ADT 2003 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

The Company also maintains two other employee stock

purchase plans for the benefit of employees of certain qualified

non-U.S. subsidiaries. Under one plan, eligible employees are

granted options to purchase shares at the end of three years of

service at 85% of the market price at the time of grant. As of

September 30, 2003, there were approximately 3.0 million

options outstanding and 7.0 million shares available for future

issuance under this plan. All shares purchased under the other

plan are purchased on the open market.

Share Options Tyco has granted employee share options which

were issued under two fixed share option plans which reserve

common shares for issuance to Tyco’s directors, executives and

managers. The majority of options have been granted under

the Tyco International Ltd. Long-Term Incentive Plan (the

“Incentive Plan”). The Incentive Plan is administered by the

Compensation Committee of the Board of Directors of the

Company, which consists exclusively of independent directors

of the Company. Options are granted to purchase common

shares at prices which are equal to or greater than the market

price of the common shares on the date the option is granted.

Conditions of vesting are determined at the time of grant.

Options which have been granted under the Incentive Plan to

date have generally vested and become exercisable over periods

of up to five years from the date of grant and have a maximum

term of ten years. Tyco has reserved 140.0 million common

shares for issuance under the Incentive Plan. Awards which

Tyco becomes obligated to make through the assumption of, or

in substitution for, outstanding awards previously granted by

an acquired company are assumed and administered under the

Incentive Plan but do not count against this limit. At Septem-

ber 30, 2003, there were approximately 25.5 million shares

available for future grant under the Incentive Plan. During

October 1998, a broad-based option plan for non-officer

employees, the Tyco Long-Term Incentive Plan II (“LTIP II”),

was approved by the Board of Directors. Tyco has reserved

100.0 million common shares for issuance under the LTIP II.

The terms and conditions of this plan are similar to the

Incentive Plan. At September 30, 2003, there were approximately

6.3 million shares available for future grant under the LTIP II.

Options assumed as part of business combination transac-

tions are administered under the Incentive Plan but retain all

the rights, terms and conditions of the respective plans under

which they were originally granted.

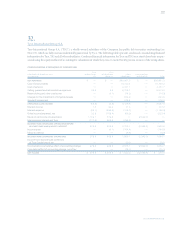

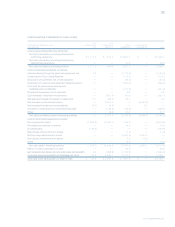

Share option activity for all Tyco plans from September 30,

2000 to September 30, 2003 is as follows:

WEIGHTED-AVERAGE

OUTSTANDING EXERCISE PRICE

At September 30, 2000 95,015,151 $32.01

Assumed from acquisition 19,094,534 33.27

Granted 33,731,727 50.53

Exercised (21,543,189) 25.32

Cancelled (6,051,186) 41.06

At September 30, 2001 120,247,037 39.44

Assumed from acquisition 10,794,826 83.02

Granted 60,012,080 29.79

Exercised (8,159,841) 22.88

Cancelled (29,260,509) 45.81

At September 30, 2002 153,633,593 37.80

Granted 26,937,609 14.80

Exercised (1,460,513) 10.13

Cancelled (30,470,736) 46.38

At September 30, 2003 148,639,953 32.28

TYCO INTERNATIONAL LTD.

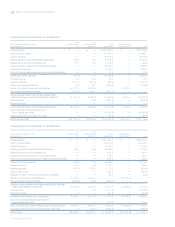

The following table summarizes information about outstanding and exercisable Tyco options at September 30, 2003:

OPTIONS OUTSTANDING OPTIONS EXERCISABLE

WEIGHTED-AVERAGE

REMAINING

RANGE OF NUMBER WEIGHTED-AVERAGE CONTRACTUAL NUMBER WEIGHTED-AVERAGE

EXERCISE PRICES OUTSTANDING EXERCISE PRICE LIFE — YEARS EXERCISABLE EXERCISE PRICE

$ 0.00 to $ 10.00 9,545,030 $««9.35 7.1 4,111,697 $««8.49

10.01 to 20.00 32,736,317 15.06 8.5 5,775,040 16.93

20.01 to 30.00 33,586,742 24.21 6.9 18,519,967 24.60

30.01 to 40.00 17,587,765 35.58 5.3 17,391,563 35.56

40.01 to 50.00 34,623,076 44.77 7.0 16,106,353 44.82

50.01 to 60.00 17,026,286 52.65 6.6 7,661,565 54.48

60.01 to 142.42 3,534,737 93.55 6.3 3,273,359 92.92

Total 148,639,953 32.28 7.0 72,839,544 36.38