IBM 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

80

ibm annual report 2004

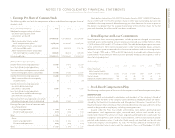

defined benefit and defined contribution plans

The company and its subsidiaries have defined benefit and defined contribution pension

plans that cover substantially all regular employees, and supplemental retirement plans

that cover certain executives.

U.S. Plans

IBM PERSONAL PENSION PLAN

IBM provides U.S. regular, full-time and part-time employees with noncontributory defined

benefit pension benefits (the IBM Personal Pension Plan, “PPP”). The PPP comprises a tax

qualified plan and a non-qualified plan. The qualified plan is funded by company contri-

butions to an irrevocable trust fund, which is held for the sole benefit of participants. The

non-qualified plan, which provides benefits in excess of IRS limitations for qualified plans,

is unfunded.

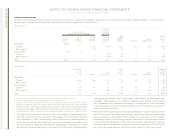

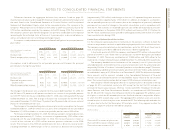

The number of individuals receiving benefits from the PPP at December 31, 2004 and

2003, was 139,804 and 136,302, respectively. The net periodic pension cost/(income) for

the qualified plan for the years ended December 31, 2004, 2003 and 2002, was $30 mil-

lion, $(692) million and $(917) million, respectively. The net periodic pension cost for the

non-qualified plan was $108 million, $107 million and $106 million for the years ended

December 31, 2004, 2003 and 2002, respectively. The costs of the non-qualified plan are

reflected in Cost of other defined benefit plans on page 81.

The funded status reconciliation for the qualified plan is on page 82. The benefit obli-

gation of the non-qualified plan was $1,116 million and $1,068 million at December 31,

2004 and 2003, respectively, and the amounts included in Retirement and nonpension

postretirement benefit obligations in the Consolidated Statement of Financial Position at

December 31, 2004 and 2003, were liabilities of $968 million and $901 million, respectively.

Effective January 1, 2005, the company amended the PPP to provide that employees

hired on and after such date, including rehires, will not be eligible to participate in this plan.

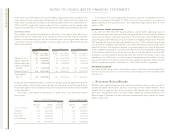

IBM SAVINGS PLAN

U.S. regular, full-time and part-time employees are eligible to participate in the IBM

Savings Plan, which is a tax-qualified defined contribution plan under section 401(k) of

the Internal Revenue Code. For employees hired prior to January 1, 2005, the company

matches 50 percent of the employee’s contribution up to the first 6 percent of the

employee’s compensation. For employees hired or rehired after December 31, 2004

who have also completed one year of service, the company matches 100 percent of the

employee’s contribution up to the first 6 percent of compensation. All contributions,

including the company match, are made in cash, in accordance with the participants’

investment elections. There are no minimum amounts that must be invested in company

stock, and there are no restrictions on transferring amounts out of the company’s stock to

another investment choice. The total cost of all of the company’s U.S. defined contribution

plans was $338 million, $333 million and $315 million for the years ended December 31,

2004, 2003 and 2002, respectively.

IBM EXECUTIVE DEFERRED COMPENSATION PLAN

The company also maintains an unfunded, non-tax-qualified, defined contribution plan,

the IBM Executive Deferred Compensation Plan (EDCP), which allows eligible U.S. execu-

tives to defer compensation, and to receive company matching contributions under the

applicable IBM Savings Plan formula described above, with respect to amounts in excess

of IRS limits for tax-qualified plans. The total cost of the IBM EDCP was $9 million, $9 mil-

lion and $8 million for the years ended December 31, 2004, 2003 and 2002, respectively.

These amounts are included in the total cost of all of the company’s defined contribution

plans of $338 million, $333 million and $315 million for the years ended December 31,

2004, 2003 and 2002, respectively.

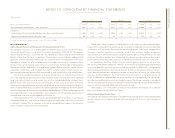

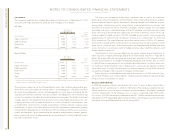

U.S. SUPPLEMENTAL EXECUTIVE RETENTION PLAN

The company also has a non-qualified U.S. Supplemental Executive Retention Plan (SERP).

The SERP, which is unfunded, provides defined benefit pension benefits in addition to the

PPP to eligible executives based on average earnings, years of service and age at retire-

ment. Effective July 1, 1999, the company adopted the SERP (which replaced the previous

Supplemental Executive Retirement Plan). Some participants of the prior SERP will still be

eligible for benefits under that plan if those benefits are larger than benefits provided

under the new plan. Certain former partners of PwCC also participate in the SERP under

two separate benefit formulas. The total cost of this plan for the years ended December 31,

2004, 2003 and 2002, was $22 million, $25 million and $18 million, respectively. These

amounts are reflected in Cost of other defined benefit plans on page 81. At December 31,

2004 and 2003, the benefit obligation was $191 million and $181 million, respectively, and

the amounts included in Retirement and nonpension postretirement benefit obligations in

the Consolidated Statement of Financial Position at December 31, 2004 and 2003, were

liabilities of $203 million and $186 million, respectively.

Non-U.S. Plans

Most subsidiaries and branches outside the United States have defined benefit and/or

defined contribution retirement plans that cover substantially all regular employees, under

which the company deposits funds under various fiduciary-type arrangements, purchases

annuities under group contracts or provides reserves. Benefits under the defined benefit

plans are typically based either on years of service and the employee’s compensation,

generally during a fixed number of years immediately before retirement, or on annual

credits. The range of assumptions that are used for the non-U.S. defined benefit plans

reflects the different economic environments within various countries. The total non-U.S.

pension plan cost/(income) of these plans for the years ended December 31, 2004, 2003

and 2002, was $572 million, $254 million and $(46) million, respectively. The funded status

reconciliation for the principal non-U.S. pension plans is on page 82.