ADT 2003 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

by the investees, lack of sufficient future expected cash flows,

and lower entity valuations based on recent private financing

activity. During the quarter ended March 31, 2003, the Company

also recognized other expense of $8.5 million in connection

with a bank guarantee on behalf of an equity investee (see Note

20). It is possible that the Company may have additional write

downs on other investments if market conditions continue

recent negative trends.

The $62.3 million for other accounting estimates includes a

charge to selling, general and administrative expenses of $17.3

million resulting from the Company’s revision in the second

quarter of deferred commissions related to long-term contracts,

$12.1 million to write down company-owned properties based

on real estate assessments and purchase offers received in the

second quarter for assets held for sale, $11.5 million of additional

severance related to terminated executives, and $21.4 million of

other accounting estimate changes, none of which are individ-

ually significant, that were included primarily in selling, general

and administrative expenses.

An increase of $18.0 million due to increased environmental

accruals resulting from the finalization of the Company’s plan

to remediate one of its manufacturing sites in the second quarter,

$20.0 million to establish an accrual related to the estimated

settlement amount for contractual disputes and other legal mat-

ters based on our determination that such amounts became both

probable and estimable in the second quarter, and $15.2 million

of other miscellaneous increased accrual estimates are prima-

rily included in selling, general and administrative expenses.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements

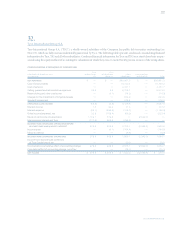

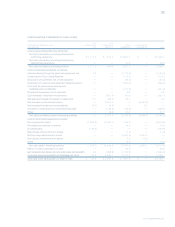

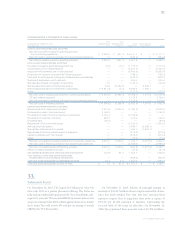

Summarized quarterly financial data for the year ended September 30, 2002 ($ in millions, except per share data):

YEAR ENDED SEPTEMBER 30, 2002 1ST QTR. (1) 2ND QTR. (2) 3RD QTR. (3) 4TH QTR. (4)

Net revenues $8,510.5 $«8,607.1 $«9,099.4 $«9,372.8

Gross profit 3,306.1 2,974.8 3,285.6 2,958.0

Income (loss) from continuing operations 1,038.7 (2,085.9) (395.9) (1,395.1)

Net income (loss) 1,303.4 (6,408.9) (2,631.2) (1,442.8)

BASIC INCOME (LOSS) PER COMMON SHARE:

Income (loss) from continuing operations 0.53 (1.05) (0.20) (0.70)

Income (loss) per common share 0.66 (3.22) (1.32) (0.72)

DILUTED INCOME (LOSS) PER COMMON SHARE:

Income (loss) from continuing operations 0.52 (1.05) (0.20) (0.70)

Income (loss) per common share 0.65 (3.22) (1.32) (0.72)

(1) Includes charges totaling $30.5 million, which includes restructuring and other

charges and impairment charges of $26.2 million, of which $5.8 million is included

in cost of sales, primarily related to the termination of employees and the write down

of inventory associated with the closure of facilities and the exiting of a product line.

Also includes a loss of $4.3 million related to the early retirement of debt.

(2) Includes charges totaling $3,132.7 million. The charges consist of impairment

charges of $2,389.2 million primarily related to the write down of the TGN; restruc-

turing and other charges of $600.1 million, of which $251.3 million is included in

cost of sales, primarily related to the write down of inventory and facility closures

within the Electronics segment; a loss on the write off of investments of $141.0 mil-

lion; and a loss of $2.4 million relating to the early retirement of debt.

(3) Includes charges totaling $1,172.4 million. The charges consist of goodwill impair-

ment charges of $844.4 million relating to continuing operations; impairment

charges of $125.2 million related primarily to the impairment of property, plant and

equipment associated with the termination of a software development project

within the Fire and Security segment; net restructuring and other charges of $182.9

million, of which $2.5 million is included in cost of sales, related primarily to the write

off of investment banking fees and other deal costs associated with the terminated

break-up plan and certain acquisitions that were not completed, and to a less extent,

to severance associated with consolidating and streamlining operations and an

accrual for anticipated resolution and disposition of various labor and employment

matters within the Fire and Security segment; a write off of purchased in-process

research and development related to the acquisition of Sensormatic of $13.4 mil-

lion; and a loss on the write down of investments of $6.5 million.

(4) Includes charges totaling $2,426.7 million consisting of goodwill impairment

charges of $499.3 million relating to continuing operations; net restructuring and

other charges of $1,066.0 million, of which $375.8 million is included in cost of

sales and $115.0 million relates to a bad debt provision which is included in selling,

general and administrative expenses, primarily related to the decision to significantly

scale back our Telecommunications business; impairment of long-lived assets of

$794.6 million primarily related to the write down of property, plant and equipment

within our Telecommunications business; the write off of in-process research and

development of $4.4 million within our Fire and Security business; loss on the write

down of investments of $123.3 million; a gain on sale of businesses of $23.6 million;

and $37.3 million of income related to the early retirement of debt.