ADT 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

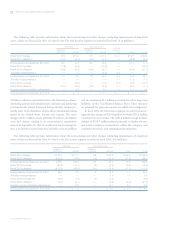

Workforce reductions primarily relate to the elimination of

manufacturing and sales personnel associated with the closure

of sales offices and manufacturing facilities in the United States

and Europe. At September 30, 2003, $0.4 million of the remain-

ing balance is included in accrued expenses and other current

liabilities and $0.4 million is included in other long-term

liabilities on the Consolidated Balance Sheet. These amounts

primarily relate to non-cancellable lease payments.

The Plastics and Adhesives segment recorded restructuring

and other charges of $10.1 million, of which charges of $1.1

million are included in cost of sales. Additionally, the charge

includes charges of $9.0 million associated with the consolida-

tion of operations and the exiting of certain business lines.

TYCO INTERNATIONAL LTD.

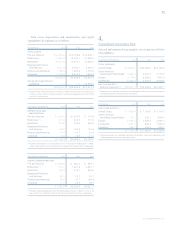

The following table provides information about the restructuring and other charges (excluding impairments of long-lived assets

which are discussed in Note 6) related to the Engineered Products and Services segment recorded in fiscal 2002 ($ in millions):

SEVERANCE FACILITIES-RELATED

NUMBER OF NUMBER OF

EMPLOYEES AMOUNT FACILITIES AMOUNT OTHER TOTAL

Fiscal 2002 charges 1,217 $«35.7 48 $«4.1 $«4.8 $«44.6

Fiscal 2002 utilization (712) (27.7) (27) (1.5) (4.0) (33.2)

Ending balance at September 30, 2002 505 8.0 21 2.6 0.8 11.4

Fiscal 2003 reversals (312) (0.5) (7) (0.4) (0.3) (1.2)

Fiscal 2003 utilization (193) (7.3) (14) (1.4) (0.6) (9.3)

Foreign currency translation adjustments — (0.2) — — 0.1 (0.1)

Ending balance at September 30, 2003 — $««««— — $«0.8 $««— $«««0.8

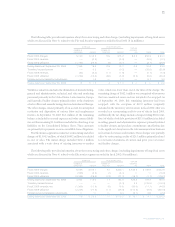

The following table provides information about the restructuring and other charges (excluding impairments of long-lived assets

which are discussed in Note 6) related to the Plastics and Adhesives segment recorded in fiscal 2002 ($ in millions):

SEVERANCE FACILITIES-RELATED

NUMBER OF NUMBER OF

EMPLOYEES AMOUNT FACILITIES AMOUNT OTHER TOTAL

Fiscal 2002 charges 317 $««4.2 5 $«3.0 $«1.8 $«9.0

Fiscal 2002 utilization (43) (0.2) (1) (0.1) (1.8) (2.1)

Ending balance at September 30, 2002 274 4.0 4 2.9 — 6.9

Fiscal 2003 reversals (33) (0.5) — (0.6) — (1.1)

Fiscal 2003 utilization (222) (2.8) (1) (1.1) — (3.9)

Foreign currency translation adjustments —0.3 —0.2 —0.5

Ending balance at September 30, 2003 19 $««1.0 3 $«1.4 $««— $«2.4

Workforce reductions primarily relate to the elimination of

manufacturing and sales personnel associated with the shut-

down of manufacturing and administrative facilities in the

United States. At September 30, 2003, $1.7 million of the

remaining balance is included in accrued expenses and other

current liabilities and the remaining $0.7 million is included in

other long-term liabilities on the Consolidated Balance Sheet.

These amounts primarily relate to non-cancellable lease obliga-

tions and severance.

In addition to segment charges, the Company recorded

charges of $169.6 million consisting of $78.6 million for sever-

ance and $15.0 million for contract terminations, legal fees and

other items associated with the downsizing of the corporate

headquarters and $76.0 million for the write off of investment

banking fees and other deal costs associated with the termi-

nated break-up plan and certain acquisitions that were not

completed. At September 30, 2003, $5.6 million remained in

accrued expenses and other current liabilities on the Consoli-

dated Balance Sheet.

2001 CHARGES AND CREDITS

In fiscal 2001, the Fire and Security segment recorded a net

restructuring and other charge of $84.1 million, of which charges

of $5.4 million are included in cost of sales. The $84.1 million

net charge consists of charges of $80.3 million related primarily

to the restructuring of the existing U.S. security business and

U.S. fire protection business in connection with the acquisi-

tions of SecurityLink and Simplex, partially offset by a credit of

$1.6 million representing a revision of estimates of prior years’

restructuring and other charges.