ADT 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

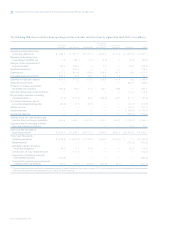

Net revenues for the Healthcare segment increased 11.8% in

fiscal 2002 over fiscal 2001 including a 11.8% increase in prod-

uct revenue and a 10.1% increase in service revenue, primarily

as a result of increased sales volume resulting from acquisitions

in our U.S. healthcare businesses and, to a much lesser extent,

increased revenues from our domestic and international

healthcare businesses. Excluding the $11.2 million decrease

from foreign currency exchange fluctuations and the acquisi-

tions of Mallinckrodt Inc. (“Mallinckrodt”) in October 2000,

InnerDyne, Inc. in December 2000, Paragon, and all other

acquisitions with a purchase price of $10 million or more,

pro forma revenues (calculated in the manner described

above in “Overview”) for the Healthcare segment increased an

estimated 2.9%.

Operating income increased 22.4% in fiscal 2002 compared

to fiscal 2001 primarily due to a decrease in charges recorded in

fiscal 2002 as compared to fiscal 2001, as well as the impact of

acquisitions and operating efficiencies realized from cost

reductions at Mallinckrodt. This increase was partially offset by

lower margins of businesses acquired at Tyco Healthcare.

Operating income and margins for fiscal 2002 reflect net

restructuring and other charges of $44.8 million. The $44.8

million net charge includes charges of $48.7 million, of which

inventory write downs of $0.5 million are included in cost of

sales. These charges primarily relate to severance associated

with the consolidation of operations and facility-related costs

due to exiting certain business lines, and are partially offset by

a credit of $3.9 million relating to current and prior years’

restructuring charges. Operating income and margins for fiscal

2002 also include a charge for the write off of long-lived assets

of $2.5 million primarily related to the impairment of long-

lived assets.

Operating income and margins for fiscal 2001 include net

restructuring and other charges of $48.4 million primarily related

to the closure of several manufacturing plants. Included within

the $48.4 million are charges of $64.0 million, of which charges

of $35.0 million for the write-up of inventory under purchase

accounting and inventory write downs of $5.0 million are

included in cost of sales, partially offset by credits of $15.6 mil-

lion related to the merger with U.S. Surgical. Operating income

and margins also include a charge of $184.3 million for the

write off of purchased in-process research and development

associated with the acquisition of Mallinckrodt and charges of

$14.2 million for the impairment of property, plant and equip-

ment related to the closure of the manufacturing plants.

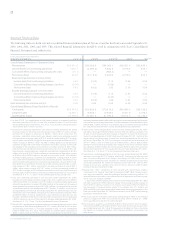

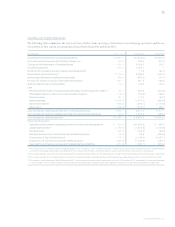

Engineered Products and Services The following table sets

forth net revenues and operating income and margins for the

Engineered Products and Services segment ($ in millions):

FISCAL 2003 FISCAL 2002 FISCAL 2001

Revenue from

product sales $4,010.1 $4,064.1 $3,594.5

Service revenue 674.3 645.2 576.3

Net revenues $4,684.4 $4,709.3 $4,170.8

Operating income $«««355.2 $«««252.5 $«««704.8

Operating margins 7.6% 5.4% 16.9%

Net revenues for the Engineered Products and Services segment

remained essentially level in fiscal 2003 as compared to fiscal

2002, including a 1.3% decrease in product revenue partially

offset by a 4.5% increase in service revenue. Net revenue

decreased year over year, as the increase in net revenues due

to favorable changes in foreign currency exchange rates

($233.1 million calculated in the manner described above in

“Overview”) and the effect of acquisitions ($41.2 million) was

more than offset by continued weak conditions in major mar-

kets at Flow Control and Electrical and Metal Products, most

notably in non-residential construction. Also contributing to

the overall decrease was lower levels of capital spending and

increased pricing pressure, resulting in lower selling prices. The

$41.2 million effect from acquisitions included Century Tube

Corporation (“Century”) in October 2001, Water & Power

Technologies (“Water & Power”) in November 2001, and Clean

Air Systems (“Clean Air”) in February 2002 and all other acqui-

sitions with a purchase price of $10 million or more.

The 40.7% increase in operating income and the increase in

margins in fiscal 2003 compared to fiscal 2002 were due to

lower than usual operating income in the prior year period, as

a result of recording charges of $379.5 million (discussed below).

During fiscal 2003, we recorded charges totaling $56.7 million.

Included within the $56.7 million are charges of $33.1 million

related to changes in estimates recorded in connection with the

Company’s intensified internal audits, detailed controls and

operating reviews and as a result of applying management’s

judgments and estimates (including $19.0 million related to

adjustments to workers’ compensation, $1.0 million primarily

related to reconciling items in the current period and $13.1 mil-

lion associated with asset reserves). Also included within the

$56.7 million are net restructuring and other charges of

$7.8 million, of which $6.1 million is included in cost of sales,

due to changes in estimates of costs being less than anticipated;

charges for the impairment of long-lived assets of $2.2 million

relating to manufacturing and distribution consolidation at

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations