ADT 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

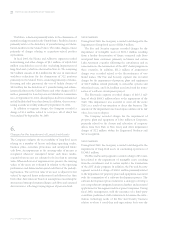

included consideration of (i) the stage of completion of each

of the projects, (ii) the technological feasibility of each of the

projects, (iii) whether the projects had an alternative future use,

and (iv) the estimated future residual cash flows that could be

generated from the various projects and technologies over their

respective projected economic lives.

As of the Mallinckrodt acquisition date, there were several

projects under development at different stages of completion.

The primary basis for determining the technological feasibility

of these projects was obtaining Food and Drug Administration

(“FDA”) approval. As of the acquisition date, none of the IPR&D

projects had received FDA approval. In assessing the techno-

logical feasibility of a project, consideration was also given to

the level of complexity and future technological hurdles that

each project had to overcome prior to being submitted to the

FDA for approval. As of the acquisition date, none of the

IPR&D projects were considered to be technologically feasible

or to have any alternative future use.

Future residual cash flows that could be generated from

each of the projects were determined based upon an estimate of

future revenue and expected profitability of the various products

and technologies involved. These projected cash flows were

then discounted to their present values taking into account the

estimate of future expenses that would be necessary to bring

the projects to completion. The discount rates include a rate of

return, which accounts for the time value of money, as well as

risk factors that reflect the economic risk that the cash flows

projected may not be realized. The cash flows were discounted

at discount rates ranging from 14% to 25% per annum, depend-

ing on the project’s stage of completion and the type of FDA

approval needed. This discounted cash flow methodology for

the various projects included in the purchased IPR&D resulted

in a total valuation of $184.3 million. Although work on the

projects related to the IPR&D continued after the acquisition,

the amount of purchase price allocated to IPR&D was written

off because the projects underlying the IPR&D that was being

developed were not considered technologically feasible as of the

acquisition date. As of September 30, 2003, approximately 53%

of the IPR&D projects have been successfully completed and

approximately 25% of the projects have been discontinued or

are currently inactive. The remainder are in various stages of

completion. There are currently no expected material variations

between projected results from the projects versus those at the

time of the acquisition.

8.

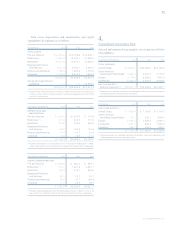

Other (Expense) Income, Net

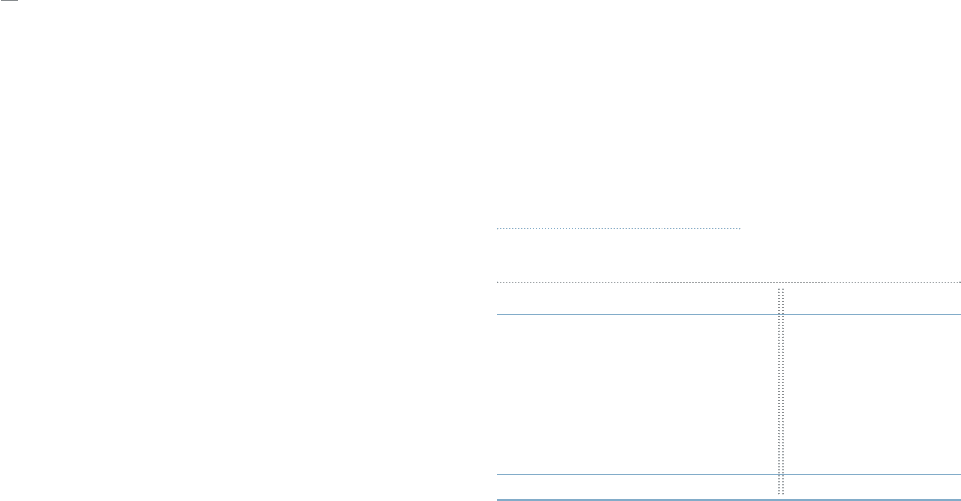

Other (expense) income, net is as follows ($ in millions):

YEAR ENDED SEPTEMBER 30, 2003 2002 2001

Income (loss) from early

retirement of debt $«««24.1 $«««30.6 $««(26.3)

Loss on retirement of debt (151.8) ——

Loss on investments (87.1) (270.8) (133.8)

Equity investee guarantee (8.6) ——

Net gain on sale

of businesses —23.6 410.4

$(223.4) $(216.6) $«250.3

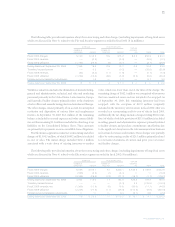

Tyco has repurchased some debt prior to scheduled maturities.

In fiscal 2003, the Company recorded other income from the

early retirement of debt totaling $24.1 million, as compared to

$30.6 million in fiscal 2002, and a loss from the early retirement

of debt totaling $26.3 million for fiscal 2001.

During fiscal 2003, the Company repurchased all of its

6.25% Dealer Remarketable Securities (“Drs.”) due 2013. The

total Dollar Price paid was $902 million based upon the $750

million par value of the Drs. The portion in excess of par of

$151.8 million was recorded as a loss on retirement of debt.

During fiscal 2003, the Company recognized a charge of

$87.1 million relating to the write down of various investments

accounted for under both the cost and equity methods, of

which $81.3 million was recorded, when it became evident that

the declines in the fair value of the investments were other than

temporary, primarily due to the continuing depressed economic

conditions specifically within the telecommunications industry.

Included within the $81.3 million is $75.6 million recorded

during the quarter ended March 31, 2003 (see Note 31). The

remaining $5.8 million charge adjusted a portion of the

remaining portfolio to its fair value based upon estimates

received in conjunction with our decision to sell such invest-

ments. During fiscal 2002, the Company recognized a $270.8

million loss on various investments, primarily related to its

investments in FLAG Telecom Holdings Ltd. (“FLAG”) when it

became evident that the declines in the fair value of FLAG and

other investments were other than temporary. During fiscal

2001, the Company recognized a $133.8 million loss on various

investments primarily related to its investment in 360networks

when it became evident that the declines in the fair value of the

investments were other than temporary.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements