ADT 2003 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

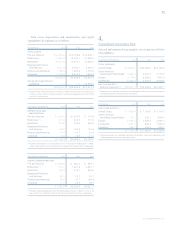

Workforce reductions primarily relate to the elimination of

manufacturing personnel in the United States. Facilities closures

primarily relate to the shutdown of manufacturing and distri-

bution facilities in the United States. The other charges consist

primarily of charges relating to acquisition-related product

replacement.

In fiscal 2001, the Plastics and Adhesives segment recorded

restructuring and other charges of $8.3 million, of which $4.0

million is included in cost of sales (excluding impairments of

long-lived assets, which are discussed in Note 6). The remaining

$4.3 million consists of $2.6 million for the cost of announced

workforce reductions for the elimination of 322 positions

primarily in the United States consisting primarily of manu-

facturing and sales personnel; the cost of facility closures of

$0.2 million for the shutdown of 3 manufacturing and admin-

istrative facilities in the United States; and other charges of $1.5

million primarily for lease buyouts and distributor termination

fees. At September 30, 2002, all employees had been terminated

and all facilities had been shut down. In addition, these restruc-

turing accruals were fully utilized by September 30, 2002.

In addition to segment charges, the Company recorded a

charge of $3.4 million related to severance, all of which has

been utilized by September 30, 2003.

6.

Charges for the Impairment of Long-Lived Assets

The Company evaluates the recoverability of long-lived assets

relying on a number of factors including operating results,

business plans, economic projections and anticipated future

cash flows. An impairment in the carrying value of an asset is

recognized whenever anticipated future cash flows (undis-

counted) from an asset are estimated to be less than its carrying

value. When indicators of impairment are present, the carrying

values of the assets are evaluated in relation to the operating

performance and future undiscounted cash flows of the underly-

ing business. The net book value of an asset is adjusted to fair

value if its expected future undiscounted cash flows is less than

book value. Fair values are based on assumptions concerning the

amount and timing of estimated future cash flows and assumed

discount rates, reflecting varying degrees of perceived risk.

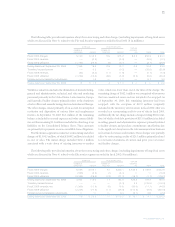

2003 CHARGES

During fiscal 2003, the Company recorded total charges for the

impairment of long-lived assets of $824.9 million.

The Fire and Security segment recorded charges for the

impairment of intangible assets of $100.7 million resulting

from a further deterioration of future estimated cash flows

anticipated from customers primarily in Mexico and certain

Latin American countries following the curtailment, and in

some instances, the termination of the ADT dealer program in

these countries. In addition, $11.2 million of impairment

charges were recorded related to the discontinuance of two

brand names. The Fire and Security segment also recorded

charges for the impairment of property, plant and equipment

of $20.9 million related primarily to subscriber systems and

other fixed assets, and $10.2 million associated with the termi-

nation of a software development project.

The Electronics segment recorded charges of $665.1 mil-

lion, of which $664.3 million relates to the impairment of the

TGN. This impairment was recorded to write off the entire

TGN as a result of our intention to divest this business. The

amount of the impairment was based upon estimates of its fair

value, less costs to dispose.

The Company recorded charges for the impairment of

property, plant and equipment of $14.6 million at Corporate,

primarily related to the closure and relocation of corporate

offices from New York to New Jersey and other impairment

charges of $2.2 million within the Engineered Products and

Services segment.

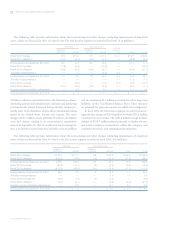

2002 CHARGES

During fiscal 2002, the Company recorded total charges for the

impairment of long-lived assets in continuing operations of

$3,309.5 million.

The Fire and Security segment recorded a charge of $5.6 mil-

lion related to the impairment of intangible assets resulting

from the curtailment, and in certain markets, the termination

of the ADT dealer program. In addition, the Fire and Security

segment recorded a charge of $109.1 million primarily related

to the impairment of property, plant and equipment associated

with the termination of a software development project. The

software development project related to a strategy to develop a

new comprehensive integrated customer database and associated

applications for this segment and its acquired companies. During

fiscal 2002, management, with the assistance of a third-party

consultant, performed a full evaluation to determine the infor-

mation technology needs of the Fire and Security business

relative to where it stood then and expectations for it over the

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements