ADT 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

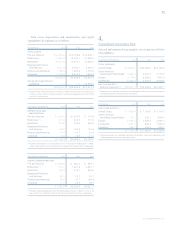

The following table summarizes the purchase accounting liabilities recorded in connection with fiscal 2002 purchase acquisitions

($ in millions):

SEVERANCE FACILITIES-RELATED ACCRUAL DISTRIBUTOR

AND SUPPLIER

NUMBER OF NUMBER OF CANCELLATION OTHER

EMPLOYEES ACCRUAL FACILITIES ACCRUAL FEES ACCRUAL TOTAL

Balance at September 30, 2002 1,453 $«39.1 82 $«51.8 $«3.1 $«7.4 $101.4

Additions to fiscal 2002 acquisition reserves 570 15.3 22 3.2 0.5 6.8 25.8

Fiscal 2003 utilization (854) (24.3) (62) (11.0) (1.3) (4.6) (41.2)

Foreign currency translation adjustment — 1.1 — 1.9 0.3 0.5 3.8

Reclassifications — (0.1) — 0.6 (1.5) 0.3 (0.7)

Reductions of estimates of

fiscal 2002 acquisition reserves (659) (10.6) (37) (8.2) (0.5) (8.1) (27.4)

Balance at September 30, 2003 510 $«20.5 5 $«38.3 $«0.6 $«2.3 $««61.7

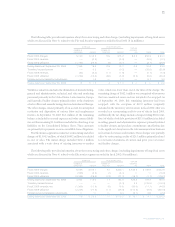

During fiscal 2003, the Company recorded additions to purchase

accounting liabilities as it continued to formulate the integration

plans of fiscal 2002 acquisitions, such as Paragon and Eberle

Controls GmbH. Finalization of components of integration

plans associated with acquisitions resulted in additional purchase

accounting liabilities of $25.8 million and a corresponding

increase to goodwill and deferred tax assets. These additions

reflect the termination of an additional 570 employees, the

closure of an additional 22 facilities, additional distributor and

supplier cancellation fees and other acquisition-related costs

consisting primarily of professional fees and other costs.

During fiscal 2003, the Company reduced its estimate of

purchase accounting liabilities relating to fiscal 2002 acquisi-

tions by $27.4 million primarily because actual costs were less

than originally estimated since the Company severed 659 fewer

employees and closed 37 fewer facilities than originally antici-

pated due to revisions to integration plans. Goodwill and related

deferred tax assets were reduced by an equivalent amount.

Also during fiscal 2003, we reclassified certain fair value

adjustments related to the write down of assets for fiscal 2002

acquisitions out of purchase accounting accruals and into the

appropriate asset or liability account. In addition, we reclassified

certain amounts related to fiscal 2002 acquisitions to separately

classify distributor and supplier cancellation fees and to correct

the categorization of other accruals. These reclassifications had

no effect on the amount of goodwill that was recorded.

Termination of employees and consolidation of facilities

related to fiscal 2002 acquisitions are substantially complete,

except for long-term non-cancellable lease obligations and certain

long-term severance arrangements.

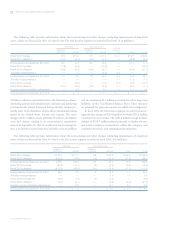

During fiscal 2002, the Company sold certain of its businesses

for net proceeds of $138.7 million in cash that consist primarily

of certain businesses within the Healthcare and Fire and Security

segments. In connection with these dispositions, the Company

recorded a net gain of $23.6 million.

TYCO INTERNATIONAL LTD.