ADT 2003 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

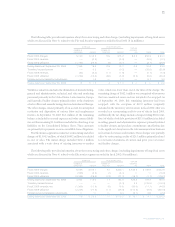

The deferred income tax balance sheet accounts result from

temporary differences between the amount of assets and liabil-

ities recognized for financial reporting and tax purposes. The

components of the net deferred income tax asset are as follows

($ in millions):

SEPTEMBER 30, 2003 2002

Deferred tax assets:

Accrued liabilities and reserves $«2,318.4 $«2,009.2

Tax loss and credit carryforwards 1,297.8 1,679.7

Capitalized research and

development 280.0 63.0

Other 822.5 639.3

4,718.7 4,391.2

Deferred tax liabilities:

Property, plant and equipment (487.3) (256.6)

Intangibles (1,000.3) (770.6)

Undistributed earnings of subsidiaries (80.1) (80.1)

Other (868.5) (527.4)

(2,436.2) (1,634.7)

Net deferred income tax asset

before valuation allowance 2,282.5 2,756.5

Valuation allowance (852.9) (603.9)

Net deferred income tax asset $«1,429.6 $«2,152.6

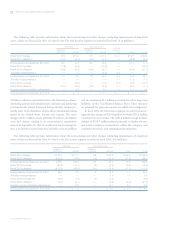

At September 30, 2003, the Company had $1,826.5 million of

net operating loss carryforwards in certain non-U.S. jurisdic-

tions. Of these, $804.1 million have no expiration, and the

remaining $1,022.4 million will expire in future years through

2013. In the U.S., there were approximately $1,256.7 million of

federal and $4,376.4 million of state net operating loss carry-

forwards at September 30, 2003, which will expire in future

years through 2023.

The deferred tax asset valuation allowance increased by

approximately $249 million due to the uncertainty of the uti-

lization of certain non-U.S. deferred tax assets. The Company

believes that it will generate sufficient future taxable income to

realize the tax benefits related to the remaining net deferred tax

assets on the balance sheet. The valuation allowance was calcu-

lated in accordance with the provisions of SFAS No. 109 which

requires a valuation allowance be established or maintained

when it is “more likely than not” that all or a portion of deferred

tax assets will not be realized. At September 30, 2003, approxi-

mately $119 million of the valuation allowance will ultimately

reduce goodwill if the net operating losses are utilized.

The Company and its subsidiaries’ income tax returns are

periodically examined by various regulatory tax authorities. In

connection with such examinations, tax authorities, including

the Internal Revenue Service, have raised issues and proposed

tax deficiencies. The Company is reviewing the issues raised by

the tax authorities and is contesting certain proposed tax defi-

ciencies. Amounts related to these tax deficiencies and other tax

contingencies that management has assessed as probable and

estimable have been accrued through the income tax provision.

Further, management has reviewed with tax counsel the issues

raised by these taxing authorities and the adequacy of these

accrued amounts. Management believes that the ultimate reso-

lution of these tax deficiencies and contingencies will not have

a material adverse effect on the Company’s financial condition,

annual results of operations or cash flows.

Except for earnings that are currently distributed, no addi-

tional provision has been made for U.S. or non-U.S. income

taxes on the undistributed earnings of subsidiaries or for

unrecognized deferred tax liabilities for temporary differences

related to investments in subsidiaries, as such earnings are

expected to be permanently reinvested, or the investments are

essentially permanent in duration. A liability could arise if

amounts were distributed by their subsidiaries or if their sub-

sidiaries were disposed. It is not practicable to estimate the

additional taxes related to the permanently reinvested earnings

or the basis differences related to investments in subsidiaries.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements