.S. Plans Non-U.S. Plans

WEIGHTED-AVERAGE ASSUMPTIONS

FOR YEARS ENDED DECEMBER 31: 2004 2003 2002 2004 2003 2002

Discount rate 6.0% 6.75% 7.0% 3.0–6.0% 4.25–6.5% 4.5–7.1%

Expected long-term return

on plan assets 8.0% 8.0% 9.50% 5.0–8.0% 5.0–8.0% 5.0–9.25%

Rate of compensation increase 4.0% 4.0% 6.0% 1.5–5.0% 2.2–5.0% 2.0–6.1%

The change in the discount rate assumption for the year ended December 31, 2004, for

the PPP from 6.75 percent to 6.0 percent resulted in an increase in net periodic pension

cost of $197 million for the year ended December 31, 2004, when compared with the year

ended December 31, 2003. The change in discount rate assumption for the PPP for the

year ended December 31, 2003 from 7.0 percent to 6.75 percent did not have a material

impact on net periodic pension cost.

The changes in the expected long-term return on plan assets assumptions for the year

ended December 31, 2004 for certain non-U.S. plans when compared with the year ended

December 31, 2003 resulted in an increase net periodic pension cost of $54 million.

For the year ending December 31, 2005, the company expects net periodic pension

cost to be approximately $1.7 billion, an increase of approximately $700 million when

compared with the year ended December 31, 2004. This increase however, is lower as

a result of the inclusion of a $320 million one-time pension settlement in the 2004

results. The increase in the 2005 net periodic pension cost is driven by several factors

including December 31, 2004 changes in the U.S. and non-U.S. discount rate assumptions

(approximately $300 million) and changes in the non-U.S. expected long-term return on

assets assumptions (approximately $100 million). In addition to changes in assumptions,

the net periodic pension cost will increase due to the recognition of previously deferred

pension costs as a result of changes in the market value of plan assets in accordance with

SFAS No. 87. The increases in net periodic pension cost will be offset partially by the com-

pany’s contributions in December 2004 ($700 million) and January 2005 ($1.7 billion) to

the PPP. These contributions are expected to yield approximately $200 million of income

from invested assets during 2005.

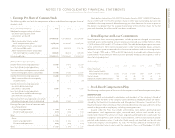

Funded Status of Defined Benefit Pension Plans

It is the company’s general practice to fund amounts for pensions sufficient to meet the

minimum requirements set forth in applicable employee benefits laws and local tax laws.

The company may also voluntarily make contributions up to the ABO level. From time to

time, the company contributes additional amounts as it deems appropriate.

In the fourth quarter of 2004, the company contributed $700 million to the qualified

portion of the PPP in cash. There were no contributions to the PPP during the year ended

December 31, 2003. There were contributions of $1,085 million and $542 million to the

material non-U.S. plans during the years ended December 31, 2004 and 2003, respectively.

The company decided not to fund certain of the company’s non-U.S. plans that had

unfunded positions to the ABO level. As a result and consistent with the accounting rules

required by SFAS No. 87 for these “unfunded” positions as described on page 79, the com-

pany recorded an additional minimum liability adjustment of $1,827 million and a reduction

to stockholders’ equity of $1,008 million as of December 31, 2004. The differences between

these amounts and the amounts included in the Consolidated Statement of Financial

Position and Consolidated Statement of Stockholders’ Equity relate to the non-material

plans. This accounting transaction did not impact 2004 retirement-related plans cost.

