IBM 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

29

ibm annual report 2004

With respect to the economic environment, while it is always difficult to predict future

economic trends, in 2004 the economic environment improved—shifting from a period of

recovery to moderate expansion. Going forward, we anticipate moderate growth for the

traditional IT industry. Several factors— including increasing complexity and globalization—

are driving clients to transform their businesses. The year-to-year and sequential quarterly

growth trend comparisons achieved by the company are indicators of this improvement.

With respect to business transformation and the continual conversion of the company

into an on demand business, the company’s supply chain initiatives are expected to allow

continued flexibility to drive additional competitive advantages. The company will con-

tinue to focus on increased productivity and efficiency to accelerate the globalization and

transformation of its global business model.

Finally, with respect to technology, in 2004 the company has again been awarded

more U.S. patents than any other company for the twelfth year in a row. The company con-

tinues to focus internal development investments on high-growth opportunities and to

broaden its ability to deliver industry- and client-specific solutions.

From a client-set perspective, the strong momentum in 2004 with respect to the Small

& Medium Business sector should continue. We anticipate continued growth in the

Communications, Distribution and Public sectors, however, the Financial Services sector

growth may moderate.

The company also will selectively pursue acquisitions, primarily in the Global Services

and Software segments, where it believes these acquisitions will expand its portfolio to

meet clients’ needs.

