IBM 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

68

ibm annual report 2004

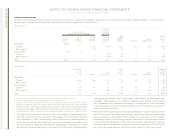

In addition, the company executed certain actions prior to 1994, and in 1999 and

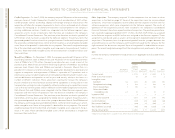

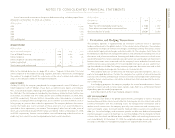

2002. The reconciliation of the December 31, 2003 to 2004 balances of the current and

non-current liabilities for restructuring actions is presented in the table below. The current

liabilities presented in the table are included in Other accrued expenses and liabilities in

the Consolidated Statement of Financial Position.

(Dollars in millions)

Balance at Balance at

Dec. 31, Other Dec. 31,

2003 Payments Adjustments*2004

Current:

Workforce $««««222 $«211 $««128 $«139

Space 129 111 68 86

Other 39 32 2 9

Total $««««390 $«354 $««198 $«234

Non-current:

Workforce $««««587 $«««— $«««(44) $«543

Space 282 — (38) 244

Other 2 — (2) —

Total $««««871 $«««— $«««(84) $«787

*The other adjustments column in the table above includes the reclassification of non-current to current and foreign

currency translation adjustments. In addition, during the year ended December 31, 2004, net adjustments to increase

previously recorded liabilities for changes in the estimated cost of employee terminations and vacant space for the

2002 actions ($42 million), offset by reductions in previously recorded liabilities for the HDD-related restructuring in

2002 ($1 million) and actions prior to 1999 ($28 million) were recorded. Of the $13 million of net adjustments

recorded during the year ended December 31, 2004 in the Consolidated Statement of Earnings, $14 million (net) was

predominantly included in Other (income) and expense offset by a $1 million credit included in Discontinued

Operations (for the HDD-related restructuring actions). Additionally, adjustments of $8 million were recorded to

Goodwill during the year ended December 31, 2004 for changes to estimated vacant space and workforce reserves.

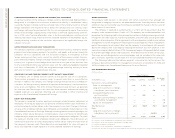

The workforce accruals primarily relate to the company’s Global Services business. The

remaining liability relates to terminated employees who are no longer working for the

company, but who were granted annual payments to supplement their incomes in certain

countries. Depending on the individual country’s legal requirements, these required pay-

ments will continue until the former employee begins receiving pension benefits or dies.

Included in the December 31, 2004 workforce accruals above is $62 million associated

with the HDD-related restructuring discussed in note c, “Acquisitions/Divestitures,” on

pages 60 and 61.

The space accruals are for ongoing obligations to pay rent for vacant space that could

not be sublet or space that was sublet at rates lower than the committed lease arrangement.

The length of these obligations varies by lease with the longest extending through 2016.

Other accruals are primarily the remaining liabilities (other than workforce or space)

associated with the 2002 second quarter actions described in note s, “2002 Actions,”

on pages 73 through 76. In addition, there are $7 million of remaining liabilities at

December 31, 2004 associated with the HDD-related restructuring discussed in note c,

“Acquisitions/Divestitures,” on pages 60 and 61.

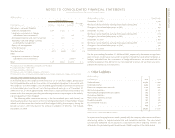

The company employs extensive internal environmental protection programs that

primarily are preventive in nature. The company also participates in environmental assess-

ments and cleanups at a number of locations, including operating facilities, previously

owned facilities and Superfund sites.

The cost of internal environmental protection programs that are preventative in nature

are expensed as incurred. When a cleanup program becomes likely, and it’s probable that

the company will incur cleanup costs and those costs can be reasonably estimated, the

company accrues remediation costs for known environmental liabilities. In addition, esti-

mated environmental costs that are associated with AROs (for example, the required removal

and restoration of chemical storage facilities and monitoring) are also accrued when it is

probable that the costs will be incurred and the costs are reasonably estimable. The

accounting for AROs is further discussed in note a, “Significant Accounting Policies,” and in

“Depreciation and Amortization” on page 52. Our maximum exposure for all environmen-

tal liabilities cannot be estimated and no amounts have been recorded for environmental

liabilities that are not probable or estimable.

Estimated environmental costs are not expected to materially affect the consolidated

financial position or consolidated results of the company’s operations in future periods.

However, estimates of future costs are subject to change due to protracted cleanup periods

and changing environmental remediation regulations.

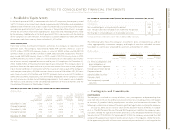

The European Commission (EC) has issued a directive that requires member states of

the European Union (EU) to meet certain targets for collection, re-use and recovery of

waste electrical and electronic equipment. In February 2003, the EU published the Waste

Electrical and Electronic Equipment directive, or WEEE (Directive 2002/96/EC, which was

amended in December 2003 by Directive 2003/108/EC). The WEEE directive regulates the

collection, reuse and recycling of waste from many electrical and electronic products. The

WEEE directive must be implemented by August 13, 2005. Under the WEEE directive,

equipment producers are required to finance the collection, recovery and disposal of

electronic scrap. The company is continuing to evaluate the impact of adopting this guid-

ance. As most member states have yet to issue their implementation requirements, it is not

possible to determine the full amount of accruals necessary to comply with the directive.

Another directive, the Restrictions of Hazardous Substances (RoHS) directive (2002/95/EC)

bans the use of certain hazardous materials in electric and electrical equipment, which are

put on the market in member states of the EU after July 1, 2006. As most member states

have yet to issue their implementation requirements, the company is continuing the eval-

uate the full impact of adopting this guidance.

The total amounts accrued for environmental liabilities, including amounts classified

as current in the Consolidated Statement of Financial Position, that do not reflect actual or

anticipated insurance recoveries, were $246 million and $243 million at December 31,

2004 and 2003, respectively.