IBM 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

59

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

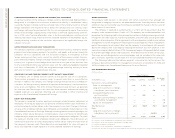

Rational Software Corporation (Rational). The largest acquisition in 2003 was that of Rational.

The company purchased the outstanding stock of Rational for $2,095 million in cash. In

addition, the company issued replacement stock options with an estimated fair value of

$68 million to Rational employees. Rational provides open, industry-standard tools and

best practices and services for developing business applications and building software

products and systems. The Rational acquisition provides the company with the ability to

offer a complete development environment for clients. The transaction was completed

on February 21, 2003, from which time the results of this acquisition were included in

the company’s Consolidated Financial Statements. The company merged Rational’s busi-

ness operations and employees into the company’s Software segment as a new division

and brand.

The primary items that generated the goodwill are the value of the synergies between

Rational and the company and the acquired assembled workforce, neither of which qualify

as an amortizable intangible asset. None of the goodwill is deductible for tax purposes. The

overall weighted-average life of the identified intangible assets acquired in the purchase

of Rational that are subject to amortization is 4.7 years. With the exception of goodwill,

these identified intangible assets will be amortized on a straight-line basis over their use-

ful lives. Goodwill of $1,405 million has been assigned to the Software segment.

As indicated above, $2,095 million of the gross purchase price was paid in cash.

However, as part of the transaction, the company assumed cash and cash equivalents held

in Rational of $1,053 million, resulting in a net cash payment of $1,042 million. In addition,

the company assumed $500 million in outstanding convertible debt. The convertible debt

was subsequently called on March 26, 2003.

Other Acquisitions. The company paid substantially all cash for the other acquisitions in the

table on page 58. Five of the acquisitions were for software companies, two related to

Strategic Outsourcing and Business Consulting Services companies and one was a hard-

ware business. The primary items that generated goodwill are the synergies between the

acquired businesses and the company, and the premium paid by the company for the

right to control the businesses acquired. The company assigned approximately $74 million

of the goodwill to the Software segment: $203 million of goodwill to the Global Services

segment; and $58 million of goodwill to the Personal Systems Group segment. These

assignments were based upon an analysis of the segments that are expected to benefit

from the acquisitions. Substantially all of the goodwill is not deductible for tax purposes.

The overall weighted-average life of the intangible assets purchased is 4.3 years. The results

of operations of the acquired businesses were included in the company’s Consolidated

Financial Statements from the respective dates of acquisition.

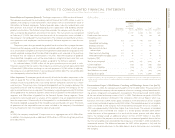

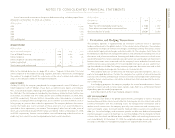

2002

In 2002, the company completed 12 acquisitions at an aggregate cost of $3,958 million.

In addition, the company paid an additional $414 million in 2003 resulting from purchase

price adjustments.

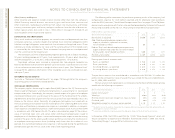

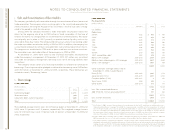

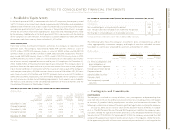

(Dollars in millions)

PwCC

Original

Amount

Disclosed in

Amortization 2002 Annual Purchase Total Other

Life (in Years) Report Adjustments*Allocation Acquisitions

Current assets $«1,197 $«(228) $««««969 $«264

Fixed assets/non-current 199 (35) 164 102

Intangible assets:

Goodwill N/A 2,461 694 3,155 364

Completed technology 3 ———66

Strategic alliances 5 103 — 103 —

Non-contractual client

relationships 4–7 131 — 131 —

Client contracts/backlog 3–5 82 — 82 6

Other identifiable intangible assets 3–5 95 — 95 10

In-process R&D ——— 4

Total assets acquired 4,268 431 4,699 816

Current liabilities (560) (26) (586) (208)

Non-current liabilities (234) 9 (225) (124)

Total liabilities assumed (794) (17) (811) (332)

Total purchase price $«3,474 $««414 $«3,888 $«484

*Adjustments relate to the amount paid by the company to PricewaterhouseCoopers as a result of the review discussed

below as well as other purchase accounting adjustments primarily related to accounts receivable, prepaid assets and

other accruals.

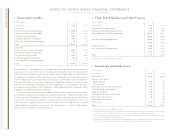

PricewaterhouseCoopers’ Global Business Consulting and Technology Services Unit (PwCC).

On October 1, 2002, the company purchased PwCC for $3,888 million. The acquisition of

PwCC provides the company with new expertise in business strategy, industry-based consult-

ing, process integration and application management. The company paid $3,474 million

of the cost related to the acquisition of PwCC in 2002. The balance was paid in 2003. The

purchase price allocation disclosed in the company’s 2002 Annual Report, which was

based on the initial $3,474 million paid, included an estimated amount of net tangible

assets to be transferred of approximately $422 million. The recorded amount of net tangible

assets transferred to the company from PricewaterhouseCoopers (PwC) on October 1,

2002, was approximately $454 million higher than the estimate. The amount of recorded

net tangible assets transferred was subject to a review process between both parties

under the terms of the agreement. As a result of the review process and other adjust-

ments, the company paid an additional amount to PwCof $397 million in July 2003.

Substantially all of the payment was accounted for as incremental goodwill due to the fact

that the net tangible assets recorded by the company as of October 1, 2002, included the

incremental amount. The difference between the $397 million payment in July and the

total purchase price adjustment in the table above is due to transaction costs incurred by

the company.