ADT 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

cash for utilization of purchase accounting liabilities related to

prior years’ acquisitions. In addition, we paid out $100.3 million

relating to holdback/earn-out liabilities related to certain prior

period acquisitions. Holdback liabilities represent a portion of

the purchase price that is withheld from the seller pending

finalization of the acquisition balance sheet. Certain acquisitions

have provisions which require Tyco to make additional “earn-

out” payments to the sellers if the acquired company achieves

certain milestones subsequent to its acquisition by Tyco. These

earn-out payments are tied to certain performance measures,

such as revenue, gross margin or earnings growth. Also, in fiscal

2003, we determined that $207.2 million of purchase account-

ing liabilities related to acquisitions prior to fiscal 2003 were

not needed and reversed that amount against goodwill. At

September 30, 2003, there remained $199.0 million in purchase

accounting accruals on our Consolidated Balance Sheet, of

which $79.7 million is included in accrued expenses and other

current liabilities and $119.3 million is included in other long-

term liabilities. In addition, $211.7 million of holdback/earn-out

liabilities remained on our Consolidated Balance Sheet, of

which $93.1 million are included in accrued expenses and other

current liabilities and $118.6 million are included in other

long-term liabilities.

As required by SFAS No. 142, all business combinations

completed in fiscal 2002 were accounted for under the purchase

accounting method. At the time each purchase acquisition is

made, we recorded transaction costs and the costs of integrating

the purchased company within the relevant Tyco business seg-

ment. The amounts of such liabilities established in fiscal 2002

are detailed in Note 2 to the Consolidated Financial Statements.

These amounts are not charged against current earnings but

are treated as additional purchase price consideration and have

the effect of increasing the amount of goodwill recorded in

connection with the respective acquisition. We view these costs

as the equivalent of additional purchase price consideration

when we consider making an acquisition. If the amount of the

liabilities proves to be in excess of costs actually incurred, any

excess is used to reduce the goodwill account that was estab-

lished at the time the acquisition was made. Any shortfall will

be recorded in earnings.

During the fourth quarter of fiscal 2003, the Company ini-

tiated a proposed divestiture program which includes the TGN

and other non-core businesses within all of our operating seg-

ments except Plastics and Adhesives. Combined fiscal 2003 rev-

enues for businesses under consideration for potential

divestiture totaled approximately $2 billion. The estimated

potential proceeds from sales (excluding the TGN) could be at

least $400 million. If we dispose of these businesses, we may not

fully recover their recorded book values. At September 30,

2003, however, under the held and used model, the assets of

these businesses were fully recoverable.

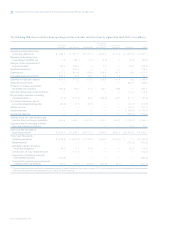

We continue to fund capital expenditures to improve the

cost structure of our businesses, to invest in new processes and

technology, and to maintain high quality production standards.

During fiscal 2003, we spent $112.7 million on construction of

the TGN. Construction of the TGN was completed during fis-

cal 2003. Consequently, the level of capital expenditures in the

Electronics segment is expected to decrease in fiscal 2004. The

level of capital expenditures in the other segments should not

exceed depreciation in fiscal 2004 and should approximate the

level of spending in fiscal 2003.

The provision for income taxes relating to continuing oper-

ations in the Consolidated Statement of Operations for fiscal

2003 was $764.5 million, and the amount of income taxes paid

(net of refunds) during the year was $142.5 million. The differ-

ence is due to timing differences, as well as net operating loss

carryforward and carryback utilization.

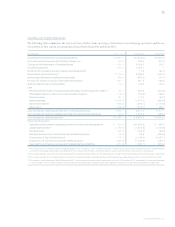

CAPITALIZATION

Shareholders’ equity was $26,369.0 million, or $13.20 per share,

at September 30, 2003, compared to $24,081.3 million, or $12.07

per share, at September 30, 2002. The increase in shareholders’

equity was due primarily to currency translation adjustments

of $1,445.4 million and net income of $979.6 million.

Tangible shareholders’ deficit was $5,359.7 million and

$7,745.0 million at September 30, 2003 and 2002, respectively.

Goodwill and other intangible assets were $31,728.7 million at

September 30, 2003, compared to $31,826.3 million at

September 30, 2002. Acquisitions have been an important part

of Tyco’s growth in prior years. While we have continued to

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations