ADT 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

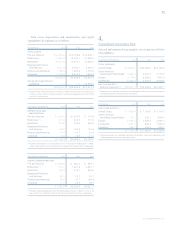

($ IN MILLIONS, EXCEPT PER SHARE DATA)

YEAR ENDED SEPTEMBER 30, 2002 (1) 2001 (2)

Net revenues $36,054.6 $40,106.1

(Loss) income from continuing

operations (2,841.0) 3,838.2

Net (loss) income (9,182.3) 3,139.6

Basic (loss) earnings per

common share:

(Loss) income from continuing

operations $««««««(1.42) $«««««««1.95

Net (loss) income (4.60) 1.60

Diluted (loss) earnings per

common share:

(Loss) income from continuing

operations $««««««(1.42) $«««««««1.93

Net (loss) income (4.60) 1.58

(1) Includes charges for the impairment of long-lived assets of $3,309.5 million; net

restructuring and other charges of $1,874.7 million; goodwill impairment charges of

$1,343.7 million; a loss on investments of $270.8 million; a net gain on the sale of

businesses of $23.6 million; gain on the early extinguishment of debt of $30.6 mil-

lion; loss from discontinued operations of $6,282.5 million, net of tax; and a loss on

the sale of discontinued operations of $58.8 million, net of tax. Excludes charges of

$17.8 million for the write off of purchased in-process research and development

associated with the acquisitions of Sensormatic and DSC discussed in Note 7.

(2) Includes a net gain on sale of businesses of $410.4 million related primarily to the

sale of ADT Automotive; a loss of $133.8 million related to the write down of an

investment; a net gain of $24.5 million on the sale of shares of a subsidiary; charges

for the impairment of long-lived assets of $120.1 million; net restructuring and other

charges totaling $585.3 million; loss on the early extinguishment of debt of $26.3

million; income from discontinued operations of $252.5 million, net of tax; and

cumulative effect of accounting changes of $683.4 million, net of tax. Excludes a

charge of $184.3 million for the write off of purchased in-process research and

development associated with the acquisition of Mallinckrodt discussed in Note 7.

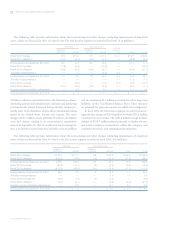

FISCAL 2001

During fiscal 2001, the Company purchased approximately 240

companies for an aggregate cost of $9,339.7 million, consisting of

$5,319.2 million in cash, net of $343.4 million of cash acquired,

the issuance of approximately 78.2 million common shares

valued at $3,904.6 million, plus the fair value of stock options

assumed of $115.9 million. Fiscal 2001 purchase acquisitions

include, among others, Mallinckrodt Inc., CIGI Investment

Group, Inc., InnerDyne, Inc., LPS, Simplex Time Recorder Co.,

Scott, and the electronic security systems businesses of

Cambridge Protection Industries, LLC. In addition, during fiscal

2001 Tyco paid $798.1 million for approximately 1.0 million

customer contracts for electronic security services through the

ADT dealer program.

In connection with these acquisitions, the Company recorded

purchase accounting liabilities of $1,021.3 million for the costs

of integrating the acquired companies and transaction costs.

Also during fiscal 2001, Tyco purchased CIT for an aggregate

cost of $9,455.5 million, consisting of $2,486.4 million in cash,

net of $2,156.4 million of cash acquired, and the issuance of

approximately 133.0 million common shares valued at $6,650.5

million, plus the fair value of options assumed of $318.6 mil-

lion. CIT was subsequently disposed of in fiscal 2002 and has

been presented as discontinued operations (see Note 11).

The cash portions of the acquisition costs were funded uti-

lizing net proceeds from the issuance of long-term debt and

Tyco common shares and net proceeds from the disposal of

businesses. Fair value of debt of acquired companies aggregated

$40,643.2 million, including $39,050.9 million of debt of CIT.

During fiscal 2001, $773.0 million of cash was paid during

the year for purchase accounting liabilities related to current

and prior years’ acquisitions. In addition, the Company paid

approximately $105.7 million relating to holdback and earn-out

liabilities primarily related to certain prior year acquisitions.

TYCO INTERNATIONAL LTD.

Notes to Consolidated Financial Statements

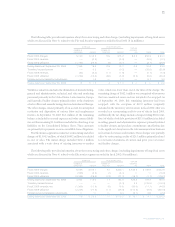

The following unaudited pro forma data summarize the

results of operations for the periods indicated as if fiscal 2002

and 2001 acquisitions and divestitures and the amalgamation

with TyCom had been completed as of the beginning of the

periods presented. The pro forma data give effect to actual

operating results prior to the acquisitions and adjustments to

interest expense and income taxes. No effect has been given to

cost reductions or operating synergies in this presentation.

These pro forma amounts do not purport to be indicative of

the results that would have actually been achieved if the acqui-

sitions, divestitures and amalgamation had occurred as of the

beginning of the periods presented or that may be achieved in

the future.