ADT 2003 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

TGN business because it has decided not to invest further in

this industry which it believes is in need of consolidation. The

Company plans to retain ownership of the construction and

maintenance portion of Tyco Submarine Telecommunications.

In connection with the decision to sell the TGN, the Company

has written down the carrying value for the network to net real-

izable value and accordingly, has recorded a loss on impairment

of $664.3 million, which is further discussed in Note 6. Fiscal

2003 revenues and operating loss for the TGN business were

$14.4 million and $799.8 million, respectively. The $799.8 mil-

lion includes the $664.3 million impairment described above

and restructuring charges of $20.1 million. The following table

presents balance sheet information for the TGN business held

for sale at September 30, 2003 ($ in millions):

Accounts receivable $««««9.2

Other current assets 26.4

Other assets 11.9

Total assets $««47.5

Accounts payable $««32.7

Accrued expenses and other current liabilities 120.8

Deferred revenue 63.4

Other long-term liabilities 4.5

Total liabilities $221.4

TYCO INTERNATIONAL LTD.

17.

Goodwill and Intangible Assets

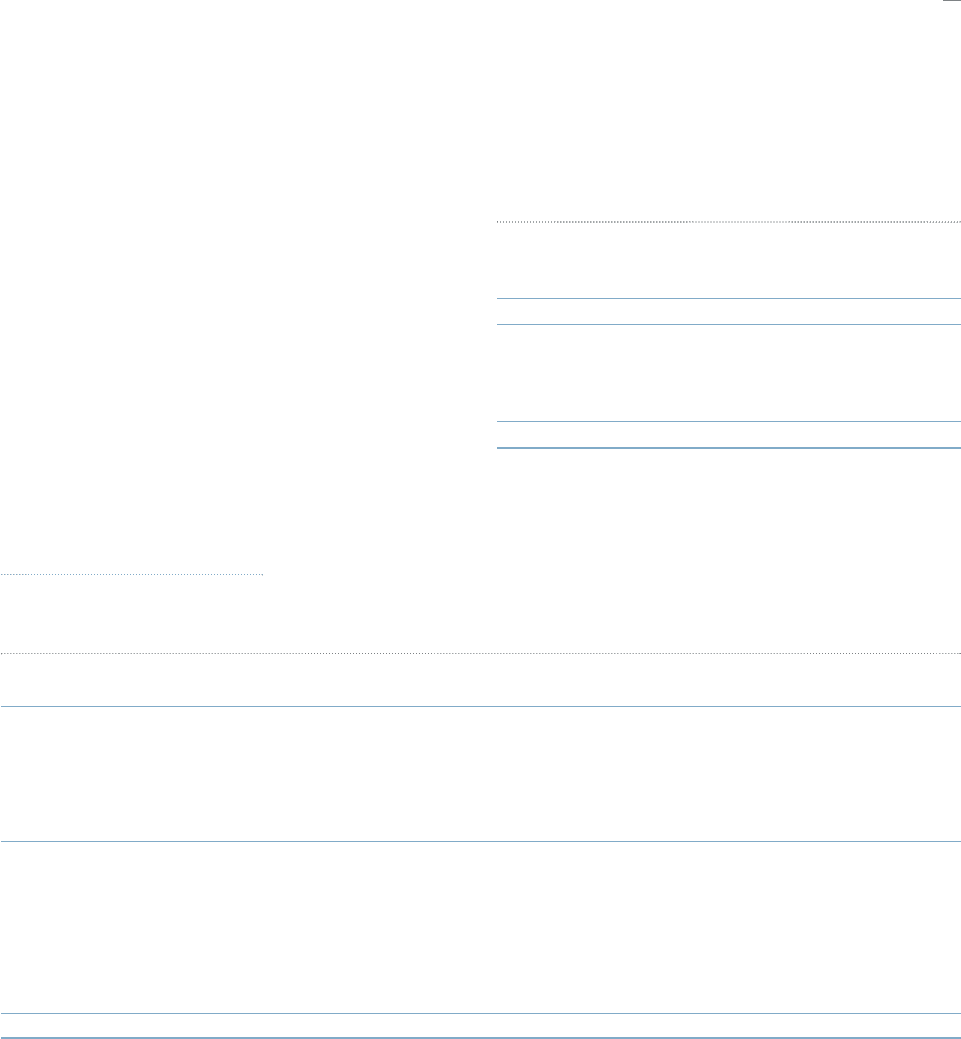

Goodwill was $25,938.7 million and $26,020.5 million at September 30, 2003 and 2002, respectively. The changes in the carrying

amount of goodwill for fiscal 2002 and 2003 are as follows ($ in millions):

ENGINEERED

FIRE AND PRODUCTS AND PLASTICS AND

SECURITY ELECTRONICS HEALTHCARE SERVICES ADHESIVES TOTAL TYCO

Balance at September 30, 2001 $5,914.3 $7,739.6 $6,131.0 $2,924.5 $699.1 $23,408.5

Goodwill related to acquisitions 2,002.2 1,090.4 471.0 253.2 10.1 3,826.9

Goodwill written-off related

to divestitures (0.3) — (55.4) — — (55.7)

Goodwill impairment — (1,024.5) — (319.2) — (1,343.7)

Currency translation adjustments 87.5 35.4 2.5 55.6 3.5 184.5

Balance at September 30, 2002 8,003.7 7,840.9 6,549.1 2,914.1 712.7 26,020.5

Reversal of purchase accounting

liabilities and fair value adjustments (232.4) (74.1) (131.2) (40.0) (2.8) (480.5)

Goodwill related to acquisitions 4.2 2.6 0.8 10.5 — 18.1

Goodwill written-off related

to divestitures (0.1) — (3.6) — — (3.7)

Goodwill impairment — (278.4) — — — (278.4)

Currency translation adjustments 351.5 96.3 16.4 191.2 7.3 662.7

Balance at September 30, 2003 $8,126.9 $7,587.3 $6,431.5 $3,075.8 $717.2 $25,938.7

FISCAL 2003

As discussed in Note 3, during fiscal 2003, a change was made to

the Company’s internal reporting structure such that the opera-

tions of Tyco’s plastics and adhesives businesses (previously

reported within the Healthcare and Specialty Products segment)

now comprise the Company’s new Plastics and Adhesives

reportable segment. As a result, the goodwill within the previous

Healthcare and Specialty Products segment was reassigned based

on the relative fair value of the new reporting units within each

new segment. No impairments resulted from this reevaluation.

The Company performed its annual impairment assess-

ments for all reporting units as of July 1, 2003. This assessment

also resulted in no goodwill impairment.

In the fourth quarter of fiscal 2003, the Company reorganized

its reporting structure (see Note 1). As part of that reorganiza-

tion, the Company finalized a plan in September 2003, to sell

TGN, the major operating asset of the Tyco Submarine telecom-

munications business previously included in the Electronics

segment. The Company plans to exit the TGN business because

it has decided not to invest further in this industry. The reorgan-

ization resulted in a change in the composition of its reporting

units. As a result, goodwill was reassigned to the new reporting

units using a relative fair value allocation approach, resulting in

the recognition of impairment charges of $278.4 million in

Power Systems, Electrical Contracting Services and the Printed

Circuit Group. This charge was based on a valuation performed