IBM 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

International Business Machines Corporation and Subsidiary Companies

56

ibm annual report 2004

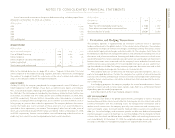

In December 2004, the FASB issued SFAS No. 153, “Exchanges of Nonmonetary Assets,

an amendment of APB Opinion No. 29” effective for nonmonetary asset exchanges occur-

ring in the fiscal year beginning January 1, 2006. SFAS No. 153 requires that exchanges of

productive assets be accounted for at fair value unless fair value cannot be reasonably

determined or the transaction lacks commercial substance. SFAS No. 153 is not expected

to have a material effect on the company’s Consolidated Financial Statements.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs, an amendment

of ARB No. 43, Chapter 4.” SFAS No. 151 requires certain abnormal expenditures to be

recognized as expenses in the current period. It also requires that the amount of fixed

production overhead allocated to inventory be based on the normal capacity of the pro-

duction facilities. The standard is effective for the fiscal year beginning January 1, 2006.

It is not expected that SFAS No. 151 will have a material effect on the company’s

Consolidated Financial Statements.

standards implemented

As noted on page 30, the new U.S. tax law provides a deduction for income from qualified

domestic production activities, which will be phased in from 2005 through 2010. Under

the guidance in FASB Staff Position (FSP) No. FAS 109-1, “Application of FASB Statement

No. 109, Accounting for Income Taxes, to the Tax Deduction on Qualified Production

Activities Provided by the American Jobs Creation Act of 2004,” issued in the fourth quar-

ter of 2004, the deduction will be treated as a “special deduction” as described in SFAS

No. 109. As such, the company has not adjusted its deferred tax assets and liabilities as of

December 31, 2004 to reflect the impact of this special deduction. Rather, the impact of

this deduction will be reported in the period for which the deduction is claimed on the

company’s U.S. federal income tax return.

As discussed in note p, “Taxes” on pages 72 and 73, the new U.S. tax law enacted in

October 2004 creates a temporary incentive for the company to repatriate earnings accu-

mulated outside the U.S. FSP No. FAS 109-2, “Accounting and Disclosure Guidance for the

Foreign Earnings Repatriation Provision within the American Jobs Creation Act of 2004,”

issued in the fourth quarter of 2004, provides that an enterprise is allowed time beyond

the financial reporting period of enactment to evaluate the effect of the new tax law on

its plan for applying SFAS No. 109. The company has not yet completed its evaluation of

the possible effect of the new tax law on its plan for repatriation of foreign earnings for

purposes of applying SFAS No. 109. Accordingly, as provided for in FSP SFAS No. 109-2,

the company has not adjusted its income tax expense or deferred tax liability as of

December 31, 2004 to reflect the possible effect of the new repatriation provision. Income

tax expense, if any, associated with any repatriation under the Act will be provided in the

company’s financial statements in the quarter in which the required management and

board approvals have been completed.

In December 2003, the FASB revised SFAS No. 132, “Employers’ Disclosures about

Pensions and other Postretirement Benefits, an amendment of FASB Statements No. 87, 88

and 106.” SFAS No. 132(R) retained all of the disclosure requirements of SFAS No. 132,

however, it also required additional annual disclosures describing types of plan assets,

investment strategy, measurement date(s), expected employer contributions, plan obliga-

tions, and expected benefit payments of defined benefit pension plans and other defined

benefit postretirement plans. In accordance with the transition provisions of SFAS No.

132(R), note w, “Retirement-Related Benefits,” on pages 78 through 86 has been expanded

to include the new disclosures required as of December 31, 2003.

In January 2003, the FASB issued FASB Interpretation No. 46 (FIN 46), “Consolidation

of Variable Interest Entities,” and amended it by issuing FIN 46(R) in December 2003. FIN

46(R) addresses consolidation by business enterprises VIEs that either: (1) do not have

sufficient equity investment at risk to permit the entity to finance its activities without

additional subordinated financial support, or (2) have equity investors that lack an essen-

tial characteristic of a controlling financial interest.

As of December 31, 2003 and in accordance with the transition requirements of

FIN 46(R), the company chose to apply the guidance of FIN 46 to all of its interests in

special-purpose entities (SPEs) as defined within FIN 46(R) and all non-SPE VIEs that were

created after January 31, 2003. Also in accordance with the transition provisions of

FIN 46(R), the company adopted FIN 46(R) for all VIEs and SPEs as of March 31, 2004.

These accounting pronouncements did not have a material impact on the company’s

Consolidated Financial Statements.

In 2003, the Emerging Issues Task Force (EITF) reached a consensus on two revenue

recognition issues relating to the accounting for multiple-element arrangements: Issue No.

00-21, “Accounting for Revenue Arrangements with Multiple Deliverables,” (EITF No. 00-21)

and Issue No. 03-05, “Applicability of AICPA SOP 97-2 to Non-Software Deliverables in an

Arrangement Containing More Than Incidental Software” (EITF No. 03-05). The consensus

opinion in EITF No. 03-05 clarifies the scope of both EITF No. 00-21 and SOP 97-2, and was

reached on July 31, 2003. The transition provisions allowed either prospective application

or a cumulative effect adjustment upon adoption. The company adopted the issues

prospectively as of July 1, 2003. EITF No. 00-21 and No. 03-05 did not have a material impact

on the company’s Consolidated Financial Statements.

In May 2003, the FASB issued SFAS No. 150, “Accounting for Certain Financial Instru-

ments with Characteristics of both Liabilities and Equity.” It establishes classification and

measurement standards for three types of freestanding financial instruments that have

characteristics of both liabilities and equity. Instruments within the scope of SFAS No. 150

must be classified as liabilities within the company’s Consolidated Financial Statements

and be reported at settlement date value. The provisions of SFAS No. 150 are effective for

(1) instruments entered into or modified after May 31, 2003, and (2) pre-existing instruments

as of July 1, 2003. In November 2003, through the issuance of FSP No. FAS 150-3, the FASB

indefinitely deferred the effective date of certain provisions of SFAS No. 150, including

mandatorily redeemable instruments as they relate to minority interests in consolidated

finite-lived entities. The adoption of SFAS No. 150, as modified by FSP No. FAS 150-3, did

not have a material effect on the Consolidated Financial Statements.