ADT 2003 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

5.

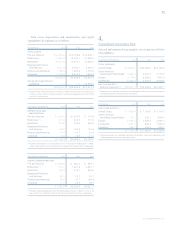

Restructuring and Other (Credits) Charges, Net

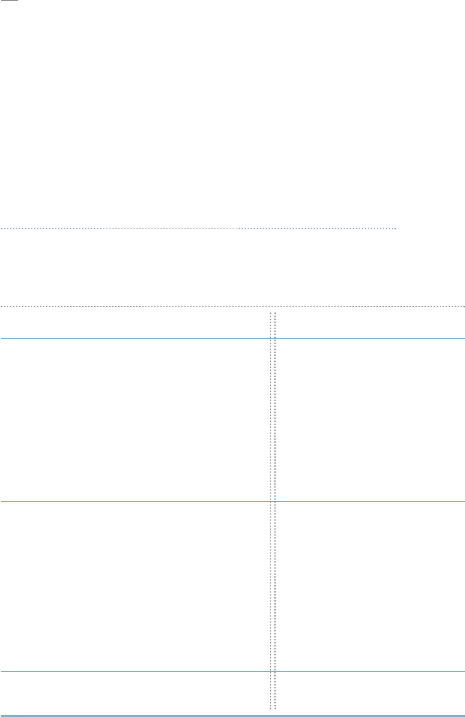

Restructuring and other (credits) charges, net, are as follows

($ in millions):

YEAR ENDED SEPTEMBER 30, 2003 2002 2001

Fire and Security $«««9.7 $÷÷«94.9 $÷«84.1

Electronics (90.5) 1,504.5 383.8

Healthcare (9.2) 44.8 48.4

Engineered Products

and Services 7.8 50.8 57.3

Plastics and Adhesives (1.0) 10.1 8.3

Corporate (1.6) 169.6 3.4

(84.8) 1,874.7 585.3

Less:

Inventory-related amounts

credited (charged) to

cost of sales 10.5 (635.4) (184.9)

Bad debt provision charged

to selling, general and

administrative expenses —(115.0) —

Restructuring and other

(credits) charges, net $(74.3) $1,124.3 $«400.4

2003 CHARGES AND CREDITS

The Company has engaged in a series of restructuring programs

in which we have attempted to make our operations more

efficient through exiting certain non-core businesses or business

lines, or streamlining general operations.

The Fire and Security segment recorded net restructuring

and other charges of $9.7 million, of which charges of $3.5 mil-

lion are included in cost of sales and $2.8 million relates to other

non-cash charges. The remaining $3.4 million net charge con-

sists of charges of $19.4 million associated with streamlining

the business, partially offset by a credit of $16.0 million related

to changes in estimates of charges recorded in prior periods.

The $19.4 million charge is primarily comprised of $16.0 million

for employee severance in connection with the elimination of

1,367 positions primarily relating to general and administrative,

manufacturing, technical, and sales and marketing personnel in

the United States, Canada, Asia, Europe and Australia. During

fiscal 2003, the Company incurred costs of $5.4 million related

to this restructuring program, consisting primarily of $5.0 mil-

lion in severance for the termination of 553 employees.

The Electronics segment recorded restructuring and other

credits of $90.5 million, of which credits of $19.9 million are

included in cost of sales. These restructuring credits primarily

related to severance costs being less than originally anticipated

due to employee attrition and redeployment and termination

fees being less than anticipated due to negotiated settlements.

The Healthcare segment recorded restructuring and other

credits of $9.2 million, of which credits of $0.2 million are

included in cost of sales.

The Engineered Products and Services segment recorded

net restructuring and other charges of $7.8 million (excluding

impairments of long-lived assets which are discussed in Note

6), of which charges of $6.1 million are included in cost of sales.

The remaining $1.7 million net charge consists of charges of

$12.1 million associated with streamlining the business, partially

offset by a credit of $10.4 million primarily related to changes

in estimates of charges recorded in prior periods. The $12.1 mil-

lion includes $9.5 million for severance associated with the

elimination of 113 positions primarily manufacturing and sales

personnel in the United States and Europe; $2.0 million related

to the shutdown of 2 manufacturing facilities located in the

United States and Europe; and other costs of $0.6 million. At

September 30, 2003, all employees had been terminated and

both facilities had been shut down. In addition, these restruc-

turing accruals were fully utilized by September 30, 2003.

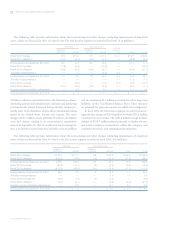

During fiscal 2003, Corporate recorded net restructuring

and other credits of $1.6 million consisting of charges of $17.1

million, of which $7.9 million relates to non-cash charges

(excluding impairments of long-lived assets which are discussed

in Note 6), offset by credits of $18.7 million related to changes

in estimates of charges recorded in prior periods. The remaining

charges of $9.2 million includes $5.8 million for the elimination

of 33 administrative positions primarily in the United States

and $3.4 million for the shutdown of 1 administrative office in

the United States. At September 30, 2003, 32 employees had

been terminated and the facility had been closed; and, there

remained $4.4 million and $3.3 million of severance and facility-

related restructuring accruals, respectively, on the Consolidated

Balance Sheet.

2002 CHARGES AND CREDITS

The Fire and Security segment recorded net restructuring and

other charges of $94.9 million, of which charges of $19.4 million

are included in cost of sales. Additionally, the net charge

includes charges totaling $94.1 million related primarily to

severance and facility closures associated with streamlining the

business, partially offset by a credit of $18.6 million related to

current and prior years’ restructuring charges.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements