ADT 2003 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

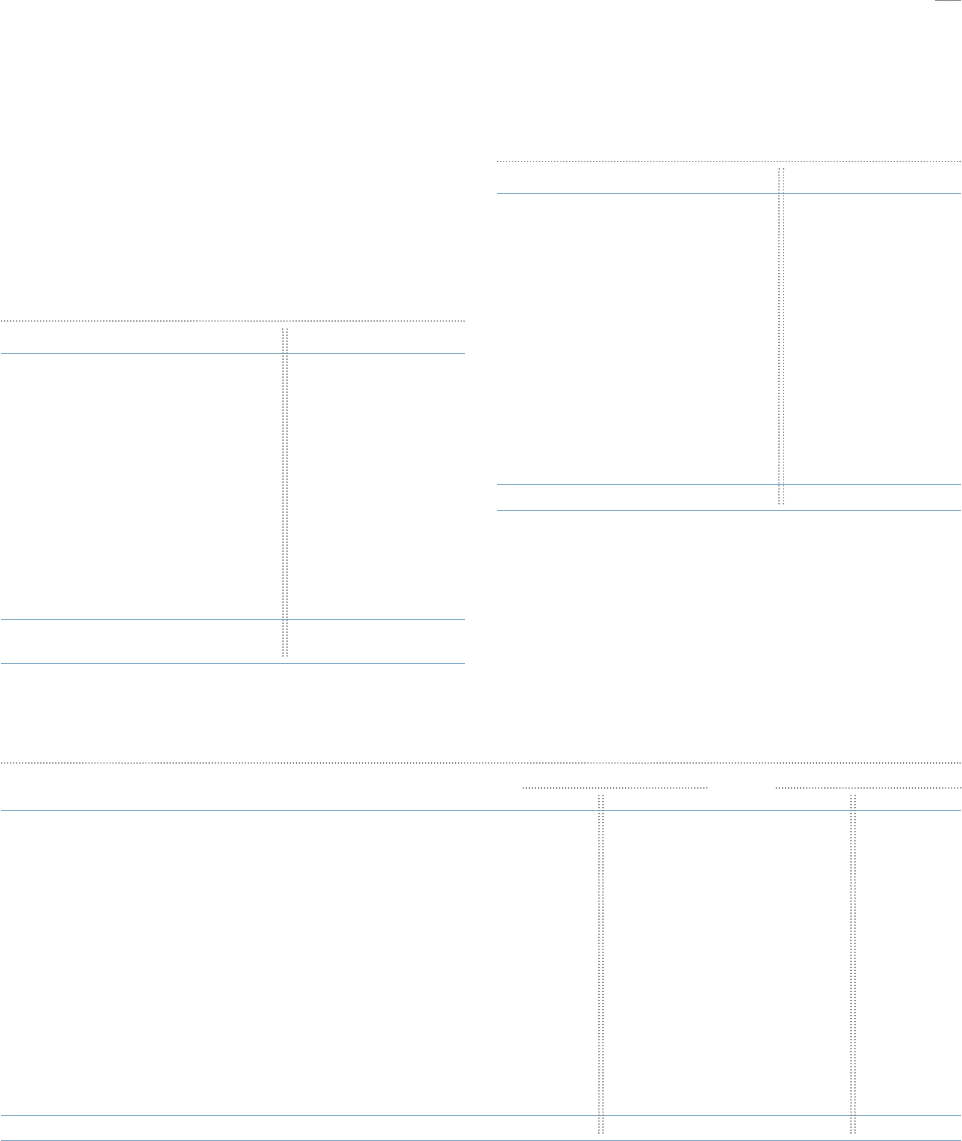

are based on various factors, such as years of service and com-

pensation. The following tables exclude amounts related to the

discontinued operations of CIT for all periods presented.

The net periodic benefit cost (income) for all U.S. and

non-U.S. defined benefit pension plans includes the following

components ($ in millions):

U.S. PLANS 2003 2002 2001

Service cost $««25.5 $«««19.2 $«««28.2

Interest cost 131.0 134.2 127.7

Expected return on

plan assets (99.2) (123.4) (170.6)

Recognition of initial net asset (1.0) (1.0) (1.0)

Recognition of prior service cost 2.8 0.8 0.6

Recognition of net actuarial

loss (gain) 39.0 8.8 (11.3)

Curtailment/settlement

loss (gain) 9.7 1.4 (56.8)

Cost of special termination

benefits 0.2 1.6 0.6

Net periodic benefit

cost (income) $108.0 $«««41.6 $««(82.6)

NON-U.S. PLANS 2003 2002 2001

Service cost $««85.0 $«69.0 $«65.4

Interest cost 101.3 88.1 79.2

Expected return on plan assets (74.7) (81.8) (96.8)

Recognition of initial

net obligation 0.5 0.1 0.2

Recognition of prior

service cost 1.0 0.9 1.7

Recognition of net

actuarial loss 43.1 15.1 0.5

Curtailment/settlement

loss (gain) 8.7 (2.3) 3.0

Cost of special termination

benefits 1.2 2.4 16.2

Net periodic benefit cost $166.1 $«91.5 $«69.4

The curtailment/settlement gains in fiscal 2001 in the U.S.

relate primarily to the freezing of certain pension plans. These

curtailment/settlement gains have been recorded in selling,

general and administrative expenses in the Consolidated State-

ments of Operations.

TYCO INTERNATIONAL LTD.

The net pension amount recognized on the Consolidated Balance Sheet at September 30, 2003 and 2002 for all U.S. and non-

U.S. defined benefit plans is as follows ($ in millions):

U.S. PLANS NON-U.S. PLANS

2003 2002 2003 2002

CHANGE IN BENEFIT OBLIGATION

Benefit obligation at beginning of year $2,048.1 $1,832.5 $1,938.3 $1,571.9

Service cost 25.5 19.2 85.0 69.0

Interest cost 131.0 134.2 101.3 88.1

Employee contributions ——10.7 9.9

Plan amendments 1.2 24.6 1.3 1.1

Actuarial loss 221.3 203.2 159.6 210.9

Benefits and administrative expenses paid (153.2) (155.9) (70.7) (74.8)

Acquisitions —15.6 17.9 12.9

Plan curtailments (1.6) (20.7) 2.0 (4.9)

Plan settlements (28.7) (6.2) (32.0) (20.0)

Special termination benefits 0.2 1.6 1.2 2.4

Currency translation adjustment ——199.3 71.8

Benefit obligation at end of year $2,243.8 $2,048.1 $2,413.9 $1,938.3