IBM 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

13

ibm annual report 2004

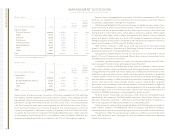

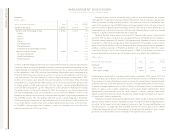

With regard to Assets, approximately $3.6 billion of the increase relates to the impact

of currency translation. The remaining increase primarily consists of an increase in Cash and

cash equivalents, an increase in Goodwill associated with recent acquisitions and increased

Prepaid pension assets. The increases were partially offset by lower financing receivables

and lower deferred tax assets.

For additional information, see the Year in Review section on pages 17 to 26.

Global Financing debt decreased, but the company’s Global Financing debt-to-equity

ratio remained flat at 6.9 to 1 and within the company’s targeted range.

Global Services signings were $43 billion in 2004 as compared to $55 billion in 2003.

The Global Services backlog is estimated to be $111 billion at December 31, 2004 versus

$120 billion at December 31, 2003. For additional information, see Global Services Signings

on page 29.

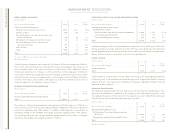

Looking forward, the company’s longer-term financial model targets earnings per

share to grow at a low double-digit rate with revenue growth in the mid-to-high single

digits, continued productivity driven margin improvement, and effective capital deploy-

ment for acquisitions and common stock repurchase. The company’s ability to meet these

objectives depends on a number of factors, including those outlined on page 17 and on

pages 69 to 71.

Description of Business

Please refer to IBM’s Annual Report on Form 10-K filed on February 24, 2005, with the

Securities and Exchange Commission (SEC) for a more detailed version of this Description

of Business, especially the detailed “Significant Factors Affecting IBM’s Business” section.

IBM is an innovation-based business serving the needs of enterprises and institutions

worldwide. It defines innovation as the intersection of business insight and technological

invention. IBM seeks to deliver client success—in whatever ways its clients define success —

by giving them differentiating capabilities that provide unique competitive advantage.

By helping its clients redesign their business processes and organizational structure,

enabled by new operating environments, IBM helps them to become on demand busi-

nesses. IBM defines an on demand business as an enterprise whose business processes

are responsive to any demand, opportunity or threat; integrated end-to-end across the

company; and capable of integrating fluidly across extended business ecosystems of part-

ners, suppliers and clients.

IBM first described this new model and set of capabilities in 2002, believing they

represent the current evolution of information technology architectures and of business

and institutional models. IBM calls this architecture the On Demand Operating

Environment: an infrastructure based on industry-wide standards (commonly referred to

as “open standards”), rather than on proprietary technologies. In IBM’s view, an enterprise’s

investment in such an infrastructure provides both superior returns and maximum freedom

of interoperability and action. Standards have become a core element of IBM’s overall

strategy and impact all of our unit strategies.

The shift to standards-based technologies has been bolstered significantly in recent

years by the rapid growth of the “open source” software movement, a result of large-scale

collaboration among members of the worldwide developer and business communities.

Examples include the Linux operating system, the Eclipse computing platform and the

Java programming language.

IBM’s clients include many different kinds of enterprises, from sole proprietorships to

the world’s largest organizations, governments and companies representing every major

industry and endeavor. Over the last decade, IBM has exited or greatly de-emphasized its

involvement in consumer markets and divested itself of other noncore businesses to con-

centrate on the enterprise market. In IBM’s view, opportunities in the enterprise market are

superior— representing approximately two-thirds of the IT industry’s revenue. As a result,

IBM has made acquisitions and invested in emerging business opportunities important to

its enterprise clients. Many of these investments have grown into multibillion dollar busi-

nesses in their own right, and are now contributing to IBM’s growth.

The majority of the company’s enterprise business, which excludes the company’s

original equipment manufacturer (OEM) technology business, occurs in industries that are

broadly grouped into six sectors around which the company’s go-to-market strategies,

and sales and distribution activities are organized:

•Financial Services: Banking, Financial Markets, Insurance

•Public: Education, Government, Healthcare, Life Sciences

•Industrial: Aerospace, Automotive, Defense, Chemical and Petroleum, Electronics

•Distribution: Consumer Products, Retail, Travel, Transportation

•Communications: Telecommunications, Media and Entertainment, Energy and Utilities

•Small and Medium Business: Mainly companies with less than 1,000 employees

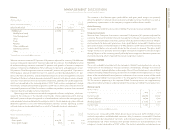

the it industry and ibm’s strategy

IBM operates in the IT industry, which comprises three principal categories:

•Business Value

•Infrastructure Value

•Component Value

IBM has realized and continues to see a shift in revenue and profit growth from Component

Value to Infrastructure Value and Business Value, where revenue and profit potential are

thought to be greatest in the years ahead.