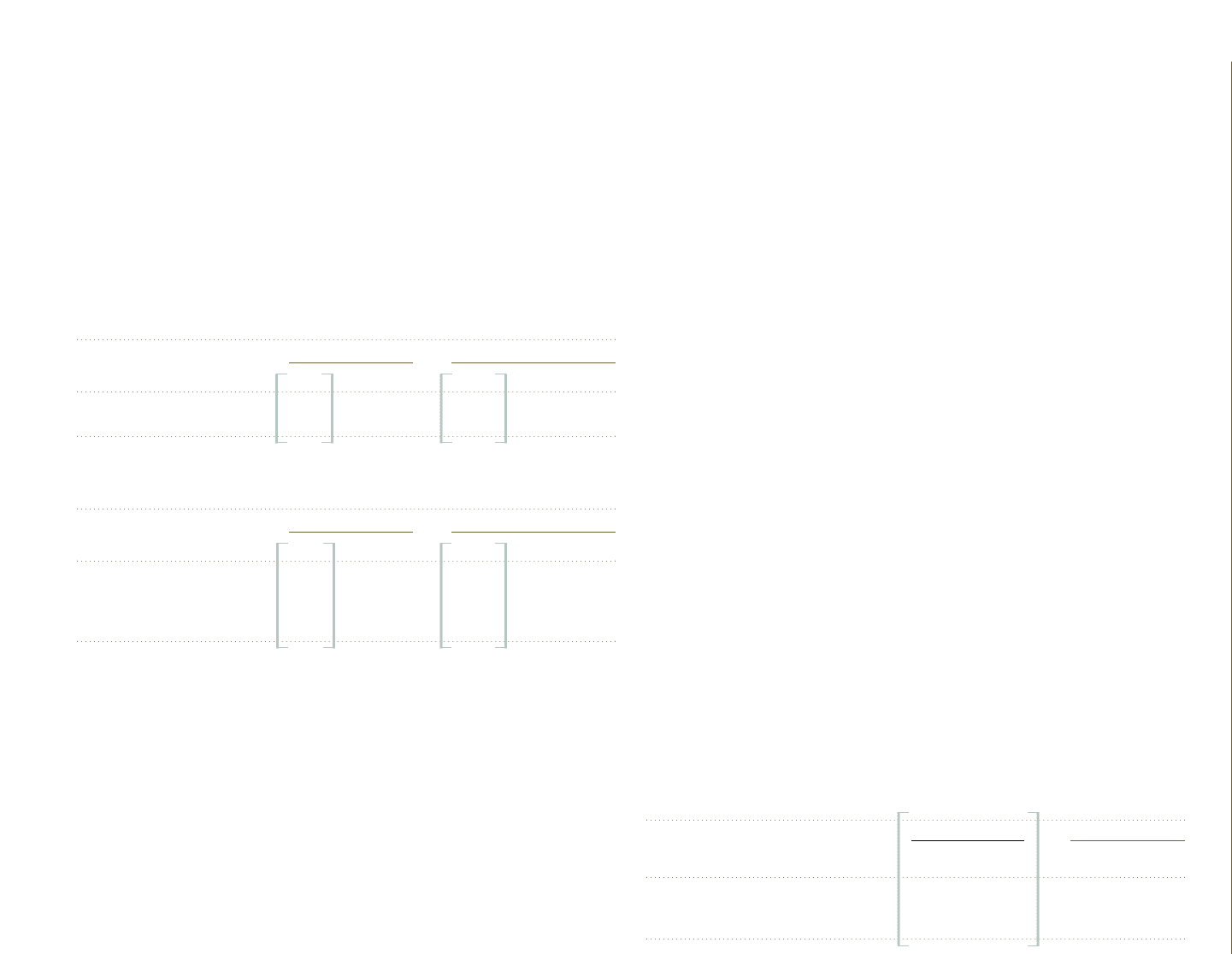

The company’s Benefit Obligation (BO) for its significant plans is disclosed at the top

of page 82. BO is calculated similarly to ABO except for the fact that BO includes an

estimate for future salary increases. SFAS No. 132 (revised 2003), “Employers’ Disclosures

about Pensions and Other Postretirement Benefits—an amendment of FASB Statements

No. 87, 88 and 106,” requires that companies disclose the aggregate BO and plan assets

of all plans in which the BO exceeds plan assets. Similar disclosure is required for all plans

in which the ABO exceeds plan assets. The aggregate BO and plan assets are also dis-

closed for plans in which the plan assets exceed the BO. The following table excludes the

U.S. plans due to the fact that these plans’ BO and plan assets, if any, appear in either the

narrative on pages 79 and 80 or the table on page 82.

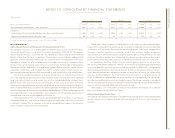

(Dollars in millions)

2004 2003

Benefit Plan Benefit Plan

Obligation Assets Obligation Assets

Plans with BO in excess of plan assets $«29,949 $«19,921 $«21,101 $«12,985

Plans with ABO in excess of plan assets $«23,813 $«15,428 $«19,902 $«12,985

Plans with assets in excess of BO $«««8,781 $«11,219 $«10,774 $«13,561