ADT 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

receivables. The amount outstanding under this program was

$103.2 million at September 30, 2003.

On November 12, 2003, TIG issued $1.0 billion par value 6%

Notes due 2013 in a private placement offering. The Notes are

fully and unconditionally guaranteed by Tyco. The Company

announced its intention to negotiate new revolving bank credit

facilities and, upon negotiation of such facilities, to use the note

proceeds to reduce the $2.0 billion outstanding under the 5-year

revolving credit facility due 2006. In addition, subsequent to

year end, TIG executed LIBOR-in-arrears interest rate swaps on

notional value $875 million against these notes. Under these

swaps Tyco will receive 6% and pay on average 6-month LIBOR

plus 90.3 basis points.

Tyco is currently negotiating a $1.5 billion 3-year revolving

credit facility which includes a $500 million sublimit for the

issuance of standby and commercial letters of credit and a $1.0

billion 364-day revolving credit facility with a 1-year term out

option. These facilities have a variable interest rate based on

LIBOR. The margin over LIBOR payable by TIG can vary

depending upon changes in its credit rating. These new facilities

will replace the $1.5 billion undrawn 364-day revolving credit

facility, due to expire at the end of January 2004, and the $2.0

billion drawn 5-year revolving credit facility, due to expire in

February 2006.

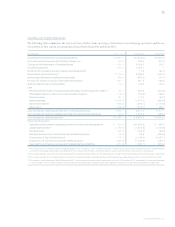

The following table details our debt ratings at September 30, 2003.

SEPTEMBER 30, 2003 SHORT TERM LONG TERM

Moody’s Not prime Ba2

Standard & Poor’s A3 BBB-

Fitch B BB

On December 3, 2003, Fitch upgraded its rating to BB+ on the

senior unsecured debt of Tyco as well as on the unconditionally

guaranteed debt of TIG. Fitch’s upgrade of Tyco’s long-term

debt recognizes the progress made by the Company with

respect to debt reduction and improving cash flow.

On December 11, 2003, Moody’s confirmed the debt ratings

of TIG and raised the rating outlook of Tyco to positive. Moody’s

indicated that this action reflects the progress the Company has

made in addressing recent liquidity concerns through the refi-

nancing/repayment of approximately $11 billion of debt matu-

rities and putable debt in 2003, as well as Moody’s expectation

for continued strong free cash flow generation, profit improve-

ment and debt reduction over the near-to-intermediate-term.

The security ratings set forth above are not a recommendation

to buy, sell or hold securities and may be subject to revision or

withdrawal by the assigning rating organization. Each rating

should be evaluated independently of any other rating.

TYCO INTERNATIONAL LTD.

COMMITMENTS AND CONTINGENCIES

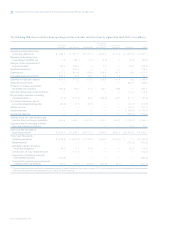

A summary of our contractual obligations and commitments for debt, minimum lease payment obligations under non-cancellable

operating leases and other obligations are as follows ($ in millions):

FISCAL 2004 FISCAL 2005 FISCAL 2006 FISCAL 2007 FISCAL 2008 THEREAFTER

Debt (1) $2,718.4 $2,258.6 $3,949.2 $«««704.0 $122.6 $11,216.3

Operating leases (2) 714.2 563.2 421.4 303.1 227.8 1,030.1

Purchase obligations 23.2 11.6 10.1 8.8 8.3 —

Total contractual cash obligations $3,455.8 $2,833.4 $4,380.7 $1,015.9 $358.7 $12,246.4

(1) Includes capital lease obligations.

(2) Includes obligations under an off-balance sheet leasing arrangement for five cable laying sea vessels.

In addition to the commitments discussed in the table above, a

subsidiary of the Company has the option to buy five cable lay-

ing sea vessels upon expiration of the lease in fiscal 2007 for

approximately $280 million, or return the vessels to the lessor

and, under a guarantee, pay any shortfall in sales proceeds from

a third party in an amount not to exceed $235 million.

At September 30, 2003, the Company had outstanding letters

of credit and letters of guarantee in the amount of $849.2 million.

At September 30, 2003, Tyco had unsecured credit facilities

of $1.5 billion due 2004, all of which is undrawn and available,

and $2.0 billion due 2006, all of which is drawn (see Note 19 to

the Consolidated Financial Statements). In addition, certain of

the Company’s operating subsidiaries have overdraft and similar

types of facilities which total $1.1 billion, of which $0.7 billion

was undrawn and available. These facilities expire at various

dates through the year 2015, most of which are renewable and

are established primarily within international operations.

At September 30, 2003, the Company had a contingent

liability of $80 million related to the fiscal 2001 acquisition of

Com-Net by the Electronics segment. The $80 million is the