ADT 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

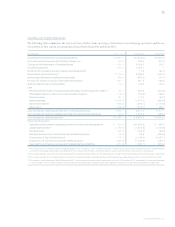

The net change in total working capital, net of the effects of

acquisitions and divestitures, was an increase of $307.0 million

in fiscal 2003, including cash paid out for restructuring and

other charges of $503.3 million. The components of this change

are set forth in detail in our Consolidated Statement of Cash

Flows. The significant changes in working capital included a

$627.6 million decrease in accounts payable due primarily to an

overall decrease across all of our business segments resulting

from improved inventory management, as well as a decrease

within Tyco Telecommunications due to lower purchasing

resulting from the completion of the TGN. In addition, accrued

expenses and other current liabilities decreased $559.9 million

primarily as a result of cash paid out associated with accruals

for restructuring and other charges. We focus on maximizing

the cash flow from our operating businesses and attempt to

keep the working capital employed in the businesses to the

minimum level required for efficient operations.

During fiscal 2003, we decreased our participation in our

sale of accounts receivable program by $119.0 million.

During fiscal 2003, fiscal 2002 and fiscal 2001, we paid out

$271.8 million, $624.1 million and $878.7 million, respectively,

in cash that was charged against accruals established in con-

nection with acquisitions. This amount is included in “Cash

paid for purchase accounting and holdback/earn-out liabilities”

under Cash Flows From Investing Activities in the Consoli-

dated Statements of Cash Flows.

Accruals for restructuring and other items are taken as a

charge against current earnings at the time the accruals are

established in accordance with SFAS No. 146, “Accounting for

Costs Associated with Exit or Disposal Activities.” Amounts

expended for restructuring and other costs are charged against

the accruals as they are paid out. If the amount of the accruals

proves to be greater than the costs actually incurred, any excess

is credited against restructuring and other charges in the

Consolidated Statement of Operations in the period in which

that determination is made.

At September 30, 2002, there existed accruals for restructur-

ing and other charges of $1,021.6 million on the Consolidated

Balance Sheet. During fiscal 2003, we recorded net restructuring

credits of $84.8 million, of which credits of $10.5 million are

included in cost of sales, related to a revision of estimates of

prior years’ restructuring charges. During fiscal 2003, we paid

out $503.3 million in cash and incurred $0.3 million in non-cash

uses that were charged against these liabilities. We also reclassi-

fied $197.5 million of restructuring accruals to the appropriate

balance sheet accounts, recorded $7.4 million in foreign currency

translation adjustments and recorded non-cash adjustments of

$40.0 million. At September 30, 2003, there remained $293.6 mil-

lion of accruals for restructuring and other charges on our

Consolidated Balance Sheet, of which $159.3 million is included

in accrued expenses and other current liabilities, and $134.3 mil-

lion is included in other long-term liabilities.

During fiscal 2003, we purchased customer contracts for

electronic security services for cash of $596.8 million and

businesses for cash of $44.0 million, net of $1.1 million of

cash acquired.

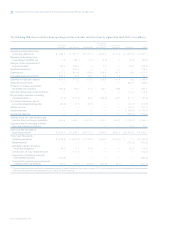

At the beginning of fiscal 2003, purchase accounting accru-

als were $539.0 million as a result of purchase accounting

transactions in prior years. In connection with fiscal 2003

acquisitions, we established purchase accounting liabilities of

$0.2 million for transaction and integration costs. In addition,

purchase accounting liabilities of $25.8 million and a corre-

sponding increase to goodwill and deferred tax assets were

recorded during fiscal 2003 relating to fiscal 2002 and prior

years’ acquisitions. These accruals related primarily to revisions

associated with finalizing the exit plans of Paragon and Eberle,

both acquired during fiscal 2002. Also, during fiscal 2003, we

reclassified $3.8 million of fair value adjustments related to the

write down of assets for fiscal 2002 acquisitions out of purchase

accounting accruals into the appropriate asset or liability account.

We also recorded $16.5 million in cumulative translation

adjustments. During fiscal 2003, we paid out $171.5 million in

TYCO INTERNATIONAL LTD.