ADT 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Amortization of Goodwill Amortization of goodwill was $543.0

million in fiscal 2001. In accordance with accounting rule

changes, goodwill is no longer amortized beginning with

our fiscal 2002 year. See Goodwill within Note 1 to our

Consolidated Financial Statements for a discussion of these

accounting rule changes.

Other (Expense) Income, Net Tyco has repurchased some debt

prior to scheduled maturities. In fiscal 2003, the Company

recorded other income from the early retirement of debt total-

ing $24.1 million, as compared to $30.6 million in fiscal 2002,

and a loss from the early retirement of debt totaling $26.3 million

for fiscal 2001.

During fiscal 2003, the Company repurchased all of its

6.25% Dealer Remarketable Securities (“Drs.”) due 2013. The

total Dollar Price paid was $902 million based upon the $750

million par value of the Drs. The portion in excess of par of

$151.8 million was recorded as a loss on retirement of debt.

During fiscal 2003, the Company recognized a charge of

$87.1 million relating to the write down of various investments

accounted for under both the cost and equity methods, of

which $81.3 million was recorded, when it became evident that

the declines in the fair value of the investments were other than

temporary, primarily due to the continuing depressed economic

conditions specifically within the telecommunications indus-

try. Included within the $81.3 million is $75.6 million recorded

in the second quarter (see “Changes in Estimates Recorded

During the Quarter Ended March 31, 2003”). The remaining

$5.8 million charge adjusted a portion of the remaining port-

folio to its net realizable value based upon estimates received in

conjunction with our decision to sell such investments. During

fiscal 2002, the Company recognized a $270.8 million loss on

various investments, primarily related to its investments in

FLAG Telecom Holdings Ltd. (“FLAG”) when it became evident

that the declines in the fair value of FLAG and other investments

were other than temporary. During fiscal 2001, the Company

recognized a $133.8 million loss on various investments, prima-

rily related to its investment in 360networks when it became

evident that the declines in the fair value of the investments

were other than temporary.

During fiscal 2003, the Company recognized other expense

of $8.6 million in connection with a bank guarantee on behalf

of an equity investee (see “Off-Balance Sheet Arrangements

—

Guarantees” below for further information).

During fiscal 2002, the Company sold certain of its businesses

for net proceeds of approximately $138.7 million in cash that

consist primarily of certain businesses within the Healthcare

and Fire and Security segments. In connection with these dis-

positions, the Company recorded a net gain of $23.6 million.

In fiscal 2001, the Company sold its ADT Automotive business

to Manheim Auctions, Inc., a wholly-owned subsidiary of Cox

Enterprises, Inc., for approximately $1.0 billion in cash. The

Company recorded a net gain on the sale of businesses of

$410.4 million after deducting commissions and other direct

costs, principally related to the sale of ADT Automotive. This

gain is net of direct and incremental costs of the transaction, as

well as $60.7 million of special bonuses paid to key employees.

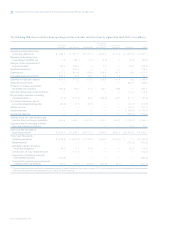

Interest Expense, Net Interest income was $107.2 million in

fiscal 2003, as compared to $117.3 million and $128.3 million

in fiscal 2002 and 2001, respectively. Interest expense was

$1,148.0 million in fiscal 2003, as compared to $1,077.0 million

in fiscal 2002 and $904.8 million in fiscal 2001. Interest expense

in fiscal 2003 includes a charge of $0.4 million related to changes

in estimates recorded during the quarter ended March 31,

2003, and a charge of $2.4 million related to the interest com-

ponent of a state sales tax charge. Fiscal 2003 interest income

includes $18.7 million related to interest received on a tax

refund. The increase in net interest expense in fiscal 2003 over

fiscal 2002 is primarily the result of the negative impact of the

cancellation of certain swaps in fiscal 2002, a decrease in capi-

talized interest due to the completion of TGN, an increase in

the weighted-average interest rate year over year, in addition to

a decrease in interest income as a result of the collection of a

note receivable. Slightly offsetting this overall increase was the

favorable impact of a lower average debt balance during fiscal

2003. The increase in fiscal 2002 as compared to fiscal 2001 was

due to a higher average debt balance for the year, which more

than offset the decrease in our weighted-average interest rate

during fiscal 2002. The weighted-average rates of interest on

our long-term debt outstanding during fiscal 2003 and 2002

were 4.7% and 4.5%, respectively. Our weighted-average rate

during fiscal 2003 increased due to the continued effects of the

credit downgrades that began in February 2002 including the

exiting of the commercial paper market and the retirement of

lower interest rate debt.

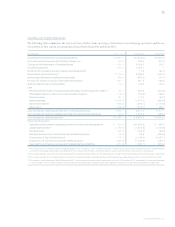

Income Tax Expense Income tax expense was $764.5 million on

pre-tax income of $1,802.8 million for fiscal 2003 as compared

to income tax expense of $208.1 million on pre-tax loss of

$2,628.7 million for fiscal 2002 and income tax expense of

$1,172.3 million on pre-tax income of $5,114.7 million for

fiscal 2001.

Our effective income tax rate was 42.4%, (7.9%) and 22.9%

during fiscal 2003, fiscal 2002 and fiscal 2001, respectively. The

difference in the rate from fiscal 2002 to 2003 is primarily the

result of a decrease in the non-recognition of tax benefits on

impairments and a decrease in other non-deductible charges.

TYCO INTERNATIONAL LTD.