IBM 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

63

International Business Machines Corporation and Subsidiary Companies

ibm annual report 2004

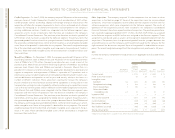

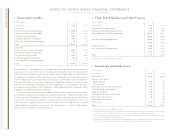

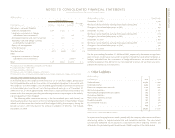

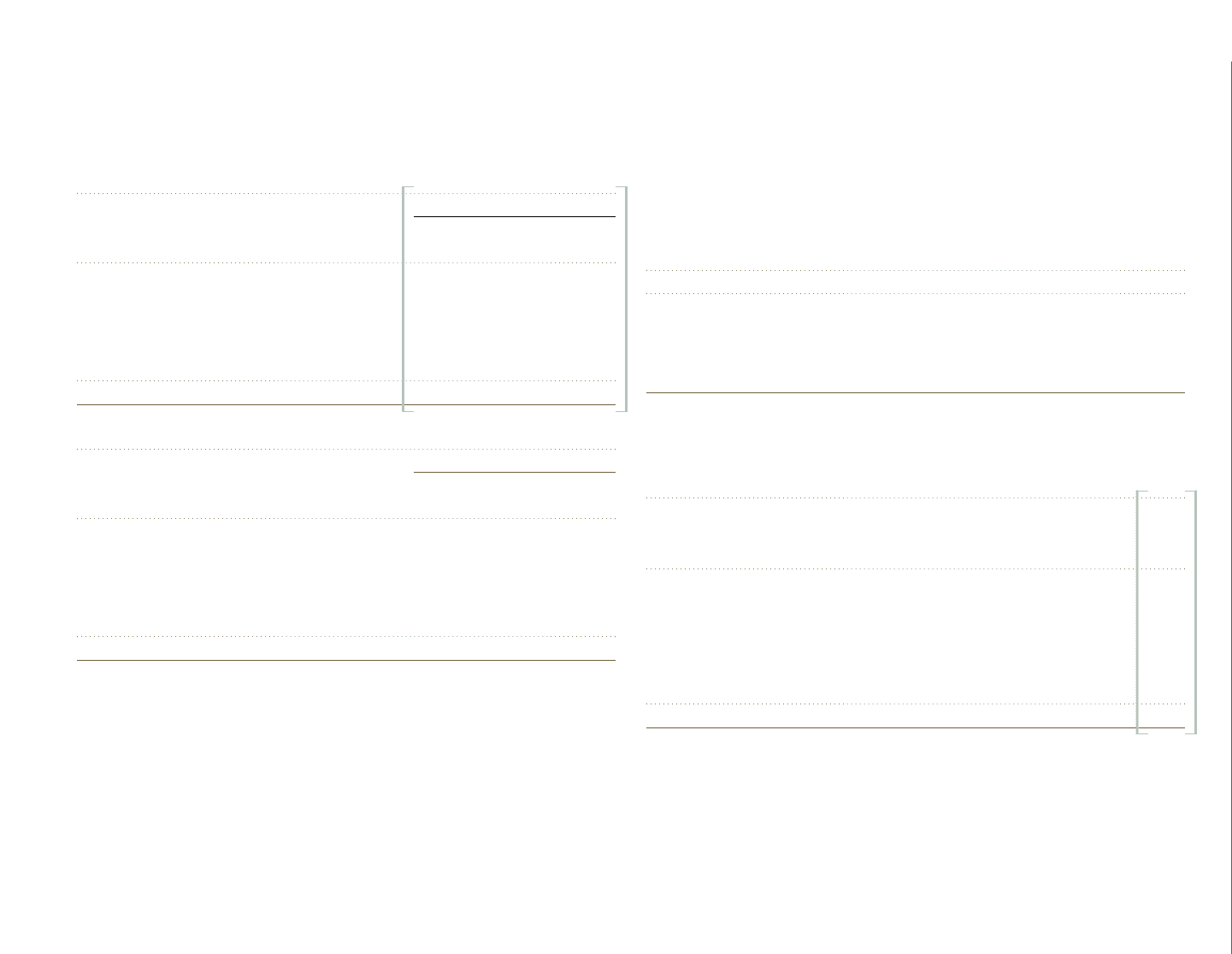

i. Intangible Assets Including Goodwill

The following schedule details the company’s intangible asset balances by major asset class:

(Dollars in millions)

At December 31, 2004

Gross Net

Carrying Accumulated Carrying

Intangible Asset Class Amount Amortization Amount

Capitalized software $«1,565 $««««(680) $««««885

Client-related 861 (335) 526

Completed technology 364 (206) 158

Strategic alliances 104 (47) 57

Patents/trademarks 33 (11) 22

Other** 247 (106) 141

Total $«3,174 $«(1,385) $«1,789

(Dollars in millions)

At December 31, 2003

Gross Net

Carrying Accumulated Carrying

Intangible Asset Class Amount Amortization Amount

Capitalized software*$«1,616 $««««(802) $««««814

Client-related 704 (254) 450

Completed technology 448 (228) 220

Strategic alliances 118 (38) 80

Patents/trademarks 98 (66) 32

Other** 165 (37) 128

Total $«3,149 $«(1,425) $«1,724

*Reclassified to conform with 2004 presentation. In prior years, capitalized software was recorded in Investments and

sundry assets.

**Other intangibles are primarily acquired proprietary and nonproprietary business processes, methodologies and systems,

and impacts from currency translation.

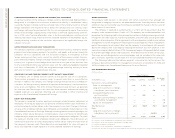

The company amortizes the cost of intangible assets over their estimated useful lives

unless such lives are deemed indefinite. Amortizable intangible assets are tested for

impairment based on undiscounted cash flows and, if impaired, written down to fair value

based on either discounted cash flows or appraised values. Intangible assets with indefinite

lives are tested annually for impairment and written down to fair value as required. No

impairment of intangible assets has been identified during any of the periods presented.

The net carrying amount of intangible assets increased by $65 million for the year

ended December 31, 2004, primarily due to increased investments in Software.

Total amortization was $956 million, $955 million and $802 million for the years ended

December 31, 2004, 2003 and 2002, respectively. The aggregate amortization expense for

acquired intangibles (excluding capitalized software) was $370 million, $349 million and

$181 million for the years ended December 31, 2004, 2003 and 2002, respectively.

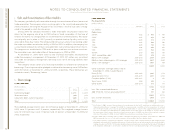

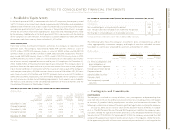

The future amortization expense for each of the five succeeding years relating to all

intangible assets that are currently recorded in the Consolidated Statement of Financial

Position is estimated to be the following at December 31, 2004:

(Dollars in millions)

2005 $«875

2006 494

2007 200

2008 93

2009 72

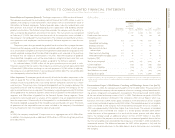

goodwill

The changes in the carrying amount of goodwill, by reporting segment, for the year ended

December 31, 2004, are as follows:

(Dollars in millions)

Foreign

Currency

Balance Purchase Translation Balance

Jan. 1, Goodwill Price and Other Dec. 31,

Segment 2004 Additions Adjustments Divestitures Adjustments 2004

Global Services $«4,184 $««««808 $«««(41) $«(2) $«222 $«5,171

Systems and

Technology Group 161 — — — 8 169

Personal Systems Group 71 — — — 5 76

Software 2,505 585 (75) — 6 3,021

Global Financing —— ————

Enterprise Investments —— ————

Total $«6,921 $«1,393 $«(116) $«(2) $«241 $«8,437

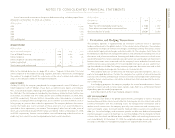

Goodwill is tested annually for impairment using a fair value approach, at the “reporting

unit” level. A reporting unit is the operating segment, or a business which is one level

below that operating segment (the “component” level) if discrete financial information is

prepared and regularly reviewed by management at the component level. No impairment

of goodwill has been identified during any of the periods presented.