IBM 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

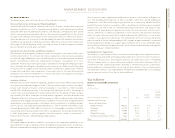

Software

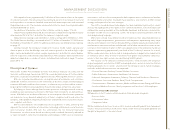

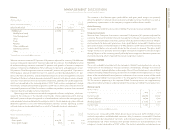

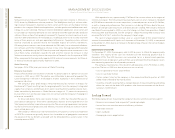

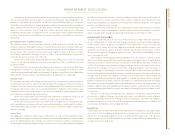

(Dollars in millions)

Yr. to Yr.

FOR THE YEAR ENDED DECEMBER 31: 2004 2003*Change

Software Revenue: $«15,094 $«14,311 5.5%

Middleware $«11,963 $«11,240 6.4%

WebSphere family 14.2

Data Management 6.6

Lotus 2.7

Tivoli 15.0

Rational 15.5

Other middleware 1.8

Operating systems 2,474 2,452 0.9

Other 657 619 6.1

*Reclassified to conform with 2004 presentation.

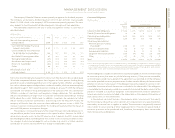

Software revenue increased 5.5 percent (0.6 percent adjusted for currency). Middleware

revenue increased 6.4 percent (1.5 percent adjusted for currency). The WebSphere family

of software offerings revenue increased 14 percent with growth in business integration

software (14 percent), WebSphere Portal software (12 percent) and application servers

(20 percent). Data Management revenue increased 7 percent with growth of 12 percent in

DB2 Database software on both the host (13 percent) and distributed platforms (11 per-

cent), DB2 Tools (8 percent), and distributed enterprise content management software

(23 percent). Rational software revenue increased (15 percent) with growth across all prod-

uct areas. Tivoli software revenue increased (15 percent), aided by the Candle acquisition,

which was completed in the second quarter of 2004. Tivoli systems management, storage

and security software all had revenue growth in 2004 versus 2003. Lotus software revenue

increased 3 percent and Other Foundation middleware products revenue also increased

2 percent due to favorable currency movements.

Operating system software increased due to growth in xSeries and pSeries, which cor-

relates to the increases in the related server brands. zSeries operating system revenue

declined 1 percent despite the growth in related hardware volumes due to ongoing soft-

ware price performance delivered to enterprise clients. iSeries operating system software

declined 6 percent in line with related hardware volumes. Overall, operating systems

software revenue increased primarily as a result of favorable currency movements.

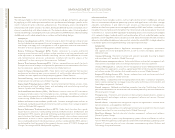

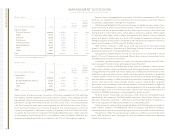

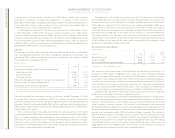

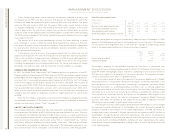

(Dollars in millions)

Yr. to Yr.

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 Change

Software:

Gross profit $«13,175 $«12,384 6.4%

Gross profit margin 87.3% 86.5% 0.8pts.

The increase in the Software gross profit dollars and gross profit margin was primarily

driven by growth in software revenue due to favorable currency movements, as well as

productivity improvements in the company’s support and distribution models.

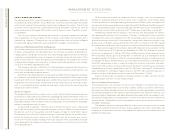

Global Financing

See pages 35 and 36 for a discussion of Global Financing’s revenue and gross profit.

Enterprise Investments

Revenue from Enterprise Investments increased 10.8 percent (4.2 percent adjusted for

currency). Revenue for product life-cycle management software increased primarily in the

automotive and aerospace industries, partially offset by lower hardware revenue (48 per-

cent), primarily for document processors. Gross profit dollars increased 12.4 percent and

gross profit margins increased 0.6 points to 44.2 percent in 2004 versus 2003. The increase

in gross profit dollars was primarily driven by the increase in revenue. The gross profit

margin increase was primarily driven by higher life-cycle management software margins

driving 0.8 points of the increase, partially offset by lower margins on document processors

due to discounting, which impacted the overall margin by 0.2 points.

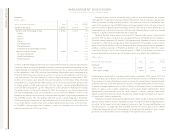

financial position

Dynamics

The assets and debt associated with the company’s Global Financing business are a sig-

nificant part of the company’s financial condition. Accordingly, although the financial

position amounts appearing below and on pages 24 and 25 are the company’s consolidated

amounts including Global Financing, to the extent the Global Financing business is a major

driver of the consolidated financial position, reference in the narrative section will be made

to the separate Global Financing section in this Management Discussion on pages 35 to

39. The amounts appearing in the separate Global Financing section are supplementary

data presented to facilitate an understanding of the company’s Global Financing business.

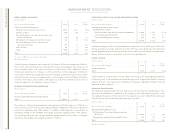

Working Capital

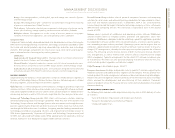

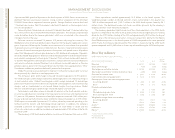

(Dollars in millions)

AT DECEMBER 31: 2004 2003*

Current assets $«46,970 $«44,662

Current liabilities 39,798 37,623

Working capital $«««7,172 $«««7,039

Current ratio 1.18:1 1.19:1

*Reclassified to conform with 2004 presentation.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

23

ibm annual report 2004

Current assets increased $2,308 million driven by an increase of $2,923 million in Cash

and cash equivalents and Marketable securities. Also, Inventories increased $374 million

primarily driven by new product transitions and increased capacity in the 300 millimeter

semiconductor fab. These increases were partially offset by an overall decrease in the

company’s current receivables of $787 million. The current receivables net decrease was