ADT 2003 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

TYCO INTERNATIONAL LTD.

Bermuda law differs from the laws in effect in the United States

and may afford less protection to holders of our securities.

Holders of Tyco securities may have more difficulty protecting

their interests than would holders of securities of a corpora-

tion incorporated in a jurisdiction of the United States. See

“Enforcement of Civil Liabilities.”

As a Bermuda company, Tyco is governed by the Companies

Act 1981 of Bermuda, which differs in some material respects

from laws generally applicable to United States corporations

and shareholders, including, among others, differences relating

to interested director and officer transactions, shareholder law-

suits and indemnification. Under Bermuda law, directors and

officers may have a personal interest in contracts or arrange-

ments with a company or its subsidiaries transactions so long

as such personal interest is first disclosed to the company.

Likewise, the duties of directors and officers of a Bermuda

company are generally owed to the company only. Shareholders

of Bermuda companies do not generally have a personal right

of action against directors or officers of the company and may

only exercise such rights of action on behalf of the company in

limited circumstances. Under Bermuda law, a company may

also agree to indemnify directors and officers for any personal

liability, not involving fraud or dishonesty, incurred in relation

to the company.

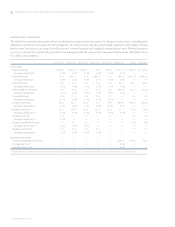

Quantitative and Qualitative Disclosures

About Market Risk

We are subject to market risk associated with changes in interest

rates, foreign currency exchange rates and certain commodity

prices. In order to manage the volatility relating to our more

significant market risks, we enter into forward foreign currency

exchange contracts, cross-currency swaps, foreign currency

options, commodity swaps and interest rate swaps. We do not

anticipate any material changes in our primary market risk

exposures in fiscal 2004.

We utilize risk management procedures and controls in

executing derivative financial instrument transactions. We do

not execute transactions or hold derivative financial instruments

for trading purposes. Derivative financial instruments related

to interest rate sensitivity of debt obligations, intercompany

cross-border transactions and anticipated non-functional cur-

rency cash flows, as well as commodity price exposures, are

used with the goal of mitigating a significant portion of these

exposures when it is cost effective to do so. Counter-parties to

derivative financial instruments are limited to financial institu-

tions with at least an A+ long-term debt rating.