ADT 2003 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

Share Premium and Contributed Surplus In accordance with the

Bermuda Companies Act of 1981, when Tyco issues shares for

cash at a premium to their par value, the resulting premium is

credited to a share premium account, a non-distributable reserve.

When Tyco issues shares in exchange for shares of another

company, the excess of the fair value of the shares acquired over

the par value of the shares issued by Tyco is credited, where

applicable, to contributed surplus, which is, subject to certain

conditions, a distributable reserve.

Income Taxes Deferred tax liabilities and assets are recognized

for the expected future tax consequences of events that have

been reflected in the Consolidated Financial Statements.

Deferred tax liabilities and assets are determined based on the

differences between the book values and the tax basis of partic-

ular assets and liabilities, using tax rates in effect for the years

in which the differences are expected to reverse. A valuation

allowance is provided to offset any net deferred tax assets if,

based upon the available evidence, it is more likely than not

that some or all of the deferred tax assets will not be realized.

Financial Instruments All derivative instruments are reported

on the balance sheet at fair value. Changes in a derivative’s fair

value are recognized currently in earnings unless specific hedge

criteria are met. At its inception, if the derivative is designated

as a fair value hedge, the changes in the fair value of the deriv-

ative and of the hedged item attributable to the hedged risk are

recognized as a charge or credit to earnings.

The fair value estimates are based on relevant market infor-

mation, including current market rates and prices, assuming

adequate market liquidity. Fair value estimates for interest rate

and cross-currency swaps are provided to the Company by

high-quality third-party financial institutions known to be

high volume participants in this market.

The Company uses derivative instruments to manage expo-

sures to foreign currency, commodity price and interest rate

risks. The Company’s objectives for utilizing derivatives is to

manage these risks using the most effective methods to elimi-

nate or reduce the impacts of these exposures. The Company

documents relationships between hedging instruments and

hedged items, and links derivatives designated as fair value,

cash flow or foreign currency hedges to specific assets and lia-

bilities on the Consolidated Balance Sheet or to specific firm

commitments or forecasted transactions. The Company also

assesses and documents, both at the hedge’s inception and on

an ongoing basis, whether the derivatives that are used in hedg-

ing transactions are highly effective in offsetting changes in fair

values or cash flows associated with the hedged items.

As part of managing the exposure to changes in market

interest rates, the Company, as an end-user, enters into various

interest rate swap transactions, all of which are transacted in

over-the-counter markets, with other financial institutions acting

as principal counterparties. To ensure both appropriate use as a

hedge and hedge accounting treatment, all derivatives entered

into are designated according to a hedge objective against specified

liabilities such as a specifically underwritten debt issue. The

Company’s primary hedge objectives include the conversion of

fixed-rate liabilities to variable rates. The derivatives associated

with these objectives are classified as fair value hedges.

As part of managing the exposure to changes in foreign

currencies, the Company utilizes forward and option contracts

transacted in over-the-counter markets, with financial institu-

tions acting as principal counterparties. The objective of these

hedging contracts is to minimize impacts to cash flows due to

changes in foreign exchange rates on intercompany loans,

booked accounts and notes receivable and accounts payable,

and forecasted transactions. Only in very limited circumstances

is hedge accounting designated. The remaining hedges are

marked to market.

The Company’s derivative instruments present certain

market and counterparty risks; however, concentration of

counterparty risk is mitigated as Tyco deals with a variety of

major banks worldwide with long-term Standard & Poor’s and

Moody’s credit ratings of A+/A1 or higher. In addition, only

conventional derivatives are utilized thereby affording optimum

clarity as to the market risk. None of the Company’s derivative

instruments outstanding at year end would result in a significant

loss to the Company if a counterparty failed to perform accord-

ing to the terms of its agreement. At this time, the Company

does not require collateral or other security to be furnished by

the counterparties to its derivative instruments.

Accrued Product Warranty The Company generally accrues

estimated product warranty costs at the time of sale, and any

additional amounts are recorded when such costs are probable

and can be reasonably estimated. Manufactured products are

warranted against defects in material and workmanship when

properly used for their intended purpose, installed correctly,

and appropriately maintained. Generally, product warranties

are implicit in the sale; however, the customer may purchase an

extended warranty. Manufactured equipment is also warranted

in the same manner as product warranties. However, in most

instances the warranty is either negotiated in the contract or sold

as a separate component. Warranty period terms range from

90 days (e.g., consumable products) up to 20 years (e.g., power

TYCO INTERNATIONAL LTD.

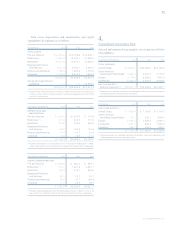

Notes to Consolidated Financial Statements