ADT 2003 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27.

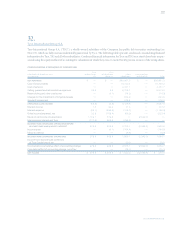

Supplementary Income Statement Information

Selected supplementary income statement information is presented below ($ in millions).

YEAR ENDED SEPTEMBER 30, 2003 2002 2001

Company-sponsored research and development $670.6 $633.4 $572.0

Advertising 186.6 180.7 152.3

114

Deferred Stock Units The Company granted 1.7 million

deferred stock units (“DSU’s”) under the existing Incentive

Plan described above during fiscal 2003 and fiscal 2002, all of

which were outstanding at September 30, 2003. DSU’s are

notional units that are tied to the value of Tyco common shares

with distribution deferred until termination of employment.

Distribution, when made, will be in the form of actual shares.

Similar to restricted stock grants that vest through the passage

of time, the fair market value of the DSU’s at the time of the

grant is amortized to expense over the period of vesting. The

unamortized portion of deferred compensation expense is

recorded as a reduction of shareholders’ equity. Recipients of

DSU’s do not have the right to vote such shares and do not have

the right to receive cash dividends. However, they have the right

to receive dividends in the form of additional DSU’s.

Dividends Tyco has paid a quarterly cash dividend of $0.0125

per common share since July 1997.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements

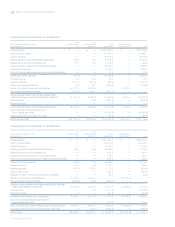

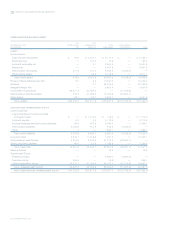

26.

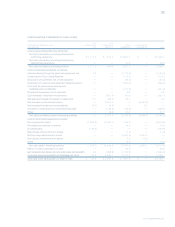

Comprehensive Income (Loss)

The purpose of reporting comprehensive income (loss) is to report a measure of all changes in equity, other than transactions with

shareholders. Total comprehensive income (loss) is included in the Consolidated Statements of Shareholders’ Equity. The compo-

nents of accumulated other comprehensive income (loss) are as follows ($ in millions):

UNREALIZED UNREALIZED ACCUMULATED

CURRENCY (LOSS) (LOSS) GAIN MINIMUM OTHER

TRANSLATION GAIN ON ON DERIVATIVE PENSION COMPREHENSIVE

ITEMS SECURITIES INSTRUMENTS LIABILITY INCOME (LOSS)

Balance at September 30, 2000 $«««(798.1) $«1,083.5 $««««— $««(18.3) $««««267.1

Pre-tax current period change (191.6) (1,187.4) (1) (2.3) (401.6) (1,782.9)

Income tax benefit — 24.8 — 140.6 165.4

Activity of discontinued operations net of tax (13.3) — (63.4) — (76.7)

Balance at September 30, 2001 (1,003.0) (79.1) (65.7) (279.3) (1,427.1)

Pre-tax current period change 92.2 77.0 (2) 1.6 (611.7) (440.9)

Income tax (expense) benefit — (3.2) — 205.9 202.7

Activity of discontinued operations net of tax 13.3 — 63.4 — 76.7

Balance at September 30, 2002 (897.5) (5.3) (0.7) (685.1) (1,588.6)

Pre-tax current period change 1,445.4 3.9 2.7 (206.1) 1,245.9

Income tax (expense) benefit — (1.9) — 71.3 69.4

Balance at September 30, 2003 $««««547.9 $«««««««(3.3) $«««2.0 $(819.9) $«««(273.3)

(1) Primarily related to Tyco’s investment in 360networks, Inc.

(2) Includes $112.8 million pre-tax ($100.6 million after-tax) reclassification of unrealized losses related to the other than temporary impairment of investments.