ADT 2003 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

11.

Discontinued Operations of Tyco Capital

(CIT Group Inc.)

On July 8, 2002, the Company divested of Tyco Capital through

the sale of 100% of CIT’s common shares in an IPO.

Accordingly, the results of Tyco Capital are presented as dis-

continued operations for all periods. Prior year amounts

include Tyco Capital’s operating results after June 1, 2001, the

date of acquisition of CIT by Tyco.

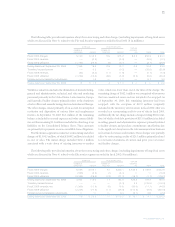

Operating results from the discontinued operations of Tyco

Capital through July 8, 2002 were as follows ($ in millions):

FOR THE PERIOD

FOR THE PERIOD JUNE 2 (DATE OF

OCTOBER 1, 2001 ACQUISITION)

THROUGH THROUGH

JULY 8, 2002 SEPTEMBER 30, 2001

Finance income $«3,327.6 $1,676.5

Interest expense 1,091.5 597.1

Net finance income 2,236.1 1,079.4

Depreciation on operating

lease equipment 944.4 448.6

Net finance margin 1,291.7 630.8

Provision for credit losses 665.6 116.1

Net finance margin, after

provision for credit losses 626.1 514.7

Other income 741.1 335.1

Operating margin 1,367.2 849.8

Selling, general, administrative

and other costs and expenses 687.8 398.7

Goodwill impairment 6,638.1 —

Operating expenses 7,325.9 398.7

(Loss) income before income

taxes and minority interest (5,958.7) 451.1

Income taxes (316.1) (195.0)

Minority interest (7.7) (3.6)

(Loss) income from

discontinued operations $(6,282.5) $«««252.5

During the quarter ended March 31, 2002, Tyco experienced

disruptions to its business surrounding its announced break-up

plan, a downgrade in its credit ratings, and a significant decline

in its market capitalization. During this same time period, CIT

also experienced credit downgrades and a disruption to its

historical funding base. Further, market-based information

used in connection with the Company’s preliminary consid-

eration of the proposed IPO of CIT indicated that CIT’s book

value exceeded its estimated fair value as of March 31, 2002. As

a result, the Company performed a SFAS No. 142 first step

impairment analysis as of March 31, 2002 and concluded that

an impairment charge was warranted at that time.

Management’s objective in performing the SFAS No. 142 first

step analysis was to obtain relevant market-based data to calculate

the estimated fair value of CIT as of March 31, 2002 based on its

projected earnings and market factors expected to be used by

market participants in ascribing value to CIT in the planned

separation of CIT from Tyco. Management obtained relevant

market data from financial advisors regarding the range of price

to earnings multiples and market condition discounts applicable

to CIT as of March 31, 2002 and applied these market data to

CIT’s projected annual earnings as of March 31, 2002 to calculate

an estimated fair value and any resulting goodwill impairment.

The estimated fair value was compared to the corresponding

carrying value of CIT at March 31, 2002. As a result, the

Company recorded a $4,512.7 million impairment charge as of

March 31, 2002, which is included in discontinued operations.

SFAS No. 142 requires a second step analysis whenever a

reporting unit’s book value exceeds estimated fair value. This

analysis requires the Company to estimate the fair value of the

reporting unit’s individual assets and liabilities to complete the

analysis of goodwill as of March 31, 2002. The Company com-

pleted this second step analysis for CIT during the quarter

ended June 30, 2002 and, as a result, recorded an additional

goodwill impairment charge of $132.0 million. During the

June 30, 2002 quarter, CIT experienced further credit down-

grades and the business environment and other factors continued

to negatively impact the likely proceeds of the IPO. As a result,

we performed another first step and second step analysis as

of June 30, 2002 in a manner consistent with the March 2002

process described above. Each of these analyses was based upon

updated market data at June 30, 2002 and through the period

immediately following the IPO, including the IPO proceeds.

These analyses resulted in a goodwill impairment of $1,867.0

million, which is also included in discontinued operations. Tyco

also recorded an additional impairment charge of $126.4 mil-

lion in order to write down its investment in CIT to fair value

for a total CIT goodwill impairment of $2,125.4 million. This

write down was based upon net IPO proceeds of approximately

$4.4 billion, after deducting estimated out-of-pocket expenses,

and is included in the $6,282.5 million loss from discontinued

operations. During the fourth quarter of fiscal 2002, Tyco

recorded a loss on the sale of Tyco Capital of $58.8 million.

During fiscal 2003, Tyco recorded income from discontinued

operations of $20.0 million. The $20.0 million represented a

restitution payment made by Frank E. Walsh Jr. (see Note 18).

ACCOUNTING POLICIES OF DISCONTINUED OPERATIONS

Financing and Leasing Assets Tyco Capital provided funding

for a variety of financing arrangements, including term loans,

lease financing and operating leases. The amounts outstanding

TYCO INTERNATIONAL LTD.