ADT 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

maximum amount payable to the former shareholders of

Com-Net only after the construction and installation of a

communications system for the State of Florida is finished and

the State has approved the system based on the guidelines set

forth in the contract. The $80 million is not accrued at

September 30, 2003, as the outcome of this contingency cannot

be reasonably determined.

As a result of actions taken by our former senior corporate

management, Tyco, some members of our former senior corpo-

rate management, former members of our Board of Directors

and our current Chief Executive Officer are named defendants

in a number of purported class actions alleging violations of

the disclosure provisions of the federal securities laws, as well as

in a number of derivative actions. In the consolidated derivative

action, the plaintiffs have filed a motion which seeks to add

certain members of our current Board of Directors and man-

agement as defendants. Tyco, certain of our current and former

employees, some members of our former senior corporate

management and some former members of our Board of

Directors also are named as defendants in several Employee

Retirement Income Security Act (“ERISA”) actions. In addi-

tion, Tyco and some members of our former senior corporate

management are subject to an SEC inquiry, and some members

of our former senior corporate management are named as

defendants in criminal cases being prosecuted by the District

Attorney of New York County. The findings and outcomes of

the prosecutions and the SEC civil action may affect the course

of the purported class actions, derivative actions and ERISA

claims pending against Tyco. In May and July 2003, complaints

were filed against Tyco and our current Chairman and Chief

Executive Officer purporting to represent a class of purchasers

of Tyco securities alleging violations of the disclosure provisions

of the federal securities laws. We are generally obliged to

indemnify our directors and officers and our former directors

and officers who are also named as defendants in some or all

of these matters to the extent permitted by Bermuda law. In

addition, our insurance carriers may decline coverage, or our

coverage may be insufficient to cover our expenses and liability,

in some or all of these matters. See “Risk Factors” below and

“Legal Proceedings.” We are unable at this time to estimate

what our ultimate liability in these matters may be, and it is

possible that we will be required to pay judgments or settle-

ments and incur expenses in aggregate amounts that would

have a material adverse effect on our financial condition, results

of operations and liquidity. It is not possible to estimate the

amount of loss or probable losses, if any, that might result from

an adverse settlement of these matters.

We and others have received subpoenas and requests from

the SEC’s Division of Enforcement, the District Attorney of

New York County, the U.S. Attorney for the District of New

Hampshire, the Equal Opportunity Employment Commission

and others seeking the production of voluminous documents

in connection with various investigations into our governance,

management, operations, accounting and related controls. The

Department of Labor is investigating Tyco and the administra-

tors of certain of our benefit plans. In addition, while we believe

we have adequately responded to a Governmental Services

Administration (“GSA”) action questioning whether Tyco

lacked the present responsibility to be a government contractor

due to concerns the GSA has expressed as a result of the alleged

serious criminal misconduct of our former Chief Executive

Officer, Chief Financial Officer and General Counsel, the GSA

has reserved the right to take appropriate actions if additional

information warrants it. We cannot predict when these investi-

gations will be completed, nor can we predict what the results

of these investigations may be. It is possible that we will be

required to pay material fines, consent to injunctions on future

conduct, lose the ability to conduct business with government

instrumentalities (which in time could negatively impact our

business with non-governmental customers) or suffer other

penalties, each of which could have a material adverse effect on

our business. It is not possible to estimate the amount of loss,

or range of possible loss, if any, that might result from an adverse

settlement of these matters.

Tyco and our subsidiaries’ income tax returns are periodically

examined by various regulatory tax authorities. In connection

with such examinations, tax authorities, including the Internal

Revenue Service, have raised issues and proposed tax deficiencies.

We are reviewing the issues raised by the tax authorities and are

contesting certain of the proposed tax deficiencies. Amounts

related to these tax deficiencies and other tax contingencies that

management has assessed as probable and estimable have been

accrued through the income tax provision. Management

believes that the ultimate resolution of these tax deficiencies

and contingencies will not have a material adverse effect on the

Company’s financial condition, annual results of operations or

cash flows.

The Company is a defendant in a number of other pending

legal proceedings incidental to present and former operations,

acquisitions and dispositions. The Company does not expect

the outcome of these proceedings, either individually or in the

aggregate, to have a material adverse effect on its financial posi-

tion, annual results of operations or liquidity.

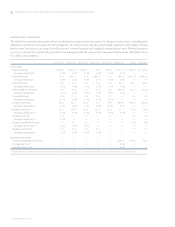

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations