ADT 2003 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

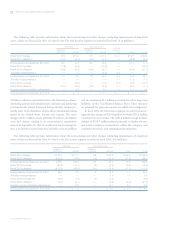

The computation of diluted earnings per common share in

fiscal 2003 excludes the effect of the potential exercise of options

to purchase approximately 110.1 million shares because the

effect would be anti-dilutive. Diluted earnings per common

share for fiscal 2003 excludes 33.0 million shares related to the

Company’s zero coupon convertible debentures due 2020

because conversion conditions have not been met. Diluted

earnings per common share for fiscal 2003 also excludes 94.2

million shares and 49.3 million shares related to the Company’s

convertible senior debentures due 2018 and 2023, respectively,

because the effect would be anti-dilutive.

The computation of diluted loss per common share in fiscal

2002 excludes the effect of the potential exercise of options to

purchase approximately 10.0 million shares and the potential

exchange of convertible debt due 2010 for 2.9 million shares,

because the effect would be anti-dilutive. Diluted loss per com-

mon share for fiscal 2002 also excludes 47.5 million and 22.4

million shares related to the Company’s zero-coupon convertible

debentures due 2020 and 2021, respectively, because conversion

conditions have not been met.

The computation of diluted earnings per common share in

fiscal 2001 excludes the effect of the potential exercise of options

to purchase approximately 12.2 million shares because the effect

would be anti-dilutive. Diluted earnings per common share for

fiscal 2001 also excludes 48.0 million and 26.4 million shares

related to the Company’s zero coupon convertible debentures

due 2020 and 2021, respectively, because conversion conditions

have not been met.

14.

Sale of Accounts Receivable

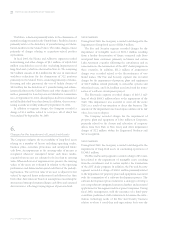

Tyco has several programs under which it sells participating

interests in accounts receivable to investors who, in turn,

purchase and receive ownership and security interests in those

receivables. As collections reduce accounts receivable included in

the pool, the Company sells new receivables. The Company has

the risk of credit loss on the receivables and, accordingly, the full

amount of the allowance for doubtful accounts has been retained

on the Consolidated Balance Sheets. At September 30, 2003,

the availability under these programs is $1,025 million. At

September 30, 2003 and 2002, $803 million and $933 million,

respectively, was utilized under the programs. The proceeds from

the sales were used to repay short-term and long-term borrow-

ings and for working capital and other corporate purposes and

are reported as operating cash flows in the Consolidated

Statements of Cash Flows. The sale proceeds are less than the face

amount of accounts receivable sold by an amount that approxi-

mates the cost that would be incurred if commercial paper were

issued backed by these accounts receivable. The discount from

the face amount is accounted for as a loss on the sale of receivables

and has been included in selling, general and administrative

expenses in the Consolidated Statements of Operations. Such

discount aggregated $29.0 million, $17.0 million, and $25.3

million, or 3.5%, 2.7%, and 5.3% of the weighted-average bal-

ance of the receivables outstanding, during fiscal 2003, 2002

and 2001, respectively. The Company retains collection and

administrative responsibilities for the participating interests in

the defined pool. Also, some of our international businesses sell

accounts receivable as a short-term financing mechanism.

These transactions qualify as true sales. The aggregate amount

outstanding under these arrangements was $202 million and

$157 million at September 30, 2003 and 2002, respectively.

As a result of the rating agencies’ downgrade of Tyco’s debt

in June 2002, investors of one of our accounts receivable pro-

grams have the option to discontinue reinvestment in new

receivables and terminate the program. However, the investors

have not exercised this option. The amount outstanding under

this program was $103.2 million and $132.4 million at

September 30, 2003 and 2002, respectively.

15.

Available-for-Sale Investments

At September 30, 2003 and 2002, Tyco had available-for-sale

equity investments with a fair market value of $23.2 million

and $24.6 million and a cost basis of $25.5 million and $32.4

million, respectively. As of September 30, 2003, there were gross

unrealized losses of $5.7 million and the gross unrealized gains

of $3.5 million associated with these investments. As of

September 30, 2002, there were gross unrealized losses of $8.2

million and the gross unrealized gains of $0.4 million associ-

ated with these investments. These amounts have been

included as a separate component of shareholders’ equity. See

Note 8 for discussion of realized losses on equity investments.

16.

Assets Held for Sale

During the fourth quarter of fiscal 2003, the Company initiated

a divestiture program through which it plans to dispose of

some non-core businesses. As part of this divestiture program,

Tyco intends to sell the TGN. The Company plans to exit the

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements