ADT 2003 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

TYCO INTERNATIONAL LTD.

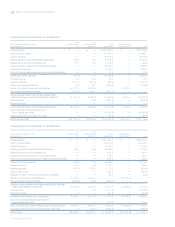

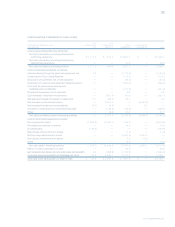

28.

Supplementary Balance Sheet Information

Selected supplementary balance sheet information is presented

below ($ in millions).

SEPTEMBER 30, 2003 2002

Purchased materials and

manufactured parts $««1,095.3 $««1,234.6

Work in process 942.7 975.4

Finished goods 2,254.2 2,397.9

Inventories $««4,292.2 $««4,607.9

Short-term investments $«««««««51.4 $««««««««««—

Short-term investments (restricted) 424.9 93.5

Contracts in process 387.2 408.5

Prepaid expenses and other 1,185.3 959.7

Other current assets $««2,048.8 $««1,461.7

Land $«««««563.7 $«««««548.0

Buildings 2,810.1 2,708.8

Subscriber systems 4,930.5 4,614.6

Machinery and equipment 10,146.5 8,467.9

Leasehold improvements 362.7 363.9

Construction in progress 550.0 773.0

Accumulated depreciation (9,063.7) (7,615.2)

10,299.8 9,861.0

Construction in progress — TGN —372.9

TGN — placed in service —214.3

Accumulated depreciation

TGN — placed in service —(5.6)

Property, plant and equipment, net $10,299.8 $10,442.6

Non-current restricted cash $«««««303.0 $««««««««««—

Long-term investments 162.1 297.8

Long-term investments (restricted) 45.3 —

Non-current portion of deferred

income taxes 2,157.0 1,800.3

Other 1,609.6 1,493.4

Other assets $««4,277.0 $««3,591.5

Accrued payroll and payroll-

related costs (including bonuses) $«««««861.8 $«««««963.7

Current portion of deferred

income taxes 27.9 18.1

Accrued expenses and other 3,109.4 4,366.9

Accrued expenses and other

current liabilities $««3,999.1 $««5,348.7

Deferred revenue — non-current portion $««1,192.2 $««1,195.8

Deferred income taxes 1,554.7 985.6

Income taxes 2,027.7 2,166.9

Other 3,465.1 2,940.6

Other long-term liabilities $««8,239.7 $««7,288.9

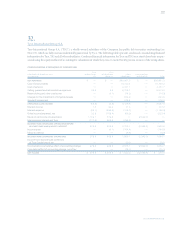

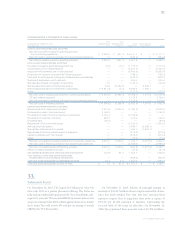

29.

Supplementary Cash Flow Information

Selected supplementary cash flow information is presented

below ($ in millions).

YEAR ENDED SEPTEMBER 30, 2003 2002 2001

Interest paid $1,143.0 $943.8 $896.5

Income taxes paid 608.0 668.3 798.9

Net (repayments of) proceeds from debt consist of the follow-

ing ($ in millions):

YEAR ENDED SEPTEMBER 30, 2003 2002 2001

Net (repayments of)

proceeds from

short-term debt $(7,908.6) $«2,065.2 $«(1,947.7)

Proceeds from issuance

of long-term debt 4,387.5 5,417.0 11,794.7

Repayment of long-term

debt, including

debt tenders (1,097.5) (5,530.9) (1,311.4)

$(4,618.6) $«1,951.3 $««8,535.6

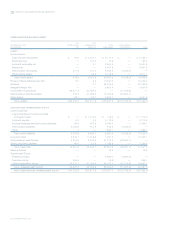

30.

Variable Interest Entities (VIE’s)

During fiscal 2003, the Company adopted FIN 46, which requires

identification of the Company’s participation in VIE’s, which

are entities with a level of invested equity that is not sufficient

to fund future activities to permit them to operate on a stand-

alone basis, or whose equity holders lack certain characteristics

of a controlling financial interest. For entities identified as

VIE’s, FIN 46 sets forth a model to evaluate potential consoli-

dation based on an assessment of which party to VIE’s, if any,

bears a majority of the risk to its expected losses, or stands to

gain from a majority of its expected returns.

The Company has programs under which it sells machinery

and equipment to investors who, in turn, purchase and receive

ownership and security interests in those assets. As such, the

Company may have certain investments in those affiliated com-

panies whereby it provides varying degrees of financial support

and where the investors are entitled to a share in the results of

those entities but do not consolidate these entities. While these

entities may be substantive operating companies, they have

been evaluated for potential consolidation under FIN 46.