ADT 2003 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

During fiscal 2003, the Company recognized other expense

of $8.6 million in connection with a bank guarantee on behalf of

an equity investee.

During fiscal 2002, the Company sold certain of its businesses

for net proceeds of approximately $138.7 million in cash that

consist primarily of certain businesses within the Healthcare

and Fire and Security segments. In connection with these dis-

positions, the Company recorded a net gain of $23.6 million. In

fiscal 2001, the Company sold its ADT Automotive business to

Manheim Auctions, Inc., a wholly-owned subsidiary of Cox

Enterprises, Inc., for approximately $1.0 billion in cash. The

Company recorded a net gain on the sale of businesses of

$410.4 million after deducting commissions and other direct

costs, principally related to the sale of ADT Automotive. This

gain is net of direct and incremental costs of the transaction, as

well as $60.7 million of special bonuses paid to key employees.

9.

TyCom Ltd.

During fiscal 2001, the Company recorded a $24.5 million net

gain on the sale of approximately 5.6 million common shares of

TyCom. This gain is net of direct and incremental costs of the

transaction, as well as $15.0 million of special bonuses paid to

key employees.

On December 18, 2001, the Company completed its amalga-

mation with TyCom and each of the approximately 56 million

TyCom common shares not owned by Tyco were converted

into the right to receive 0.3133 of a Tyco common share. Upon

completion of the amalgamation, TyCom became a wholly-

owned subsidiary of Tyco, and each outstanding option to

purchase TyCom common shares is exercisable for Tyco com-

mon shares, with the number of Tyco shares equal to the number

of TyCom common shares issuable upon exercise immediately

prior to the consummation multiplied by the exchange ratio of

0.3133. The per share exercise price for the Tyco common

shares issuable upon the exercise of TyCom options equals the

exercise price per TyCom common share, at the price such

options were exercisable prior to the amalgamation, divided by

the exchange ratio. In addition, each outstanding TyCom

restricted share was converted into a restricted Tyco common

share based on the exchange ratio. The options and restricted

shares are subject to the same terms and conditions that were

applicable immediately prior to the amalgamation.

10.

Income Taxes

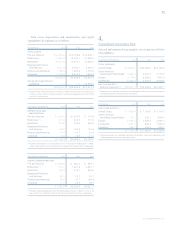

The provision for income taxes and the reconciliation between

the notional United States federal income taxes at the statutory

rate on consolidated income before taxes and the Company’s

income tax provision are as follows ($ in millions):

YEAR ENDED SEPTEMBER 30, 2003 2002 2001

Notional U.S. federal income

tax expense (benefit) at

the statutory rate $«631.0 $(920.0) $1,790.1

Adjustments to reconcile to

the Company’s income

tax provision:

U.S. state income tax

(benefit) provision, net (97.4) 26.1 74.6

Asset impairments 120.4 785.3 47.5

Non-U.S. net earnings (1) (242.1) (210.5) (859.0)

Nondeductible charges 383.0 541.2 170.4

Other (30.4) (14.0) (51.3)

Provision for income taxes 764.5 208.1 1,172.3

Deferred provision (benefit) 18.6 123.1 455.4

Current provision $«745.9 $÷«85.0 $«««716.9

(1) Excludes asset impairments, nondeductible charges and other items which are

broken out separately in the table.

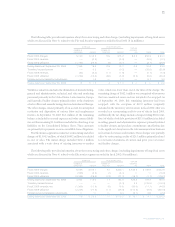

The provisions for fiscal 2003, fiscal 2002, and fiscal 2001 include

$805.9 million, $487.6 million, and $514.8 million, respectively,

for non-U.S. income taxes. The non-U.S. component of income

(loss) from continuing operations before income taxes was

$2,835.1 million, $(646.3) million and $4,005.8 million for fiscal

2003, fiscal 2002, and fiscal 2001, respectively.

TYCO INTERNATIONAL LTD.