ADT 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Flow Control and cost reduction projects; and other costs of

$13.6 million included within selling, general and adminis-

trative expenses primarily related to the reorganization and

consolidation of a manufacturing facility and certain business

offices. Operating income and margins were also negatively

effected by the lower sales discussed above; competitive condi-

tions in major markets for valves and controls, thermal controls,

and electrical and metal products; and increased raw material

costs, mostly steel. The Engineered Products and Services

segment expects to incur additional charges in future periods

related to the comprehensive cost reduction program announced

on November 4, 2003.

Net revenues increased 12.9% in fiscal 2002 over fiscal 2001

including a 13.1% increase in product revenue and a 12.0%

increase in service revenue, primarily as a result of acquisitions

and, to a much lesser extent, increased revenues at Flow Control,

which was largely due to increased demand of industrial valve

and control and thermal control products. However, offsetting

this increase in demand of valve and control products was the

decline in general economic conditions, as well as a slow-down

in the commercial construction market. Acquisitions included

Pyrotenax in March 2001, IMI Bailey Birkett in June 2001,

Century, Water & Power, and Clean Air. Excluding the $9.2 mil-

lion decrease from foreign currency exchange and the impact of

the acquisitions listed above, and all other acquisitions with a

purchase price of $10 million or more, pro forma revenues

(calculated in the manner described above in “Overview”) for

the segment were level with the prior year.

The 64.2% decrease in operating income and the decrease in

operating margins in fiscal 2002 over fiscal 2001 were primarily

due to goodwill impairment charges in addition to the impact

of lower margins at Electrical and Metal Products and Flow

Control, decreased royalty and licensing fee income from

divested businesses and reduced market activity due to contin-

ued softness in demand and worldwide competitive pressures.

This overall decrease was slightly offset by the results of acqui-

sitions and by savings realized from cost-cutting initiatives at

Flow Control and Infrastructure Services.

Operating income and margins for fiscal 2002 reflect

restructuring and other charges of $50.8 million, of which

inventory write downs of $6.2 million are included in cost of

sales, primarily related to severance and facility-related costs

associated with streamlining the business and charges of $9.5

million for the impairment of property, plant and equipment

associated with the closure of facilities. Also included are good-

will impairment charges of $319.2 million relating to Tyco

Infrastructure Services. For additional information regarding

our accounting for goodwill impairments, see “Critical

Accounting Policies

—

Goodwill” below.

Operating income and margins for fiscal 2001 include restruc-

turing and other charges of $57.3 million, of which inventory

write downs of $9.7 million are included in cost of sales, and

charges for the impairment of property, plant and equipment

of $3.4 million, primarily related to the closure of facilities.

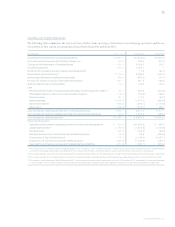

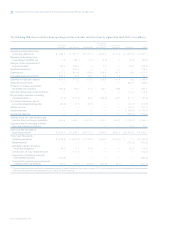

Plastics and Adhesives The following table sets forth net rev-

enues and operating income and margins for the Plastics and

Adhesives segment ($ in millions):

FISCAL 2003 FISCAL 2002 FISCAL 2001

Revenue from

product sales $1,897.2 $1,878.3 $1,747.4

Operating income $«««167.4 $«««209.2 $«««300.9

Operating margins 8.8% 11.1% 17.2%

Net revenues at Tyco Plastics and Adhesives increased slightly

in fiscal 2003 over fiscal 2002 due to the effect of favorable

changes in foreign currency exchange rates ($29.3 million) and

acquisitions ($21.0 million calculated in the manner described

above in “Overview”), which included LINQ Industrial Fabrics,

Inc. (“LINQ”) in December 2001 and all other acquisitions

with a purchase price of $10 million or more. Sales increases

were achieved by higher selling prices as a result of higher raw

material costs, increased sales volume of plastic sheeting and

duct tape products as a result of the heightened level of security

related to the potential likelihood of terrorist attacks, and a

strong residential construction market for Ludlow Coated

Products. These increases were more than offset by increased

competition and decreases in our Corrosion Protection business,

which has been negatively impacted by a slowdown in the oil

and gas pipeline construction markets created by uncertainty

in the Middle East and Venezuela, and a decline in hanger sales

due to weak demand in the retail garment industry.

The significant decrease in operating income and decrease in

operating margins in fiscal 2003 over fiscal 2002 were primarily

due to increased raw material costs (mostly polyethylene) and

increased pricing competition driven by excess production

capacity and an increase in lower priced imported goods. During

fiscal 2003, we recorded net credits totaling $1.4 million.

Included within the $1.4 million are charges of $5.6 million

related to changes in estimates recorded in connection with the

Company’s intensified internal audits, detailed controls and

operating reviews and as a result of applying management’s

judgments and estimates (including $3.2 million for adjustments

to accrual balances, $2.6 million related to asset reserves for

TYCO INTERNATIONAL LTD.