ADT 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

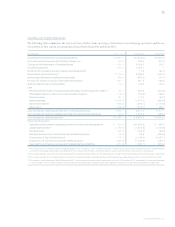

overcapacity in the market and resulting lack of demand for

new system construction. In the fourth fiscal quarter of 2002,

management decided to focus the business for the foreseeable

future on maintenance revenues and capacity sales on the TGN,

to discontinue future additions to the TGN, and limit con-

struction activities to small projects that were cash flow positive

with at least breakeven earnings. As a result of this strategy,

management devised a plan to significantly downsize the man-

ufacturing footprint, decrease project management staffing,

reduce the research and development function and minimize

staffing and expense in all other administrative areas of the

business to decrease cash outflows and losses to the maximum

extent possible. This plan was carefully crafted to ensure that

both the technical and construction competencies of the business

would be preserved in the event industry conditions improve.

Operating income and margins in fiscal 2001 include

restructuring and other charges of $383.8 million primarily

related to the closure of facilities within the communications,

computer and consumer electronics industries in response to

the severe downturn experienced. Included within the $383.8

million are inventory write downs of $74.1 million and charges

of $51.7 million for the write-up of inventory under purchase

accounting, both of which are included in cost of sales.

Operating income and margins for fiscal 2001 also include

charges of $98.5 million for the impairment of property, plant

and equipment associated with the facility closures.

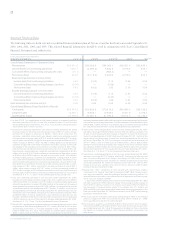

Healthcare The following table sets forth net revenues and

operating income and margins for the Healthcare segment

($ in millions):

FISCAL 2003 FISCAL 2002 FISCAL 2001

Revenue from

product sales $8,496.0 $7,828.4 $7,001.1

Service revenue 75.9 70.7 64.2

Net revenues $8,571.9 $7,899.1 $7,065.3

Operating income $2,127.1 $1,846.8 $1,509.3

Operating margins 24.8% 23.4% 21.4%

Net revenues for the Healthcare segment increased 8.5% in fiscal

2003 over fiscal 2002, including an 8.5% increase in product

revenue and a 7.4% increase in service revenue. The increase in

net revenues resulted primarily from organic growth and favor-

able foreign currency exchange rates and, to a lesser extent,

acquisitions, net of divestitures. Organic growth was due to the

following: increases in the surgical sector concurrent with the

award of a major contract and continued organic growth

within certain surgical stapling lines; increases in the medical

sector resulting from the award of a significant wound care

contract, coupled with the exit of a major competitor from the

traditional wound care business, new product launches and

higher demand in the ultrasound market; increases in pharma-

ceuticals and imaging due to higher volumes and increased

market share; and strong sales within the respiratory division.

These sales increases were partially offset by a decrease in the

diaper product segment of the Retail business largely resulting

from the adverse impact of the industry-wide down-count

issues, and a decline in the International division due to lower

sales in continental Europe and Latin America. The increase in

net revenues also resulted from favorable changes in foreign

exchange rates ($268.2 million) and incremental revenues gener-

ated from the acquisition of Paragon Trade Brands (“Paragon”)

in January 2002 ($123.8 million calculated in the manner

described above in “Overview”), slightly offset by a decline in

revenues ($48.1 million) related to the divestiture of Surgical

Dynamics, Inc. in July 2002.

The 15.2% increase in operating income and increase in

margins in fiscal 2003 compared to fiscal 2002 were due prima-

rily to favorable margin impact as a result of higher sales and

favorable manufacturing variances as a result of increased

production volumes, a shift to a more favorable product mix,

and cost savings as a result of the closure of certain Paragon

facilities, back office consolidations and our continued focus

on optimizing operating expenses. Slightly offsetting the effect

of those items were increased legal fees, insurance and pension

expense, and higher sales and marketing expense as a result of

program development aimed at supporting organic growth ini-

tiatives. Also contributing to the increase in operating income

and margins were favorable fluctuations in foreign currency

exchange rates and the impact of acquisitions and divestitures.

During fiscal 2003, we recorded net credits totaling $3.3 mil-

lion. Included within the total credits of $3.3 million are charges

of $11.7 million related to asset reserves for inventory and charges

of $0.7 million for adjustments to accrual balances related to

workers’ compensation, which were changes in estimates

recorded in connection with the Company’s intensified internal

audits, detailed controls and operating reviews and as a result

of applying management’s judgments and estimates. Also

included within the $3.3 million are restructuring credits of

$9.2 million, of which $0.2 million is included in cost of sales,

due to costs being less than anticipated and a credit of $6.5 mil-

lion included in selling, general and administrative expenses

related to an insurance reimbursement for certain legal fees

associated with product liability cases. The restructuring cred-

its of $9.2 million include credits of $4.7 million which were

also changes in estimates recorded during the quarter ended

March 31, 2003.

TYCO INTERNATIONAL LTD.