IBM 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

69

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

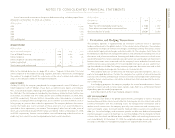

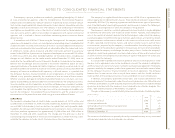

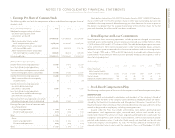

n. Stockholders’ Equity Activity

In the fourth quarter of 2002, in connection with the PwCC acquisition, the company issued

3,677,213 shares of restricted stock valued at approximately $254 million and recorded an

additional $30 million for stock to be issued in future periods as part of the purchase price

consideration paid to the PwCC partners. See note c, “Acquisitions/Divestitures,” on pages

59 and 60, for further information regarding this acquisition and related payments made

by the company. Additionally, in the fourth quarter of 2002, in conjunction with the funding

of the company’s U.S. pension plan, the company issued an additional 24,037,354 shares

of common stock from treasury shares valued at $1,871 million.

stock repurchases

From time to time, the Board of Directors authorizes the company to repurchase IBM

common stock. The company repurchased 78,562,974 common shares at a cost of

$7,275 million, 49,994,514 common shares at a cost of $4,403 million and 48,481,100

common shares at a cost of $4,212 million in 2004, 2003 and 2002, respectively. The com-

pany issued 2,840,648 treasury shares in 2004, issued 2,120,293 treasury shares in 2003

and 979,246 treasury shares in 2002, as a result of exercises of stock options by employ-

ees of certain recently acquired businesses and by non-U.S. employees. At December 31,

2004, $3,686 million of Board-authorized repurchases remained. The company plans to

purchase shares on the open market or in private transactions from time to time, depend-

ing on market conditions. In connection with the issuance of stock as part of the company’s

stock compensation plans, 422,338 common shares at a cost of $38 million, 291,921 com-

mon shares at a cost of $24 million and 189,797 common shares at a cost of $18 million in

2004, 2003 and 2002, respectively, were remitted by employees to the company in order

to satisfy minimum statutory tax withholding requirements. Such amounts are included in

the Treasury stock balance in the Consolidated Statement of Financial Position and the

Consolidated Statement of Stockholders’ Equity.

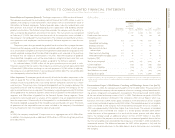

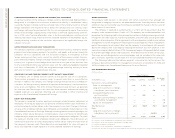

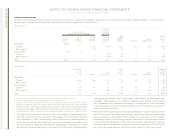

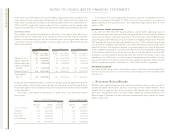

accumulated gains and (losses) not affecting retained earnings*

(Dollars in millions)

Net Net Accumulated

Unrealized Foreign Minimum Unrealized Gains/(Losses)

Losses Currency Pension (Losses)/Gains Not Affecting

on Cash Flow Translation Liability on Marketable Retained

Hedge Derivatives Adjustments Adjustment Securities Earnings

December 31, 2002 $«(363) $««««238 $«(3,291) $««(2) $«(3,418)

Change for period (91) 1,768 (162) 7 1,522

December 31, 2003 (454) 2,006 (3,453) 5 (1,896)

Change for period (199) 1,055 (1,066) 45 (165)

December 31, 2004 $«(653) $«3,061 $«(4,519) $«50 $«(2,061)

*Net of tax

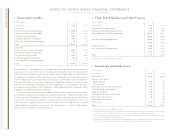

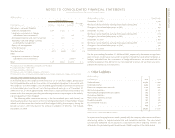

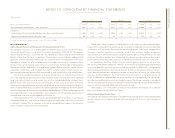

net change in unrealized gains/(losses) on marketable securities (net of tax)

(Dollars in millions)

AT DECEMBER 31: 2004 2003

Net unrealized gains arising during the period $«52 $«4

Less: net gains/(losses) included in net income for the period 7(3) *

Net change in unrealized gains on marketable securities $«45 $«7

*Includes writedowns of $0.1 million and $7 million in 2004 and 2003, respectively.

The following table shows the company’s investments’ gross unrealized losses and fair

value, aggregated by investment category and length of time that individual securities

have been in a continuous unrealized loss position, at December 31, 2004.

(Dollars in millions)

Less than 12 Months 12 Months or More Total

Unrealized Unrealized Unrealized

Description of Securities Fair Value Losses Fair Value Losses Fair Value Losses

U.S. Treasury obligations and

direct obligations of

U.S. government agencies $«— $«— $«— $«— $«— $«—

Foreign government bonds —— 22— 22—

Corporate bonds —— —— ——

Subtotal, debt securities —— 22— 22—

Common stock 31 —— 31

Total temporarily impaired

securities $«««3 $«««1 $«22 $«— $«25 $«««1

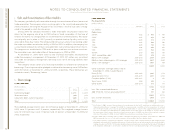

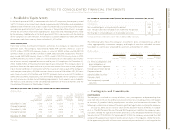

o. Contingencies and Commitments

contingencies

The company is involved in a variety of claims, suits, investigations and proceedings that

arise from time to time in the ordinary course of its business, including actions with respect

to contracts, IP, product liability, employment, securities, and environmental matters. The

following is a discussion of some of the more significant legal matters involving the company.

On July 31, 2003, the U.S. District Court for the Southern District of Illinois, in Cooper

et al. vs. The IBM Personal Pension Plan and IBM Corporation, held that the company’s pen-

sion plan violated the age discrimination provisions of the Employee Retirement Income

Security Act of 1974 (ERISA). On September 29, 2004, the company announced that IBM

and plaintiffs agreed in principle to resolve certain claims in the litigation. Under the terms

of the agreement, plaintiffs will receive an incremental pension benefit in exchange for the