IBM 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

82

ibm annual report 2004

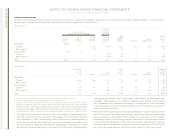

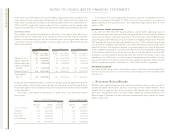

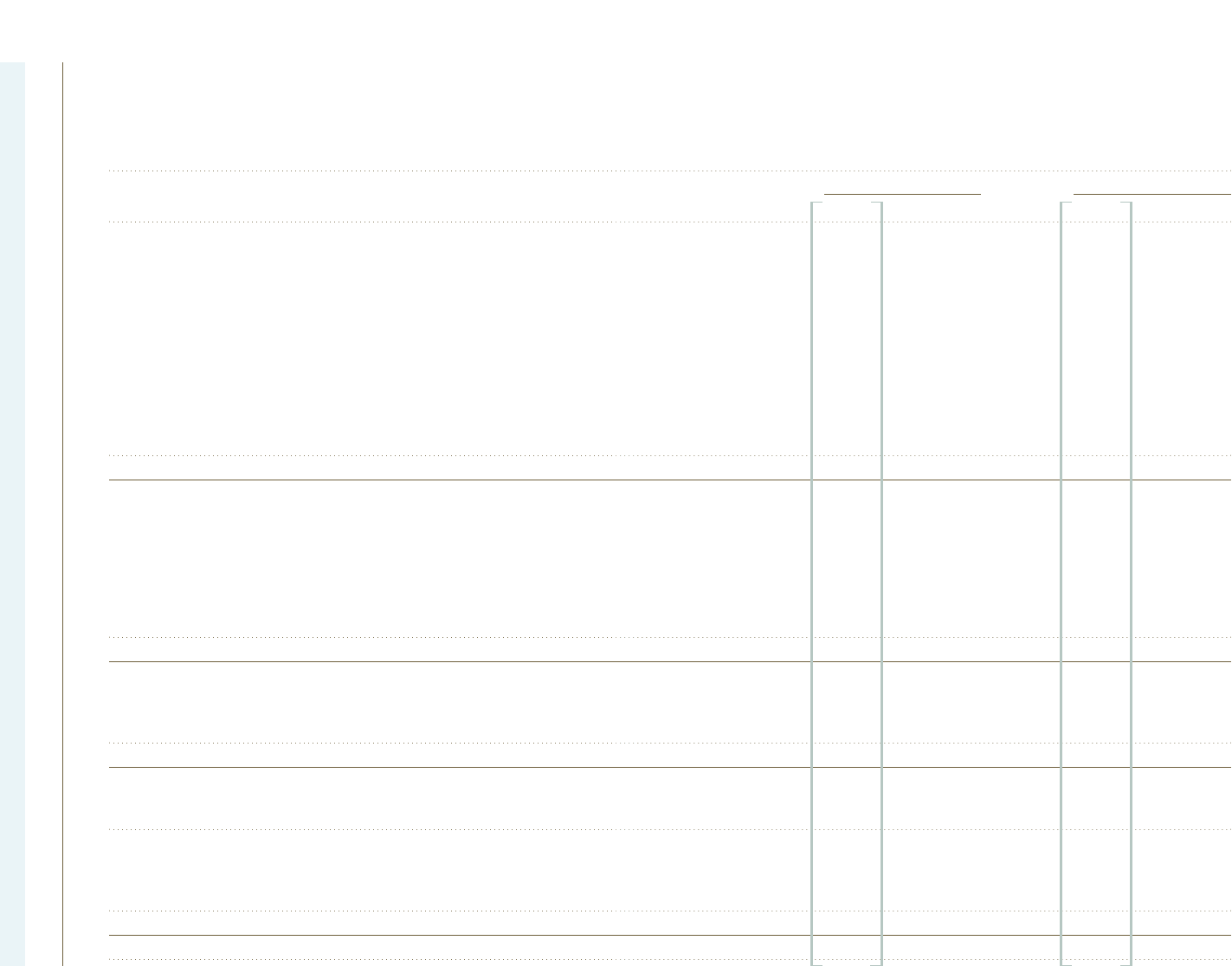

The changes in the benefit obligations and plan assets of the qualified portion of the PPP and the significant non-U.S. defined benefit plans for 2004 and 2003 were as follows:

(Dollars in millions)

PPP-Qualified Portion Non-U.S. Plans

2004 2003 2004 2003

Change in benefit obligation:

Benefit obligation at beginning of year $«42,104 $«38,357 $«31,875 $«25,699

Service cost 652 576 611 537

Interest cost 2,453 2,518 1,620 1,477

Plan participants’ contributions ——50 43

Acquisitions/divestitures, net ——93 75

Settlement of certain legal claims 320 ———

Actuarial losses 1,856 3,472 3,729 1,167

Benefits paid from trust (2,748) (2,819) (1,305) (1,093)

Direct benefit payments ——(287) (253)

Foreign exchange impact ——2,352 4,166

Plan curtailments/settlements/termination benefits ——(8) 57

Benefit obligation at end of year 44,637 42,104 38,730 31,875

Change in plan assets:

Fair value of plan assets at beginning of year 41,679 36,984 26,546 20,637

Actual return on plan assets 5,214 7,514 2,588 2,829

Employer contribution 700 —1,085 542

Acquisitions/divestitures, net ——59 7

Plan participants’ contributions ——50 43

Benefits paid from trust (2,748) (2,819) (1,305) (1,093)

Foreign exchange impact ——2,117 3,581

Fair value of plan assets at end of year 44,845 41,679 31,140 26,546

Fair value of plan assets in excess/(deficit) of benefit obligation 208 (425) (7,590) (5,329)

Unrecognized net actuarial losses 11,874 11,849 14,737 10,775

Unrecognized prior service costs 461 523 (160) (170)

Unrecognized net transition assets —(72) (3) (26)

Net prepaid pension assets recognized in the Consolidated Statement of Financial Position $«12,543 $«11,875 $«««6,984 $«««5,250

Amounts recognized in the Consolidated Statement of Financial Position captions include:

Prepaid pension assets $«12,543 $«11,875 $«««7,476 $«««6,129

Intangible assets ——44 52

Total prepaid pension assets 12,543 11,875 7,520 6,181

Retirement and nonpension postretirement benefit obligation ——(8,429) (6,982)

Accumulated gains and (losses) not affecting retained earnings ——5,088 3,888

Deferred tax assets (investments and sundry assets) ——2,805 2,163

Net amount recognized $«12,543 $«11,875 $«««6,984 $«««5,250

Accumulated benefit obligation $«43,327 $«40,423 $«36,755 $«30,240