ADT 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

During fiscal 2003, the Company reduced its estimate of pur-

chase accounting liabilities relating to fiscal 2001 acquisitions

by $162.8 million primarily because actual costs were less than

originally estimated since the Company severed 897 fewer

employees and closed 25 fewer facilities than originally antici-

pated due to revisions to integration plans. Goodwill and

related deferred tax assets in the aggregate were reduced by an

equivalent amount.

During fiscal 2001, the Company made payments totaling

$20.0 million to Mr. Frank Walsh, a director of Tyco at the time

of the CIT acquisition, and to a charitable organization specified

by such director. The payments were direct and incremental

costs incurred in connection with the acquisition of CIT and,

accordingly, were included as part of the purchase price for CIT.

The payments were refunded to the Company in fiscal 2003

(see Note 18).

In connection with the purchase acquisitions consummated

during fiscal 2001, liabilities for $13.8 million for severance and

related costs, $98.0 million for the shutdown and consolidation

of acquired facilities, $3.6 million for distributor and supplier

contractual cancellation fees and $2.1 million in transaction

and other direct costs remained on the Consolidated Balance

Sheet at September 30, 2003. Termination of employees and

consolidation of facilities related to all such acquisitions are

substantially complete, except for long-term non-cancellable

lease obligations and certain long-term severance arrangements.

In fiscal 2001, the Company sold its ADT Automotive busi-

ness to Manheim Auctions, Inc., a wholly-owned subsidiary of

Cox Enterprises, Inc., for approximately $1.0 billion in cash.

The Company recorded a net gain on the sale of businesses of

$410.4 million principally related to the sale of ADT Auto-

motive, which is recorded as other income in the Consolidated

Statement of Operations.

The following unaudited pro forma data summarize the

results of operations for the periods indicated as if fiscal 2001

acquisitions and divestitures had been completed as of the

beginning of the period presented. The pro forma data give

effect to actual operating results prior to the acquisitions and

divestitures and adjustments to interest expense, goodwill

amortization and income taxes. No effect has been given to cost

reductions or operating synergies in this presentation, and

amounts have been revised to reflect the disposition of CIT as

discontinued operations (see Note 11). These pro forma

amounts do not purport to be indicative of the results that

would have actually been achieved if the acquisitions and

divestitures had occurred as of the beginning of the periods

presented or that may be obtained in the future.

TYCO INTERNATIONAL LTD.

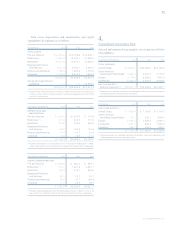

The following table summarizes the purchase accounting liabilities recorded in connection with the fiscal 2001 purchase

acquisitions ($ in millions):

SEVERANCE FACILITIES-RELATED ACCRUAL DISTRIBUTOR

AND SUPPLIER

NUMBER OF NUMBER OF CANCELLATION OTHER

EMPLOYEES ACCRUAL FACILITIES ACCRUAL FEES ACCRUAL TOTAL

Balance at September 30, 2002 2,196 $129.7 100 $207.5 $«28.7 $«29.1 $«395.0

Fiscal 2003 utilization (1,281) (56.6) (66) (44.6) (9.4) (11.7) (122.3)

Foreign currency translation adjustment — 8.6 — 0.4 0.5 1.8 11.3

Reclassifications — (0.4) — 3.3 — (6.6) (3.7)

Reductions of estimates of

fiscal 2001 acquisition reserves (897) (67.5) (25) (68.6) (16.2) (10.5) (162.8)

Balance at September 30, 2003 18 $««13.8 9 $««98.0 $«««3.6 $«««2.1 $«117.5

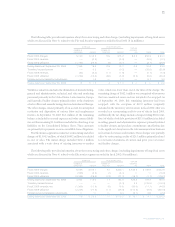

($ IN MILLIONS, EXCEPT PER SHARE DATA) YEAR ENDED SEPTEMBER 30, 2001 (1)

Net revenues $37,135.3

Income from continuing operations 3,790.5

Net income 3,099.1

Basic earnings per common share:

Income from continuing operations $«««««««1.99

Net income 1.63

Diluted earnings per common share:

Income from continuing operations $«««««««1.97

Net income 1.61

(1) Includes a net gain on sale of businesses of $410.4 million related primarily to the

sale of ADT Automotive; a loss of $133.8 million related to the write down of an

investment; a net gain of $24.5 million on the sale of shares of a subsidiary; charges

for the impairment of long-lived assets of $120.1 million; net restructuring and other

charges totaling $585.3 million; loss on the early extinguishment of debt of $26.3

million; income from discontinued operations of $252.5 million, net of tax; and

cumulative effect of accounting changes of $683.4 million, net of tax. Excludes a

charge of $184.3 million for the write off of purchased in-process research and

development associated with the acquisition of Mallinckrodt discussed in Note 7.