ADT 2003 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements

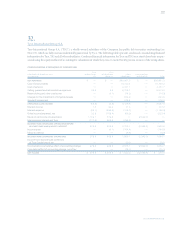

U.S. PLANS NON-U.S. PLANS

2003 2002 2003 2002

CHANGE IN PLAN ASSETS

Fair value of plan assets at beginning of year $1,253.7 $1,452.3 $«1,039.8 $1,111.4

Actual return on plan assets 183.5 (56.0) 118.6 (114.4)

Employer contributions 248.8 19.5 92.6 86.8

Employee contributions ——10.7 9.9

Acquisitions ——5.0 2.4

Plan settlements (28.7) (6.2) (32.0) (20.0)

Benefits paid (142.5) (144.5) (66.2) (71.3)

Administrative expenses paid (10.7) (11.4) (4.5) (3.5)

Currency translation adjustment ——98.7 38.5

Fair value of plan assets at end of year $1,504.1 $1,253.7 $«1,262.7 $1,039.8

Funded status $««(739.7) $««(794.4) $(1,151.2) $««(898.5)

Unrecognized net actuarial loss 751.1 650.5 858.6 737.3

Unrecognized prior service cost 28.5 30.2 5.5 5.8

Unrecognized transition asset (1.0) (2.0) (5.5) (4.8)

Net amount recognized $«««««38.9 $««(115.7) $«««(292.6) $««(160.2)

The net pension amounts recognized on the Consolidated Balance Sheet at September 30, 2003 and 2002 for all U.S. and non-

U.S. defined benefit plans is as follows ($ in millions):

U.S. PLANS NON-U.S. PLANS

2003 2002 2003 2002

AMOUNTS RECOGNIZED ON THE CONSOLIDATED BALANCE SHEETS

Prepaid benefit cost $«««««3.7 $«««««5.1 $«««26.8 $«148.2

Accrued benefit liability (711.5) (753.1) (851.6) (746.4)

Intangible asset 21.1 19.6 7.2 6.2

Accumulated other comprehensive income 725.6 612.7 525.0 431.8

Net amount recognized $«««38.9 $(115.7) $(292.6) $(160.2)

WEIGHTED-AVERAGE ASSUMPTIONS

Discount rate 6.00% 6.75% 4.85% 5.09%

Expected return on plan assets 8.49% 8.74% 6.89% 7.37%

Rate of compensation increase 4.30% 4.27% 3.42% 3.49%

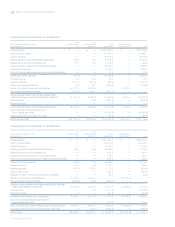

The amounts in the tables above include defined benefit

arrangements for certain current key executive officers.

The projected benefit obligation, accumulated benefit obli-

gation, and fair value of plan assets for U.S. pension plans with

accumulated benefit obligations in excess of plan assets were

$2,236.7 million, $2,200.5 million and $1,496.4 million, respec-

tively, at September 30, 2003, and $2,038.0 million, $1,980.9

million and $1,242.5 million, respectively, at September 30, 2002.

The projected benefit obligation, accumulated benefit obliga-

tion, and fair value of plan assets for non-U.S. pension plans with

accumulated benefit obligations in excess of plan assets were

$2,277.3 million, $1,936.4 million and $1,133.5 million, respec-

tively, at September 30, 2003, and $1,702.6 million, $1,423.3

million and $831.7 million, respectively, at September 30, 2002.

The Company also participates in a number of multi-

employer defined benefit plans on behalf of certain employees.

Pension expense related to multi-employer plans was $22.8

million, $17.1 million and $6.4 million for fiscal 2003, fiscal

2002 and fiscal 2001, respectively.

Executive Retirement Arrangements Messrs. Kozlowski and

Swartz participated in individual Executive Retirement

Arrangements maintained by Tyco (the “ERA”). Under the

ERA, Messrs. Kozlowski and Swartz would have fixed lifetime

benefits commencing at their normal retirement age of 65. The

Company’s accrued benefit obligations for Messrs. Kozlowski

and Swartz as of September 30, 2003 were $54.1 million and

$27.7 million, respectively. The Company’s accrued benefit