IBM 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT DISCUSSION

International Business Machines Corporation and Subsidiary Companies

22

ibm annual report 2004

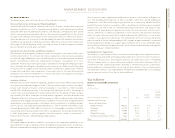

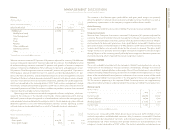

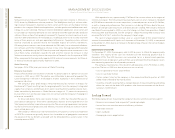

Hardware

(Dollars in millions)

Yr. to Yr.

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 Change

Hardware Revenue: $«30,710 $«27,856 10.2%

Systems and Technology Group $«17,916 $«16,469 8.8%

zSeries 14.9

iSeries (17.2)

pSeries 7.3

xSeries 22.8

Storage Systems 1.6

Microelectronics 0.6

Engineering & Technology Services 93.4

Personal Systems Group 12,794 11,387 12.4

Personal Computers 14.4

Retail Store Solutions 17.6

Printer Systems (7.6)

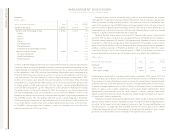

Systems and Technology Group revenue increased 8.8 percent (5.2 percent adjusting for

currency). zSeries revenue increased due to clients continuing to add new workloads on the

zSeries platform as they build their on demand infrastructures, as well as taking advantage

of the capabilities of the z990 server for consolidation. Mainframes remain the platform of

choice for hosting mission-critical transactions as well as for consolidation and infrastruc-

ture simplification. The total delivery of zSeries computing power as measured in MIPS

(millions of instructions per second) increased 33 percent in 2004 versus 2003, offsetting

price declines of 23 percent per MIPS. xSeries server revenue increased (24 percent) due

to strong growth in both high-end and 1& 2 Way Servers. xSeries-related BladeCenter

revenue had strong growth, up over 150 percent, as the company is leading and shaping

the blade market. In the fourth quarter of 2004, the company saw strong demand for

the new POWERBlade, which can run Windows, Linux and AIX on different servers in the

BladeCenter. pSeries server revenue increased reflecting clients very strong acceptance of

the POWER5 systems. The new pSeries high-end system started shipping in November

2004, marking the completion of a top to bottom refresh of the pSeries server product line

in just three months. iSeries server revenue declined driven by lower sales as the transition

to POWER5 is taking longer than in previous cycles, as customers must transition their

operating environment to the new level.

Storage Systems revenue increased slightly due to increased demand for external

midrange disk (13 percent) and tape products (9 percent). These increases were partially

offset by decreases in high-end disk products (18 percent) as clients anticipated the ship-

ment of the company’s new POWER5 high-end storage product which will ship in the first

quarter of 2005. Engineering & Technology Services had strong revenue growth due to

increased design and technical services contracts and Microelectronics revenue increased

modestly as yields in the 300 millimeter plant improved.

Personal Systems Group revenue increased 12.4 percent (8.3 percent adjusting for

currency). The increase was driven by strong performance worldwide by the company’s

ThinkPad mobile computer (22 percent). Desktop personal computer revenue increased

(4 percent) in 2004 when compared to 2003 due primarily to favorable currency move-

ments. Retail Store Solutions revenue increased due to strong demand for the company’s

products and the acquisition of Productivity Solutions Inc. in November 2003. This acqui-

sition drove 6.9 points of the unit’s revenue growth in 2004. Printer Systems maintenance

revenue declined due to lower annuity-based revenue on a declining installed base.

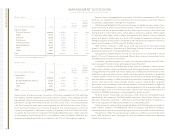

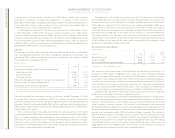

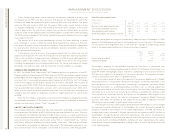

(Dollars in millions)

Yr. to Yr.

FOR THE YEAR ENDED DECEMBER 31: 2004 2003 Change

Hardware:

Gross profit $«9,552 $«8,461 12.9%

Gross profit margin 31.1% 30.4% 0.7pts.

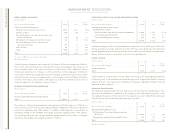

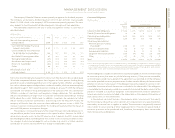

Hardware gross profit dollars and gross profit margin increased in 2004 versus 2003. The

increase in gross profit dollars was primarily driven by the increase in Hardware revenue.

The increase in the overall hardware margin was driven by several factors. Improved yields

and lower unit costs in the Microelectronics business contributed 0.8 points of the increase.

In addition, margin improvements in zSeries, xSeries and Storage Systems contributed 0.5

points, 0.2 points and 0.1 point, respectively, to the overall margin improvement. These

improvements were partially offset by lower margins in iSeries, pSeries, Retail Store

Solutions and Printer Systems, which impacted the overall margin by 0.8 points, 0.3 points,

0.1 point and 0.1 point, respectively.

Differences between the hardware segment gross profit margin and gross profit dollar

amounts above and the amounts reported on page 19 (and derived from page 40) prima-

rily relate to the impact of certain hedging transactions (see “Anticipated Royalties and

Cost Transactions” on page 66). The recorded amounts for such impact are considered

unallocated corporate amounts for purposes of measuring the segment’s gross margin

performance and therefore are not included in the segment results above.