IBM 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

87

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

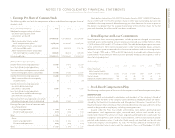

x. Segment Information

The company uses business insight and its portfolio of IT capabilities to create client

solutions. The company operates primarily in a single industry using several segments that

create value by offering solutions that include, either singularly or in some combination,

services, software, hardware and financing.

Organizationally, the company’s major operations comprise a Global Services segment;

a Software segment; two hardware product segments —Systems and Technology Group

and Personal Systems Group; a Global Financing segment; and an Enterprise Investments

segment. The segments represent components of the company for which separate finan-

cial information is available that is utilized on a regular basis by the chief executive officer

in determining how to allocate the company’s resources and evaluate performance. The

segments are determined based on several factors, including client base, homogeneity of

products, technology, delivery channels and similar economic characteristics.

Information about each segment’s business and the products and services that gener-

ate each segment’s revenue is located in the “Description of Business” section of the

Management Discussion on pages 15 and pages 21 to 23.

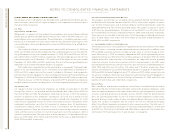

In 2003, the company renamed all of its hardware segments without changing the

organization of these segments. The Enterprise Systems segment was renamed the

Systems Group segment, the Personal and Printing Systems segment was renamed the

Personal Systems Group segment and the Technology segment was renamed the Technol-

ogy Group segment.

Over recent years, the company has been developing and enhancing a “one team”

approach to the collaboration between the Systems Group and the Technology Group.

This relationship is crucial given the core technology of the Systems Group products is a

key competitive differentiator for the company. The degree of this collaboration has

increased whereby in 2004, the company is managing these groups as one. Accordingly,

in the first quarter of 2004, the company combined the two segments into one reporting

segment. The new Systems and Technology Group segment generates one consolidated

set of financial results, which senior management uses for joint strategy, budgets, and

resource allocation decisions, as well as performance and compensation scoring.

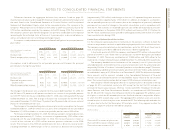

Segment revenue and pre-tax income include transactions between the segments

that are intended to reflect an arm’s-length transfer price. Specifically, semiconductors

are sourced internally from the Systems and Technology Group segment for use in the

manufacture of the Personal Systems Group segment products. In addition, hardware

and software that are used by the Global Services segment in outsourcing engagements

are mostly sourced internally from the Systems and Technology Group, Personal Systems

Group and Software segments. For the internal use of IT services, the Global Services

segment recovers cost, as well as a reasonable fee, reflecting the arm’s-length value of

providing the services. The Global Services segment enters into arm’s-length leases at

prices equivalent to market rates with the Global Financing segment to facilitate the acqui-

sition of equipment used in services engagements. Generally, all internal transaction

prices are reviewed and reset annually, if appropriate.

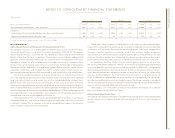

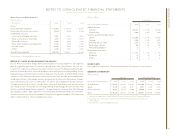

The company uses shared-resources concepts to realize economies of scale and

efficient use of resources. Thus, a considerable amount of expense is shared by all of the

company’s segments.This expense represents sales coverage, marketing and support func-

tions such as Accounting, Treasury, Procurement, Legal, Human Resources, and Billing and

Collections. Where practical, shared expenses are allocated based on measurable drivers

of expense, e.g., headcount. When a clear and measurable driver cannot be identified,

shared expenses are allocated on a financial basis that is consistent with the company’s

management system; e.g., image advertising is allocated based on the gross profits of the

segments. The unallocated corporate amounts arising from certain acquisitions, indirect

infrastructure reductions, certain IP income, miscellaneous tax items and the unallocated

corporate expense pool are recorded in net income but are not allocated to the segments.

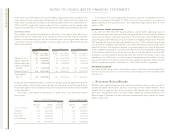

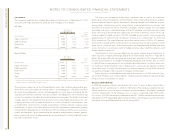

The following tables reflect the results of continuing operations of the segments con-

sistent with the company’s management system. These results are not necessarily a depic-

tion that is in conformity with GAAP; e.g., employee retirement plan costs are developed

using actuarial assumptions on a country-by-country basis and allocated to the segments

based on headcount. Different amounts could result if actuarial assumptions that are

unique to the segment were used. Performance measurement is based on income before

income taxes (pre-tax income). These results are used, in part, by management, both in

evaluating the performance of, and in allocating resources to, each of the segments.