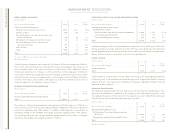

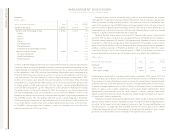

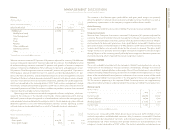

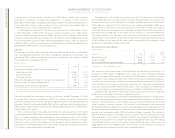

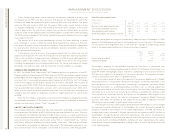

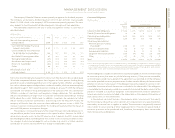

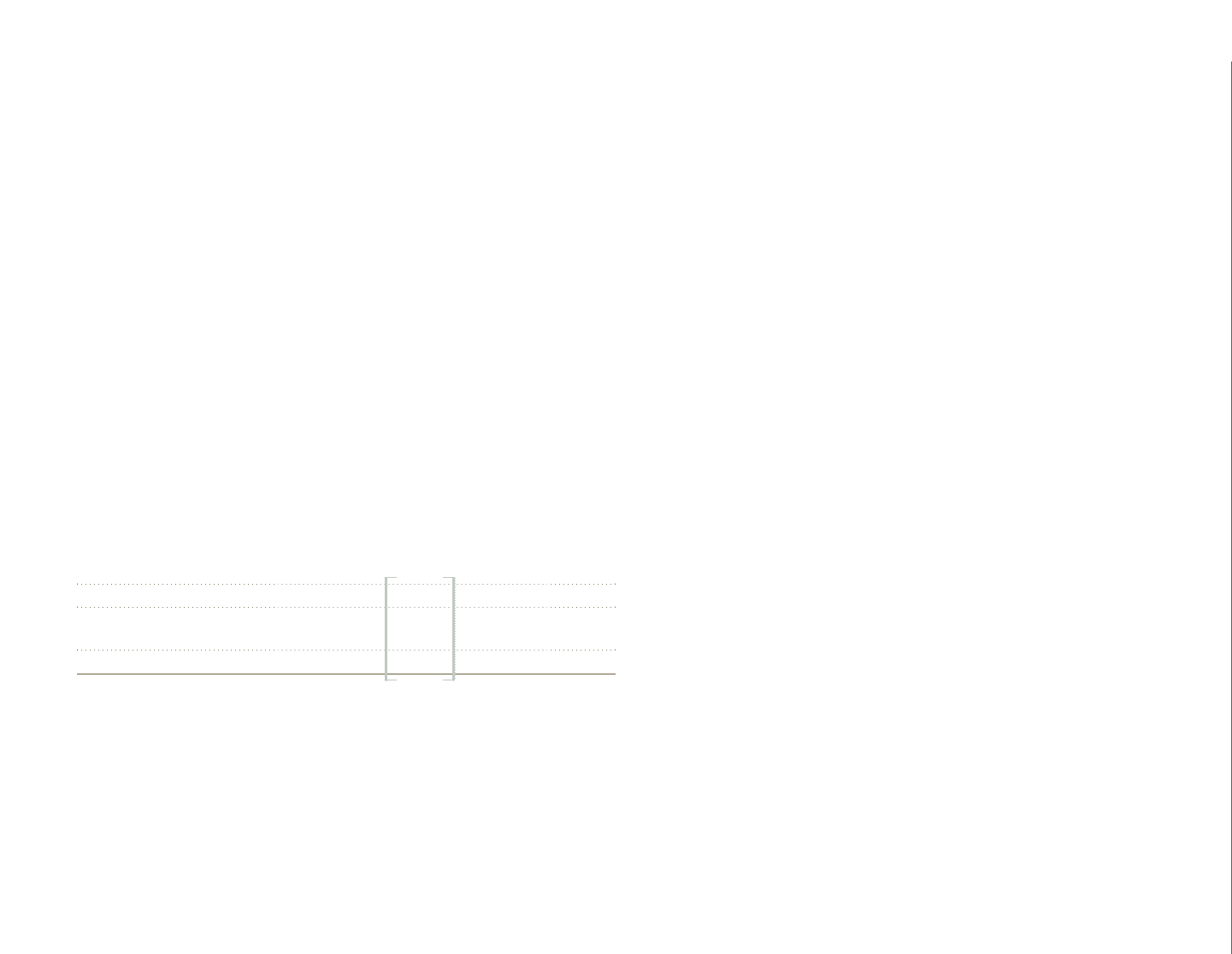

Global Services Signings

(Dollars in millions)

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 2002

Longer-term*$«22,857 $«34,608 $«33,068

Shorter-term*20,146 20,854 20,020

Total $«43,003 $«55,462 $«53,088

*Longer-term contracts are generally 7 to 10 years in length and represent SO and longer-term business transforma-

tion contracts as well as those BCS contracts with the U.S. federal government and its agencies. Shorter-term are con-

tracts generally 3 to 9 months in length and represent the remaining BCS and ITS contracts. These amounts have been

adjusted to exclude the impact of year-to-year currency changes.

Global Services signings are management’s initial estimate of the value of a client’s com-

mitment under a Global Services contract. Signings are used by management to assess

period performance of Global Services management. There are no third-party standards

or requirements governing the calculation of signings. The calculation used by manage-

ment involves estimates and judgments to gauge the extent of a client’s commitment,

including the type and duration of the agreement, and the presence of termination

charges or wind-down costs. For example, for longer-term contracts that require signifi-

cant up-front investment by the company, the portions of these contracts that are counted

as a signing are those periods in which there is a significant economic impact on the client

if the commitment is not achieved, usually through a termination charge or the customer

incurring significant wind-down costs as a result of the termination. For shorter-term con-

tracts that do not require significant up-front investments, a signing is usually equal to the

full contract value.

Signings includes SO,BCS and ITS contracts. Contract extensions and increases in

scope are treated as signings only to the extent of the incremental new value. Maintenance

is not included in signings as maintenance contracts tend to be more steady-state, where

revenues equal renewals, and therefore, the company does not think they are as useful a

predictor of future performance.

Backlog includes SO,BCS,ITS and Maintenance. Backlog is intended to be a statement

of overall work under contract and therefore does include Maintenance. Backlog estimates

are subject to change and are affected by several factors, including terminations, changes

in scope of contracts (mainly long-term contracts), periodic revalidations, and currency

assumptions used to approximate constant currency.

Contract portfolios purchased in an acquisition are treated as positive backlog adjust-

ments provided those contracts meet the company’s requirements for initial signings. A

new signing will be recognized if a new services agreement is signed incidental or coinci-

dent to an acquisition.

Although signings and backlog declined in 2004, Global Services improved its year-

to-year revenue growth rate— excluding the benefit of currency— on a sequential basis in

2004. This increase in Global Services growth rate is due to the improving yield of its back-

log and current signings. The average duration of new contracts has shortened, and the

company continues to drive additional revenue from its contract base through volumes

and scope expansion.

The combination in 2004 of the company’s Systems Group and Technology Group will

continue to benefit the company’s ability to integrate key semiconductor and other core

technology innovations into solutions for clients. The company continues to leverage its

eServer zSeries mainframe technology investments across its server and storage portfolio.

The ability to share elements of this technology such as security, automation, and virtual-

ization, with the more commoditized platforms is a key competitive advantage for IBM.

Given the commoditized nature of the personal computer industry and the company’s

announced agreement to sell its Personal Computing Division, its first half results may be

more volatile than in the company’s other businesses. The company plans to take the nec-

essary actions to mitigate those impacts. The divestiture is expected to close in the second

quarter of 2005.

The key to the company’s growth in Software will be clients’ continued adoption of its

on demand solutions. The key differentiating factor for the company is the strength and

breadth of its middleware portfolio. Software is a key component of on demand solutions,

and the company will continue to invest in this strategic area and strengthen its portfolio

through acquisitions. In addition, the company will continue to build a strong partner

ecosystem to drive growth.