ADT 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

$18.1 million due to current year acquisitions. Adjustments for

Sensormatic primarily relate to fair value adjustments as well as

the finalization of deferred tax adjustments related to previously

recorded purchase accounting liabilities. Adjustments for LPS

and Mallinckrodt primarily relate to reductions in purchase

accounting liabilities due to actual costs being less than originally

estimated. See roll forwards of purchase accounting accruals

below. Adjustments for DAAG relate to fair value adjustments.

The increase in intangible assets is due to adjustments associated

with prior years’ acquisitions.

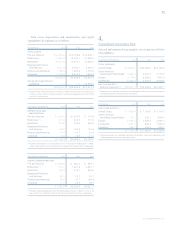

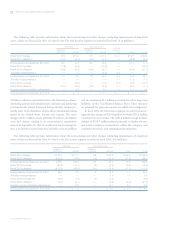

The following table shows the fair values of assets and liabili-

ties recorded for purchase acquisitions completed in fiscal

2003, adjusted to reflect changes in the fair values of assets and

liabilities and purchase accounting liabilities and holdback/

earn-out liabilities recorded for purchase acquisitions completed

prior to fiscal 2003 ($ in millions):

Accounts receivable $«««41.3

Inventories 36.1

Prepaid expenses and other current assets (0.3)

Deferred income taxes (90.6)

Property, plant and equipment, net 67.8

Goodwill (462.4)

Intangible assets 40.7

Other assets 11.8

(355.6)

Accounts payable 1.7

Accrued expenses and other current liabilities (346.8)

Holdback/earn-out liabilities 13.0

Deferred income taxes (66.2)

Other long-term liabilities (1.3)

(399.6)

Cash consideration paid

(net of $1.1 million of cash acquired) $«««44.0

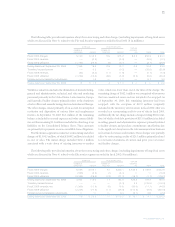

Purchase accounting liabilities recorded during fiscal 2003 in con-

nection with fiscal 2003 purchase acquisitions were immaterial.

At September 30, 2003, holdback/earn-out liabilities of

$211.7 million remained on the Consolidated Balance Sheet, of

which $93.1 million are included in accrued expenses and other

current liabilities and $118.6 million are included in other

long-term liabilities. In addition, a total of $199.0 million of

purchase accounting liabilities related mostly to fiscal 2001 and

2002 acquisitions remained on the Consolidated Balance Sheet,

of which $79.7 million are included in accrued expenses and

other current liabilities and $119.3 million are included in other

long-term liabilities. At September 30, 2003, the Company had

a contingent liability of $80 million related to the fiscal 2001

acquisition of Com-Net by the Electronics segment. The $80 mil-

lion is the maximum amount payable to the former shareholders

of Com-Net only after the construction and installation of a

communications system for the State of Florida is finished and

the State has approved the system based on the guidelines set

forth in the contract. The $80 million is not accrued at

September 30, 2003, as the outcome of this contingency cannot

be reasonably determined.

The pro forma effects of fiscal 2003 acquisitions and divesti-

tures on the Company’s results of operations are not material.

FISCAL 2002

During fiscal 2002, the Company purchased approximately 130

businesses for an aggregate cost of $3,750.5 million, consisting of

$1,683.8 million in cash, net of $158.0 million of cash acquired,

the issuance of approximately 47.8 million common shares val-

ued at $1,918.8 million, plus the fair value of stock options and

pre-existing put option rights assumed of $147.9 million

($102.6 million of the put option rights have been paid in cash).

Fiscal 2002 acquisitions include, among others, SBC/Smith Alarm

Systems, Century Tube Corporation, Sensormatic, Transpower

Technologies, DSC Group (“DSC”), Water & Power Technology,

LINQ Industrial Fabrics, Inc., Paragon Trade Brands, Inc.

(“Paragon”), Communications Instruments, Inc., Clean Air Sys-

tems and the purchase of the remaining minority public interest

of TyCom. In addition, during fiscal 2002 Tyco paid $1,139.3

million for approximately 1.4 million customer contracts for

electronic security services through the ADT dealer program.

In connection with these acquisitions, the Company recorded

purchase accounting liabilities of $194.6 million for the costs

of integrating the acquired companies and transaction costs.

Details regarding these purchase accounting liabilities are set

forth below. Tyco also issued approximately 17.7 million com-

mon shares valued at $819.9 million in connection with its

amalgamation with TyCom (see Note 9). Fair value of debt of

acquired companies aggregated $799.1 million. During fiscal

2002, the Company paid $474.8 million of cash for purchase

accounting liabilities related to current and prior years’ acqui-

sitions. In addition, the Company paid cash of $149.3 million

relating to holdback and earn-out liabilities primarily related

to certain prior year acquisitions. The Company also issued

44,139 common shares valued at $2.3 million relating to earn-

out liabilities during fiscal 2002. The value of these earn-out

common shares is based upon the fair value of the stock at the

time of issuance. The cash portions of the acquisition costs

were funded utilizing net proceeds from the issuance of long-

term debt. The results of operations of the acquired companies

have been included in Tyco’s consolidated results from their

respective acquisition dates.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements