ADT 2003 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

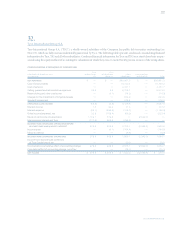

For measurement purposes, in fiscal 2003, an 11.55% com-

posite annual rate of increase in the per capita cost of covered

health care benefits was assumed. The rate was assumed to

decrease gradually to 5.00% by the year 2011 and remain at that

level thereafter. At year-end, the composite annual rate of

increase in health care benefit costs was increased to 12.71%,

decreasing to 5.00% by the year 2013. A one-percentage-point

change in assumed healthcare cost trend rates would have the

following effects on income ($ in millions):

1-PERCENTAGE-POINT 1-PERCENTAGE-POINT

INCREASE DECREASE

Effect on total of service and interest

cost components $««1.4 $««(1.2)

Effect on accumulated postretirement

benefit obligation 25.2 (22.1)

The combined weighted-average discount rate used in deter-

mining the accumulated postretirement benefit obligation was

5.52% and 6.75% at September 30, 2003 and 2002, respectively.

24.

Preference Shares

Tyco has authorized 125,000,000 preference shares, par value of

$1 per share, at September 30, 2003 and 2002, of which one

such share was issued and designated a special voting preference

share in connection with the purchase of CIT in June 2001. This

preference share provided a mechanism by which the holders of

outstanding exchangeable shares exercise their voting, dividend

and liquidation rights, which were equivalent to those of Tyco

common shareholders, except that each exchangeable share was

equivalent to 0.6907 of a Tyco common share. In connection

with the IPO of CIT, the exchangeable shares were redeemed

effective July 5, 2002 through the issuance of 3,243,322 Tyco

common shares. As a result, no one is entitled to exercise the

rights attaching to the preference share.

Rights as to dividends, return of capital, redemption, conver-

sion, voting and otherwise with respect to the preference shares

may be determined by Tyco’s Board of Directors on or before

the time of issuance. In the event of the liquidation of the

Company, the holders of any preference shares then outstanding

would be entitled to payment to them of the amount for which

the preference shares were subscribed and any unpaid dividends

prior to any payment to the common shareholders.

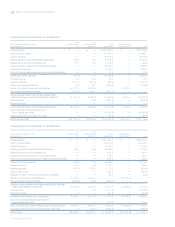

25.

Shareholders’ Equity

Shares owned by subsidiaries are treated as treasury shares and

are recorded at cost.

In fiscal 2001, Tyco sold 39 million common shares for

approximately $2,198.0 million in an underwritten public

offering. Net proceeds from the offering were $2,196.6 million

and were used to repay debt incurred to finance a portion of

the acquisition of CIT.

The total compensation cost expensed for all stock-based

compensation awards discussed below was $43.4 million, $89.9

million and $116.8 million for fiscal 2003, fiscal 2002 and fiscal

2001, respectively.

Restricted Shares The Company maintains a restricted share

ownership plan, which provides for the award of an initial

amount of common shares plus an amount equal to one-half of

one percent of the total shares outstanding at the beginning of

each fiscal year. At September 30, 2003, there were 59,831,883

shares authorized under the plan, of which 16,223,413 shares

had been granted. The number of shares available for issuance

under the 1994 Restricted Stock Plan was reduced to 999,524 in

October 2002. Common shares are awarded subject to certain

restrictions with vesting varying over periods of up to ten years.

For grants which vest based on certain specified perform-

ance criteria, the fair market value of the shares at the date of

vesting is expensed over the period of performance, once

achievement of criteria is deemed probable. For grants that vest

through passage of time, the fair market value of the shares at

the time of the grant is amortized (net of tax benefit) to expense

over the period of vesting. The unamortized portion of deferred

compensation expense is recorded as a reduction of shareholders’

equity. Recipients of all restricted shares have the right to vote

such shares and receive dividends. Income tax benefits resulting

from the vesting of restricted shares, including a deduction for

the excess, if any, of the fair market value of restricted shares at

the time of vesting over their fair market value at the time of

the grants and from the payment of dividends on unvested

shares, are credited to contributed surplus.

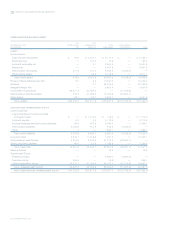

Employee Stock Purchase Plans Substantially all full-time

employees of the Company’s U.S. subsidiaries and employees of

certain qualified non-U.S. subsidiaries are eligible to participate

in an employee share purchase plan. Eligible employees authorize

payroll deductions to be made for the purchase of shares. The

Company matches a portion of the employee contribution by

contributing an additional 15% of the employee’s payroll

deduction. All shares purchased under the plan are purchased

on the open market by a designated broker.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements