IBM 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

17

ibm annual report 2004

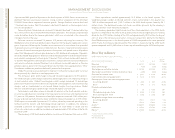

key business drivers

The following are some of the key drivers of the company’s business.

Economic Environment and Corporate IT Spending Budgets

If overall demand for hardware, software and services changes, whether due to general

economic conditions or a shift in corporate buying patterns, sales performance could be

impacted. IBM’s diverse portfolio of products and offerings is designed to gain market

share in strong and weak economic climates. The company accomplishes this by not only

having a mix of offerings with long-term cash and income streams as well as cyclical trans-

action-based sales, but also by continually developing competitive products and solutions

and effectively managing a skilled resource base. IBM continues to transform itself to take

advantage of shifting demand trends, focusing on client or industry-specific solutions,

business performance and open standards.

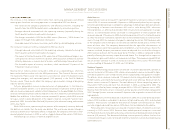

Internal Business Transformation and Efficiency Initiatives

IBM continues to drive greater productivity and cost savings as it transforms itself into an

on demand enterprise. This includes the internal supply chain initiatives discussed above,

as well as driving collaboration across the IBM enterprise to stimulate innovation and drive

growth. Transformation efforts are improving the company’s management of its costs

worldwide: rebalancing of skills, optimizing its workforce to drive growth, keeping the com-

pany’s compensation programs competitive, and creating a cost-efficient and cutting-edge

IT infrastructure to support its transformation. IBM is extending its supply chain initiatives

to labor costs and other internal processes. Continued success in this area will impact the

company’s cost structure improvements, as well as the amount of competitive leverage it

can apply by passing savings along to clients.

Innovation Initiatives

IBM invests for new and innovative capabilities, products and services. IBM has been moving

away from commoditized categories of the IT industry and into areas in which it can differ-

entiate itself through innovation and by leveraging its investments in R&D. Examples

include IBM’s leadership position in the design and fabrication of ASICs; the design of

smaller, faster and energy-efficient semiconductor devices; the design of “grid” comput-

ing networks that allow computers to share processing power; the transformation and

integration of business processes; and the company’s efforts to advance open technology

standards and to engage with governments, academia, think tanks and nongovernmental

organizations on emerging trends in technology, society and culture. In the highly compet-

itive IT industry, with large diversified competitors as well as smaller and nimble single-

technology competitors, IBM’s ability to continue its cutting-edge innovation is critical to

maintaining and increasing market share. IBM is managing this risk by more closely linking

its R&D organization to industry-specific and client-specific needs, as discussed in

Description of Business —IBM Worldwide Organizations.

Open Standards

The broad adoption of open standards is essential to the computing model for an on

demand business and is a significant driver of collaborative innovation across all industries.

Without interoperability among all manner of computing platforms, the integration of any

client’s internal systems, applications and processes remains a monumental and expensive

task. The broad-based acceptance of open standards— rather than closed, proprietary

architectures— also allows the computing infrastructure to more easily absorb (and thus

benefit from) new technical innovations. IBM is committed to fostering open standards

because they are vital to the On Demand Operating Environment, and because their

acceptance will expand growth opportunities across the entire business services and IT

industry. There are a number of competitors in the IT industry with significant resources

and investments who are committed to closed and proprietary platforms as a way to lock

customers into a particular architecture. This competition will result in increased pricing

pressure and/or IP claims and proceedings. IBM’s support of open standards is evidenced

by the enabling of its products to support open standards such as Linux, and the develop-

ment of Rational software development tools, which can be used to develop and upgrade

any other company’s software products.

Emerging Business Opportunities

The company is continuing to refocus its business on the higher value segments of enter-

prise computing— providing technology and transformation services to clients’ businesses.

Consistent with that focus, the company continues to significantly invest in Emerging

Business Opportunities, as a way to drive revenue growth and market share gain. Areas of

investment include strategic acquisitions, primarily in software and services, information-

based medicine, on demand retail, sensor and actuator solutions, Business Performance

Transformation Services, key technologies (POWER5 and POWERBlade) and emerging

growth countries such as China, Russia, India and Brazil.

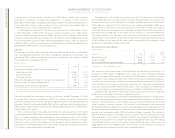

Year in Review

results of continuing operations

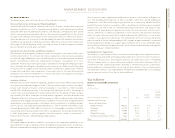

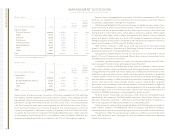

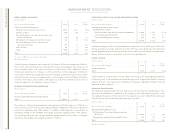

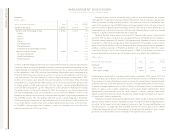

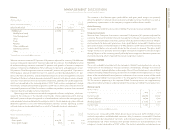

Revenue

(Dollars in millions)

Yr. to Yr.

Percent

Yr. to Yr. Change

Percent Constant

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 Change Currency

Statement of Earnings

Revenue Presentation:

Global Services $«46,213 $«42,635 8.4% 3.1%

Hardware 31,154 28,239 10.3 6.5

Software 15,094 14,311 5.5 0.6

Global Financing 2,608 2,826 (7.7) (11.5)

Enterprise Investments/Other 1,224 1,120 9.3 5.2

Total $«96,293 $«89,131 8.0% 3.4%