ADT 2003 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Company believes that the accelerated method that presently

best achieves the matching objective described above is the

double-declining balance method based on a ten-year life for the

first eight years of the estimated life of the customer relation-

ships converting to the straight-line method of amortization

for the remaining four years of the estimated relationship

period. Actual attrition data is regularly reviewed in order to

assess the continued applicability of the accelerated method of

amortization described above.

Revenue Recognition Contract sales for the installation of fire

protection systems, large security intruder systems, undersea

cable systems and other construction-related projects are

recorded on the percentage-of-completion method. Profits

recognized on contracts in process are based upon contracted

revenue and related estimated cost to completion. The risk of

this methodology is its dependence upon estimates of costs to

completion, which are subject to the uncertainties inherent in

long-term contracts. Revisions in cost estimates as contracts

progress have the effect of increasing or decreasing profits in

the current period. Provisions for anticipated losses are made

in the period in which they first become determinable. If esti-

mates are inaccurate, there is risk that our revenues and profits

for the period may be overstated or understated.

Income Taxes Estimates of full year taxable income of the various

legal entities and jurisdictions are used in the tax rate calcula-

tion, which change throughout the year. Management uses

judgment in estimating what the income will be for the year.

Since judgment is involved, there is risk that the tax rate may

significantly increase or decrease in any period.

In determining income (loss) for financial statement pur-

poses, we must make certain estimates and judgments. These

estimates and judgments occur in the calculation of certain tax

liabilities and in the determination of the recoverability of

certain of the deferred tax assets, which arise from temporary

differences between the tax and financial statement recognition

of revenue and expense. SFAS No. 109 also requires that the

deferred tax assets be reduced by a valuation allowance, if based

on the weight of available evidence, it is more likely than not

that some portion or all of the recorded deferred tax assets will

not be realized in future periods.

In evaluating our ability to recover our deferred tax assets

we consider all available positive and negative evidence includ-

ing our past operating results, the existence of cumulative losses

in the most recent fiscal years and our forecast of future taxable

income. In estimating future taxable income, we develop

assumptions including the amount of future state, federal and

international pre-tax operating income, the reversal of tempo-

rary differences and the implementation of feasible and prudent

tax planning strategies. These assumptions require significant

judgment about the forecasts of future taxable income and are

consistent with the plans and estimates we are using to manage

the underlying businesses.

We intend to maintain this valuation allowance until it is

more likely than not the deferred tax assets will be realized. Our

income tax expense recorded in the future will be reduced to the

extent of offsetting decreases in our valuation allowance. The

realization of our remaining deferred tax assets is primarily

dependent on forecasted future taxable income. Any reduction

in estimated forecasted future taxable income including but not

limited to any future restructuring activities may require that

we record an additional valuation allowance against our deferred

tax assets. An increase in the valuation allowance would result

in additional income tax expense in such period and could have

a significant impact on our future earnings.

In addition, the calculation of our tax liabilities involves

dealing with uncertainties in the application of complex tax

regulations in a multitude of jurisdictions. We recognize poten-

tial liabilities for anticipated tax audit issues in the U.S. and

other tax jurisdictions based on our estimate of whether, and

the extent to which, additional taxes will be due. If payment of

these amounts ultimately proves to be unnecessary, the reversal

of the liabilities would result in tax benefits being recognized in

the period when we determine the liabilities are no longer nec-

essary. If our estimate of tax liabilities proves to be less than the

ultimate assessment, a further charge to expense would result.

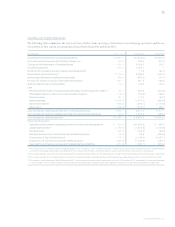

DISCONTINUED OPERATIONS OF TYCO CAPITAL (CIT GROUP INC.)

On July 8, 2002 the Company divested of Tyco Capital through

the sale of 100% of CIT’s common shares in an IPO. Accordingly,

the results of Tyco Capital are presented as discontinued oper-

ations for all periods. Prior year amounts include Tyco Capital’s

operating results after June 1, 2001, the date of acquisition of

CIT by Tyco.

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations