ADT 2003 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128

TYCO INTERNATIONAL LTD.

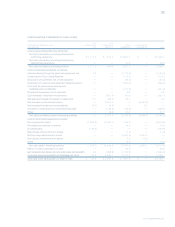

Common Shares and Dividends

The number of registered holders of Tyco’s common shares at December 2, 2003 was 51,262.

Tyco common shares are listed and traded on the New York Stock Exchange (“NYSE”) and the Bermuda Stock Exchange under

the symbol “TYC.” The following table sets forth the high and low sales prices per Tyco common share as reported by the NYSE,

and the dividends paid on Tyco common shares, for the quarterly periods presented below. As of December 12, 2003, Tyco delisted

its common shares from the Official List of the UK Listing Authority and from trading on the London Stock Exchange plc. Tyco

common shares will continue to be listed on the New York Stock Exchange and on the Bermuda Stock Exchange.

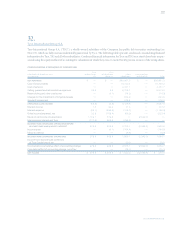

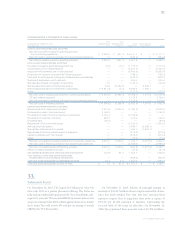

YEAR ENDED SEPTEMBER 30, 2003 YEAR ENDED SEPTEMBER 30, 2002

MARKET PRICE RANGE DIVIDEND PER MARKET PRICE RANGE DIVIDEND PER

QUARTER HIGH LOW COMMON SHARE HIGH LOW COMMON SHARE

First $18.7000 $11.9000 $0.0125 $60.0900 $44.7000 $0.0125

Second 18.3400 11.2000 0.0125 58.8000 22.0000 0.0125

Third 20.2000 12.8400 0.0125 32.6000 8.3000 0.0125

Fourth 22.0000 17.7500 0.0125 18.4500 7.0000 0.0125

$0.0500 $0.0500

Dividend Policy

We may from time to time enter into financing agreements that contain financial covenants and restrictions, some of which may

limit the ability of Tyco to pay dividends. Future dividends on our common shares, if any, will be at the discretion of Tyco’s Board

of Directors and will depend on, among other things, our results of operations, cash requirements and surplus, financial condition,

contractual restrictions and other factors that the Board of Directors may deem relevant.

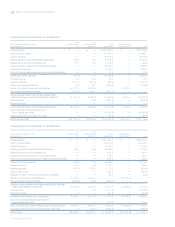

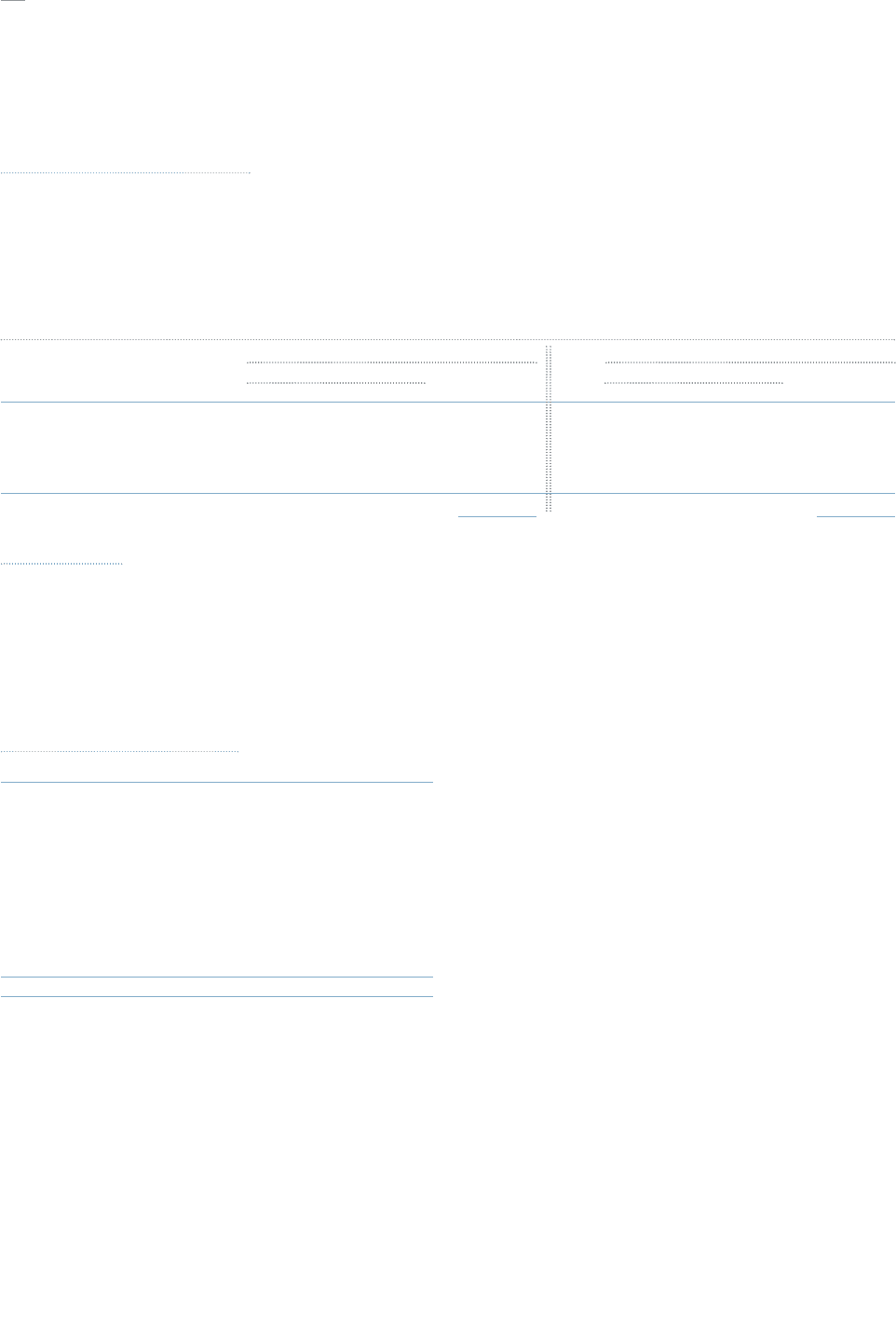

Free Cash Flow Reconciliation

($ IN MILLIONS) FISCAL 2003

Cash provided by operating activities

from continuing operations «$5,346.1

Capital expenditures, net (1,169.6)

Dividends paid (100.9)

Decrease in sale of accounts receivable programs 119.0

Construction of Tyco Global Network (112.7)

Acquisition of customer accounts (ADT dealer program) (596.8)

Cash paid for purchase accounting and

holdback/earn-out liabilities (271.8)

FREE CASH FLOW $«3,213.3

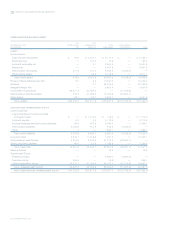

Free cash flow (“FCF”) is a non-GAAP metric and should not

be considered a replacement for GAAP results. Investors are

urged to read the Company’s financial statements as filed with

the Securities and Exchange Commission. The measure should

be used in conjunction with other GAAP financial measures

and is not presented as alternative measure of cash flow as cal-

culated and presented in accordance with GAAP. Investors

should not rely on FCF as a substitute for any GAAP financial

measure. FCF as presented herein may not be comparable to

similarly titled measures reported by other companies. FCF has

limitations due to the fact that it does not represent the residual

cash flow available for discretionary expenditures.

FCF is used by the Company to measure its ability to meet

its future debt obligations and is a significant measurement

tool in the Company’s incentive compensation plans. The

Company believes that FCF is an important measure of the

Company’s management of cash flow and operating perform-

ance. The difference between Cash from Operating Activities

(the most comparable GAAP measure) and FCF (the non-

GAAP measure) consists of significant cash outflows that the

Company believes are useful to measure its operations. The dif-

ference reflects net capital expenditures, acquisition of customer

accounts (ADT Dealer Program), Tyco Global Network spend-

ing, cash paid for purchase accounting and holdback/earn-out

liabilities from prior acquisitions, dividends paid, and the

impact from the sale of accounts receivable programs. These

items, particularly net capital expenditures and acquisition of

dealer accounts, are integral to the Company’s operations and

deducting these items provides a better picture in management’s

view of cash available for other uses including debt retirement.