ADT 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 ADT annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

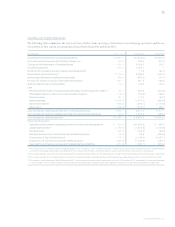

The difference in the tax rate from fiscal 2001 to fiscal 2002 was

primarily due to the non-recognition of tax benefits on signifi-

cant impairment charges, which occurred in fiscal 2002.

The tax effect on purchased in-process research and devel-

opment, restructuring and other credits (charges), charges for

the impairment of long-lived assets, charges for the impairment

of goodwill, net gain on the sale of businesses and investments,

net gain on the sale of common shares of a subsidiary and

accounting change was a benefit of $265.8 million during fiscal

2003, as compared to a benefit of $670.9 million during fiscal

2002 and a benefit of $68.6 million in fiscal 2001.

The valuation allowance increased by approximately

$249 million due to the uncertainty of the utilization of certain

non-U.S. deferred tax assets (see Note 10 to our Consolidated

Financial Statements). We believe that we will generate suffi-

cient future taxable income to realize the tax benefits related to

the remaining net deferred tax assets on our balance sheet. The

valuation allowance was calculated in accordance with the pro-

visions of SFAS No. 109 which requires a valuation allowance

be established or maintained when it is “more likely than not”

that all or a portion of deferred tax assets will not be realized.

The Company and its subsidiaries’ income tax returns are

periodically examined by various regulatory tax authorities. In

connection with such examinations, certain tax authorities,

including the Internal Revenue Service, have raised issues and

proposed tax deficiencies. The Company is reviewing the issues

raised by the tax authorities and is contesting certain proposed

tax deficiencies. Amounts related to these tax deficiencies and

other tax contingencies that management has assessed as prob-

able and estimable have been accrued through the income tax

provision. Further, management has reviewed with tax counsel

the issues raised by these taxing authorities and the adequacy of

these accrued amounts.

During fiscal 2003, the Company reached an agreement

with the Internal Revenue Service relating to the examination

of one of its subsidiary’s income tax returns. As a result, the

Company recorded a tax benefit of $22.4 million.

Except for earnings that are currently distributed, no addi-

tional provision has been made for U.S. or non-U.S. income

taxes on the undistributed earnings of subsidiaries or for

unrecognized deferred tax liabilities for temporary differences

related to investments in subsidiaries, as such earnings are

expected to be permanently reinvested, or the investments are

essentially permanent in duration. A liability could arise if

amounts were distributed by their subsidiaries or if their sub-

sidiaries were disposed. It is not practicable to estimate the

additional taxes related to the permanently reinvested earnings

or the basis differences related to investments in subsidiaries.

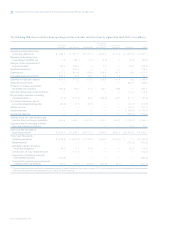

Cumulative Effect of Accounting Changes As discussed in “Off-

Balance Sheet Arrangements

—

Variable Interest Entities”

below, the Company has three synthetic lease programs uti-

lized, to some extent, by all of the Company’s segments to

finance capital expenditures for manufacturing machinery and

equipment and for ships used by Tyco Submarine Telecommu-

nications. During fiscal 2003, the Company adopted FIN 46

and, accordingly, restructured one of the synthetic leases to

meet the requirements of FIN 46 for operating lease accounting.

The Company has reclassified the remaining two leases as capi-

tal leases and consequently, recorded a cumulative effect adjust-

ment, a $75.1 million loss after-tax ($115.5 million pre-tax) in

fiscal 2003 in accordance with the provisions of FIN 46. In

addition, four joint ventures within Tyco Infrastructure

Services met the consolidation criteria set forth in FIN 46. As a

result of both the synthetic lease reclassifications and the joint

venture consolidations, the Company has increased property,

plant and equipment, net, by $433.8 million and total debt by

$562.2 million (effective July 1, 2003).

In December 1999, the SEC issued SAB 101, in which the

SEC expressed its views regarding the appropriate recognition of

revenue with respect to a variety of circumstances, some of which

are relevant to us. As required under SAB 101, we modified our

revenue recognition policies with respect to the installation of

electronic security systems (see “Revenue Recognition” within

Note 1 to our Consolidated Financial Statements). In addition,

in response to SAB 101, we undertook a review of our revenue

recognition practices and identified certain provisions included

in a limited number of sales arrangements that delayed the

recognition of revenue under SAB 101. During the fourth

quarter of fiscal 2001, we changed our method of accounting

for these items retroactive to the beginning of the fiscal year to

conform to the requirements of SAB 101. This was reported as

a $653.7 million after-tax ($1,005.6 million pre-tax) charge for

the cumulative effect of change in accounting principle in the

fiscal 2001 Consolidated Statement of Operations.

During fiscal 2003 and 2002, the Company recognized

$249.4 million and $294.2 million, respectively, of revenue that

had previously been included in the SAB 101 cumulative effect

adjustment recorded as of October 1, 2000. The impact of SAB

101 on net revenues in fiscal 2001 was a net decrease of $241.1

million, reflecting the deferral of $520.5 million of fiscal 2001

revenues, partially offset by the recognition of $279.4 million of

revenue that is included in the cumulative effect adjustment as

of the beginning of fiscal 2001.

We recorded a cumulative effect adjustment, a $29.7 million

loss, net of zero tax, in fiscal 2001 in accordance with the tran-

sition provisions of SFAS No. 133, “Accounting for Derivative

Instruments and Hedging Activities.”

TYCO INTERNATIONAL LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations