ADT 2003 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

are individually significant, that were included primarily in

selling, general and administrative expenses.

An increase of $18.0 million due to increased environmental

accruals resulting from the finalization of the Company’s plan to

remediate one of its manufacturing sites in the second quarter,

$20.0 million to establish an accrual related to the estimated set-

tlement amount for contractual disputes and other legal matters

based on our determination that such amounts became both

probable and estimable in the second quarter, and $15.2 million

of other miscellaneous increased accrual estimates are primarily

included in selling, general and administrative expenses.

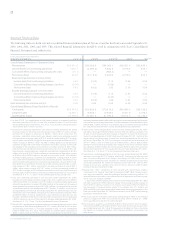

SEGMENT REVENUE, OPERATING INCOME AND MARGINS

Fire and Security The following table sets forth net revenues

and operating income and margins for the Fire and Security

segment ($ in millions):

FISCAL 2003 FISCAL 2002 FISCAL 2001

Revenue from

product sales $««5,124.1 $««4,955.5 $3,494.4

Service revenue 6,168.7 5,683.5 3,978.6

Net revenues $11,292.8 $10,639.0 $7,473.0

Operating income $÷÷«360.2 $÷÷«904.7 $÷«883.2

Operating margins 3.2% 8.5% 11.8%

Net revenues in the Fire and Security segment increased 6.1%

in fiscal 2003 over fiscal 2002, including a 3.4% increase in

product revenue and an 8.5% increase in service revenue. The

increase in net revenues was due to favorable changes in foreign

currency exchange rates ($519.7 million) and fiscal 2002 acqui-

sitions ($213.8 million calculated in the manner described

above in “Overview”). Acquisitions included SBC/Smith Alarm

Systems in October 2001, DSC Group and Sensormatic in

November 2001, and all other acquisitions with a purchase

price of $10 million or more. In addition, an increase in net

revenues due to customer contracts purchased through the

ADT dealer program ($371.2 million) and generated through

our internal sales force offset a decline in revenue due to

increased attrition rates in worldwide security. The overall

increase was also partially offset by a decline in net revenues at

worldwide fire protection due to continued softness in the

commercial construction market.

Operating income and margins decreased significantly in

fiscal 2003 over fiscal 2002 due to charges totaling $512.4 million

recorded during fiscal 2003. Included within the $512.4 million

are charges of $266.7 million related to changes in estimates

recorded during the quarter ended March 31, 2003 (includes

charges of $127.6 million primarily related to adjustments to

accrual balances such as workers’ compensation, professional

fees, and environmental exposure, a charge of $98.1 million pri-

marily due to adjusting reserves for doubtful accounts and slow

and non-moving inventory, as well as a write off of subscriber

systems, charges of $34.5 million for other accounting adjust-

ments primarily related to deferred commissions, and charges

of $6.5 million related to reconciling items in the current period)

in connection with the Company’s intensified internal audits,

detailed controls and operating reviews and as a result of apply-

ing management’s judgments and estimates. Also included

within the $512.4 million are impairment charges of $143.0

million primarily related to the impairment of intangible assets

associated with the ADT dealer program mostly as a result of

increased attrition rates (discussed below), and to the impair-

ment of property, plant and equipment of subscriber systems

and other fixed assets; net restructuring and other charges of

$9.7 million, of which charges of $3.5 million are included in

cost of sales and $2.8 million is for the write off of non-current

assets, related to streamlining the business; and other charges of

$93.0 million, of which $34.0 million is included in cost of sales

and $59.0 million is included in selling, general and adminis-

trative expenses, primarily related to uncollectible receivables,

product warranty and the dismantlement of customers’ ADT

security systems. Included within the $143.0 million impair-

ment charge and the $9.7 million net restructuring charge is a

charge of $10.2 million and a credit of $2.0 million, respec-

tively, also related to changes in estimates recorded during the

quarter ended March 31, 2003. The decrease in operating

income and margins was also due to increased depreciation

and amortization expense in the security business due to

growth in the subscriber asset and dealer asset base as well as

the impact of the acquisitions of Sensormatic Electronics

Corporation (“Sensormatic”) and DSC Group (“DSC”) in fiscal

2002; decline in operating income in the continental European

security business; and a weaker worldwide fire and contracting

environment. The Fire and Security segment expects to incur

additional restructuring charges in future periods related to

the comprehensive cost reduction program announced on

November 4, 2003.

Attrition rates for customers in our global electronic security

services business averaged 15.9% on a trailing twelve-month

basis for fiscal 2003, as compared to 13.2% for fiscal 2002. This

increase relates to attrition in customer accounts acquired

through our worldwide dealer program, as well as internally

generated commercial customer accounts in continental Europe

and internally generated residential customer accounts in the

United States (both of which were partly driven by increased

management and control of delinquent accounts). For those

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations